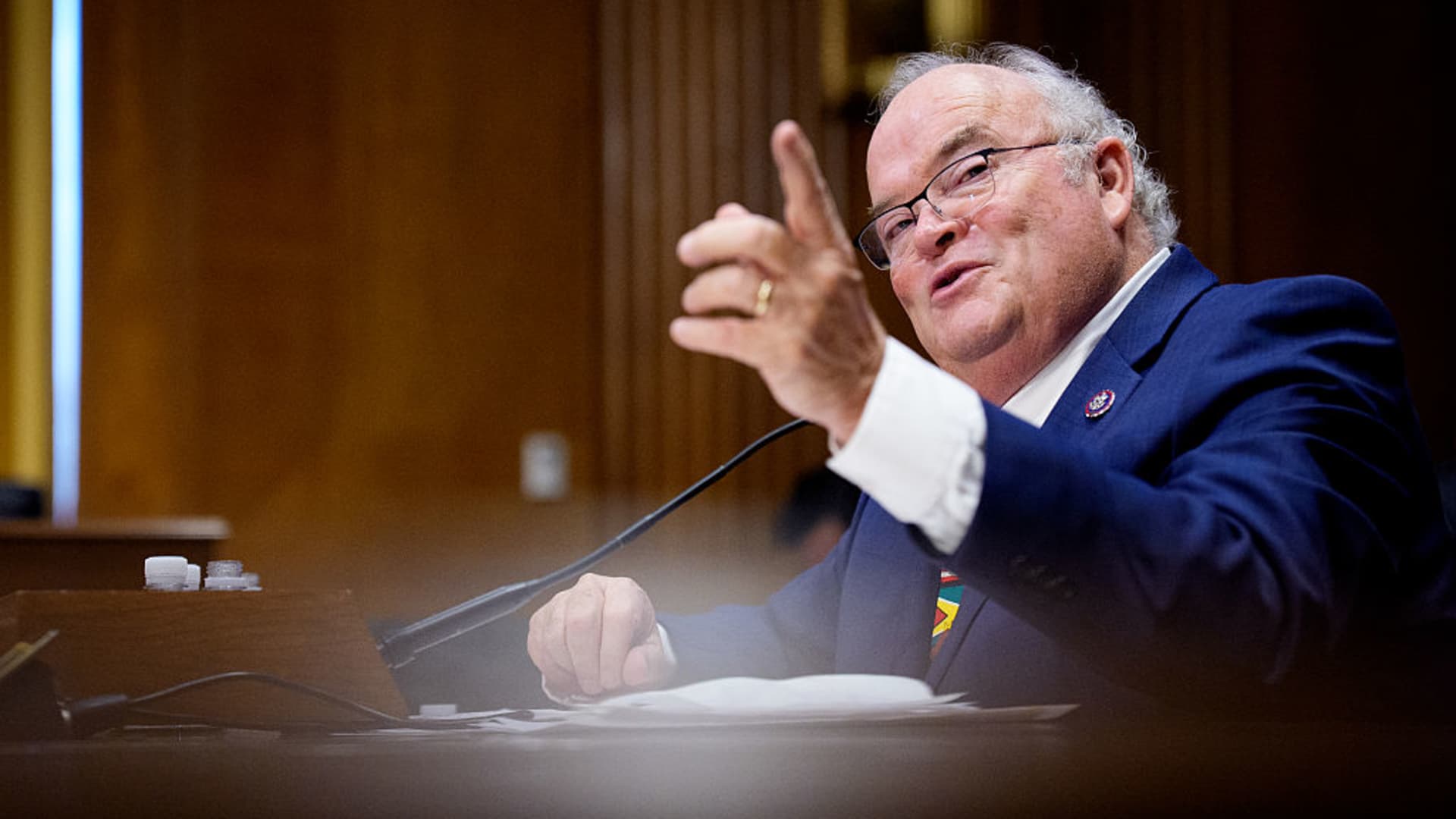

The IRS will discontinue its Direct File program after a limited pilot and one full filing season, according to Commissioner Bill Long. This decision aligns with the policy directives within a large spending bill, which allocated resources to research and potentially replace direct e-file programs. Despite positive feedback from users, with 94% rating their experience as “excellent” or “above average,” the program is ending. The IRS is committed to modernizing its operations and will provide transparency regarding tax returns and audits.

Read the original article here

“I don’t care about Direct File”: That phrase seems to be the crux of the matter, doesn’t it? It’s the sentiment that’s driving the planned demise of a service many people actually found useful. The IRS’s free filing program, Direct File, was a hit. People genuinely liked it. But apparently, that’s a problem. Why? Because the prevailing narrative suggests the system is designed to inflict pain.

The issue is that the IRS chief, at the time the decision was made, seemed to be prioritizing the interests of private tax preparation companies like Intuit (TurboTax) and H&R Block. The implication is that these companies, with their deep pockets and powerful lobbying arms, have essentially “bought” influence, leading to a decision that benefits them at the expense of everyday taxpayers. This isn’t just a political squabble; it feels personal. It’s seen as a blatant display of corruption, with the agency prioritizing corporate profits over the well-being of the public.

This perception of corruption is fueled by the actions of the former administration. Appointees, described as lacking empathy, appear to have been hand-picked for their ability to prioritize personal gain and corporate interests. The decision to end Direct File fits this pattern, as it removes a service that could have benefited a large segment of the population. It feels like the goal is to make tax filing a confusing, expensive, and time-consuming process for everyone except the wealthy.

The experience of using Direct File is mentioned, highlighting its user-friendliness and efficiency. It apparently streamlined the filing process, even integrating seamlessly with state portals. This is in stark contrast to the existing, paid software options, which often feel clunky and expensive. That’s the part that is puzzling, why would the IRS choose a less efficient method that benefits paid services? The response to this perceived injustice is a return to old-fashioned methods – mailing paper returns. This is not just an act of defiance, but a tactic to slow the process down and make things more difficult for the IRS, which some see as a justifiable response to what they believe is unfair treatment.

The frustration extends beyond the tax filing system. The broader sentiment reflects a feeling of being exploited and manipulated. It’s a system where ordinary people are forced to pay for the privilege of paying taxes, while corporations reap the rewards. The analogy with health insurance rates is apt. The fear is that the private tax preparation companies will hike their prices if they have the upper hand. The frustration also extends to the fact that tax payers have to rely on third-party services when the IRS already has access to their information.

The comparison with other countries, like Germany and Denmark, provides a powerful contrast. These countries have streamlined, user-friendly, and government-run tax filing systems. In these places, filing taxes is easy and automatic, showing how different things could be.

The implications of this situation are widespread. It feels like a coordinated effort to dismantle public services and hand them over to private interests, with the former administration taking steps to weaken the agency from within. The goal appears to be to create a system that is inefficient and ineffective, providing a justification for further privatization.

The situation is seen as an indirect tax on the poor and middle class, taking money away from them and handing it to corporations, which then donate to politicians. It’s a vicious cycle that perpetuates itself, benefiting the wealthy and harming everyone else.

The solution is not simple. Some suggest collective action, from refusing to pay taxes. Others look to more direct political action, demanding that the system be reformed to work for the people, not against them. In conclusion, the decision to end Direct File feels like another example of a broken system that prioritizes corporate profits over the needs of the average person.