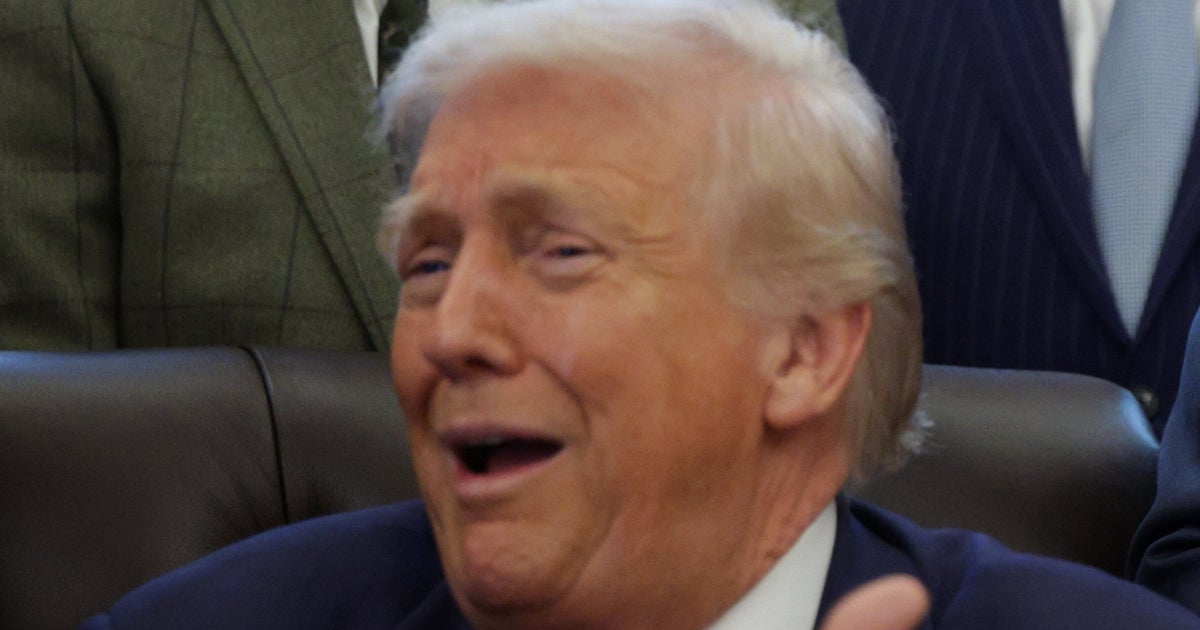

President Donald Trump has asserted that a lawsuit against the U.S. government, seeking $10 billion, has been “essentially” won, with any awarded funds intended for approved charities. This suit stems from the alleged violation of IRS confidentiality rules concerning the leak of his tax returns, which reportedly showed minimal federal income tax payments in certain years. Trump also mentioned a separate $230 million lawsuit against taxpayers related to the FBI’s search of his Mar-a-Lago home. His claim of winning and his promise to donate the proceeds to charity have drawn criticism, citing his history with the Trump Foundation and allegations of self-dealing.

Read the original article here

The recent pronouncements suggesting that a significant amount of taxpayer money was “won” have sparked outrage, with many interpreting these statements as a brazen display of “naked corruption.” The sentiment circulating is one of profound disgust, with individuals expressing their frustration at working tirelessly only to see their hard-earned money potentially lining the pockets of someone perceived as looting public accounts. The idea of being compelled to provide funds to a leader as if they were royalty is deeply offensive to many, with the prospect of their departure being met with celebration.

This perception of corruption is further fueled by the notion that such admissions are made openly, with the individual seemingly unconcerned about the implications. The normalization of what is described as “insane bullshit” is a recurring theme, with past actions, from questioning presidential eligibility to alleged attempts to sue the country for personal financial gain, cited as evidence of profound damage to the nation’s trust and integrity. Bragging about enriching oneself at the expense of taxpayers is seen not as a flex, but as a deeply disturbing admission of guilt.

The characterization of this individual as a scammer who managed to secure elected office is prevalent. The suggestion that every American could be indirectly contributing a sum, even a seemingly small one, to fund potential IRS demands paints a picture of widespread financial exploitation. The sheer scale of such alleged “fleecing” is alarming, with some pointing out the individual’s age and the vast wealth amassed, questioning who will ultimately benefit from it, and suggesting that future administrations might recover such funds.

