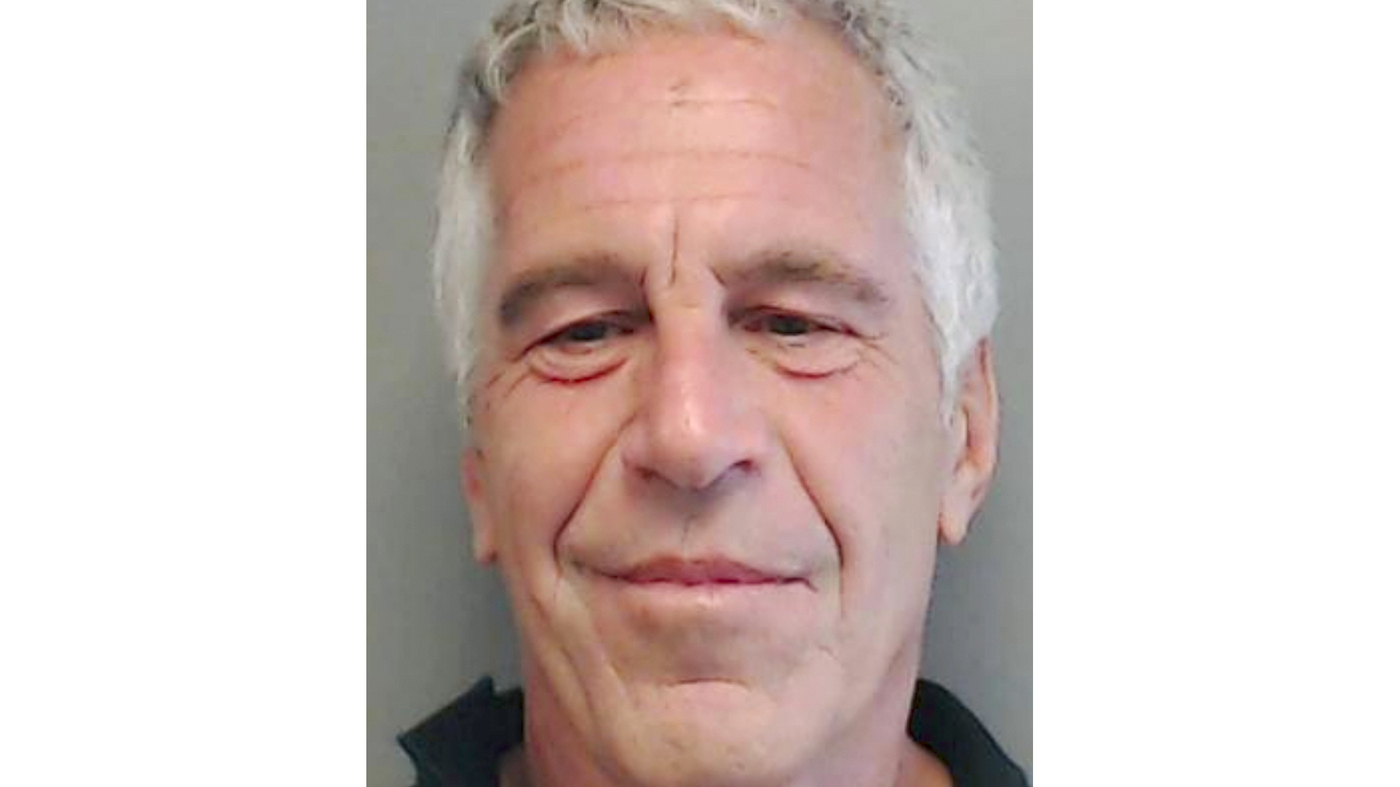

A lawsuit filed by the U.S. Virgin Islands alleges that JPMorgan Chase aided Jeffrey Epstein’s sex-trafficking operation by turning a blind eye to suspicious activities. The complaint claims the bank facilitated and concealed financial transactions related to the trafficking enterprise. The U.S.V.I. contends that JPMorgan provided services to Epstein even after his 2008 conviction, prioritizing his financial influence and overlooking red flags for over a decade. The lawsuit further states that human trafficking was the primary activity of Epstein’s accounts at JPMorgan.

Read the original article here

Epstein’s sex trafficking was aided by JPMorgan, a U.S. Virgin Islands lawsuit says, and it seems this is the kind of story that’s been getting suppressed, potentially to protect individuals with high-powered careers and businesses. It underscores the importance of supporting independent journalism, even with small contributions, because it’s crucial for keeping this kind of reporting available to everyone. This is a truly shocking situation, and it’s hardly a surprise when we consider the involvement of high-profile figures and the complex web of relationships involved.

The lawsuit brought forward by the U.S. Virgin Islands alleges that JPMorgan played a crucial role in enabling Epstein’s sex trafficking operation. The investigation revealed that the bank knowingly, negligently, and unlawfully provided the means through which recruiters and victims were paid. The bank’s actions were “indispensable to the operation and concealment of the Epstein trafficking enterprise.” This all seems to have happened over a decade and it is alleged that the bank ignored evidence of the trafficking, possibly due to Epstein’s financial influence and the potential for lucrative deals and clients he brought to the bank. The lawsuit explicitly states that decisions facilitating Epstein’s activities were approved at the highest levels of JPMorgan.

According to the complaint, JPMorgan facilitated and concealed financial transactions that raised suspicions and were, in fact, part of a criminal enterprise where the currency was the sexual servitude of numerous women and girls. The complaint even goes on to claim that human trafficking was the primary business of the accounts Epstein maintained at JPMorgan. This all puts a lot of pressure on high-profile figures within the company and raises questions about how much they really knew, and when they knew it. It definitely makes you wonder about the extent of their culpability. It’s clear that this story has the potential to cause serious damage, not just to JPMorgan, but potentially to other entities involved.

The accusations are serious, and the implications are vast. The fact that the U.S. Virgin Islands official who filed the lawsuit was fired just four days later further suggests that powerful forces are at play here, potentially trying to keep this from gaining traction. It highlights the scale of the cover-up and is, frankly, not okay. The focus here needs to be on following the money. Where did the money go, and who was involved? This case illustrates how companies can pay substantial sums of money, but accountability sometimes seems to take a back seat. It’s important to remember that entities that are considered “people” under the law can also face charges.

The scale of the alleged trafficking operation is heartbreaking. The lawsuit suggests that vast sums of money, potentially billions, were funneled through these accounts. It’s chilling to consider that this money was allegedly used to facilitate the exploitation and abuse of young girls. The potential involvement of powerful individuals and the complex web of connections involved make this an incredibly sensitive issue, and it raises very troubling questions about the structures of power and influence. The whole situation has become a massive international scandal, and the longer this all takes to address the more it highlights that there are very, very powerful people who don’t want the truth to come out.

The idea that this has been going on for a decade, and that key personnel in the bank were aware, or could have known, is deeply disturbing. It’s easy to see how this could be suppressed, given the potential for collateral damage, including damage to businesses and careers of those involved. The implications are far-reaching, and the case needs to be fully investigated.

The narrative that’s forming here is one of a systemic cover-up, a deliberate attempt to obscure the truth to protect powerful individuals. It also brings up the conversation of how the international banking system is being used for financial grift and money laundering on a massive scale. This is another good reason why exposing the international banking cartel and taking it down is of major importance. The fact that JPMorgan might have been complicit in this, and that they are a massive corporation, adds a layer of complexity to the situation.