There’s a deep-seated anger directed at the perceived lack of accountability, with individuals lamenting the possibility of this person being remembered for actions described as lying, harming others, and causing widespread destruction, all stemming from what’s perceived as a lifelong need for validation. The promise to donate any winnings to charity is met with skepticism, with the assertion that such money is not theirs to decide the fate of, and that the actual donation is doubted.

The personal impact of financial strain, such as a reduced tax return, juxtaposed with an individual allegedly flaunting wealth acquired through questionable means, creates a potent sense of injustice. The image of someone golfing while others struggle to make ends meet, using their money, is deeply frustrating. From an external perspective, the situation appears baffling, prompting calls for a complete overhaul of the governmental system.

The idea that an individual would need outside adversaries when they have a leader like this is a common sentiment. Attempts to discuss concerns about potential market manipulation and self-enrichment through government actions are sometimes met with dismissive attitudes, suggesting that personal gain for doing a “good job” is acceptable. This raises a critical question about the very purpose of public service and financial transparency.

A radical suggestion emerging is the collective refusal to pay federal taxes, particularly during the remaining term of this administration. The argument is that this would be a powerful form of protest, a way to reclaim agency. The belief that the government might be actively suppressing this advice or using bots to counter it points to a perceived conspiracy to maintain the status quo. The idea that states could cease federal tax contributions and manage their own funding more effectively, potentially impacting the federal government’s reliance on their contributions, is also floated.

The notion that individual states, like California, contribute more to federal funding than they receive back is highlighted, suggesting that withholding these contributions could lead to significant leverage. The subsequent financial implications for the nation are considered a powerful incentive for change. The potential for each American to be burdened by a significant sum if certain lawsuits are won is a terrifying prospect, especially when considering the existence of offshore accounts beyond the reach of the U.S. Treasury. This raises the question of why federal taxes should be paid at all under such circumstances, with the suggestion to change withholding to “exempt” as a direct form of protest.

The idea that no president should be permitted to enrich themselves while in office is a fundamental principle being violated, according to many. The calls for impeachment, jail time, and the forfeiture of all ill-gotten gains are strong. The individual is often described as driven solely by personal enrichment, willing to cause destruction to achieve it, with the belief that the consequences of such actions will eventually be severe.

The specific quote about “winning a lot of money” from lawsuits, especially those against executive branch agencies that the individual leads, is particularly galling. The ability to “settle with myself” highlights the perceived conflict of interest and lack of oversight. The frustration is amplified by the belief that those who voted for such actions will likely face no repercussions, leading to a sense of hopelessness. This is contrasted with the concern for those genuinely in need, suggesting that taxpayer money should prioritize assistance for the vulnerable, not those in power.

The term “embezzled” is frequently used, alongside accusations of widespread voter ignorance. The concept of “cronyism” is also central, with questions raised about why a government would settle lawsuits that would ultimately drain the U.S. Treasury. While not endorsing violence, some express a morbid curiosity about when public anger might reach a tipping point, leading to more extreme actions, or whether such events are simply kept from the public.

The accusations extend to lying, causing harm, engaging in warfare on personal whim, fostering racism and sexism, environmental destruction, defunding essential programs, and punishing institutions that don’t show allegiance. The stark contrast between the outrage over an immigrant receiving healthcare and the alleged acceptance of billions in looting is a point of contention. The desire for accountability and the clawing back of stolen funds are seen as crucial priorities for any future administration. The challenge of convincing followers of the reality of these actions is acknowledged, particularly when the alleged theft from each citizen is quantified. The idea of a “break-in” at Mar-a-Lago, when a search warrant was executed, is seen as a manufactured narrative. The question of whether civil lawsuits on behalf of the American people are possible, with the goal of leaving the individual and their family destitute, is frequently raised.

The skepticism surrounding promises to donate to charity is immense, especially when those charities are perceived as being run by family members. The idea of using civil asset forfeiture to seize all assets and wealth from the entire family is seen as a just outcome. The argument that any “wins” are in a rigged game, where the rules are constantly changed, and the individual declares themselves the victor, is a potent metaphor for the perceived unfairness. The impending consequences for the individual, their family, and their supporters are seen as inevitable.