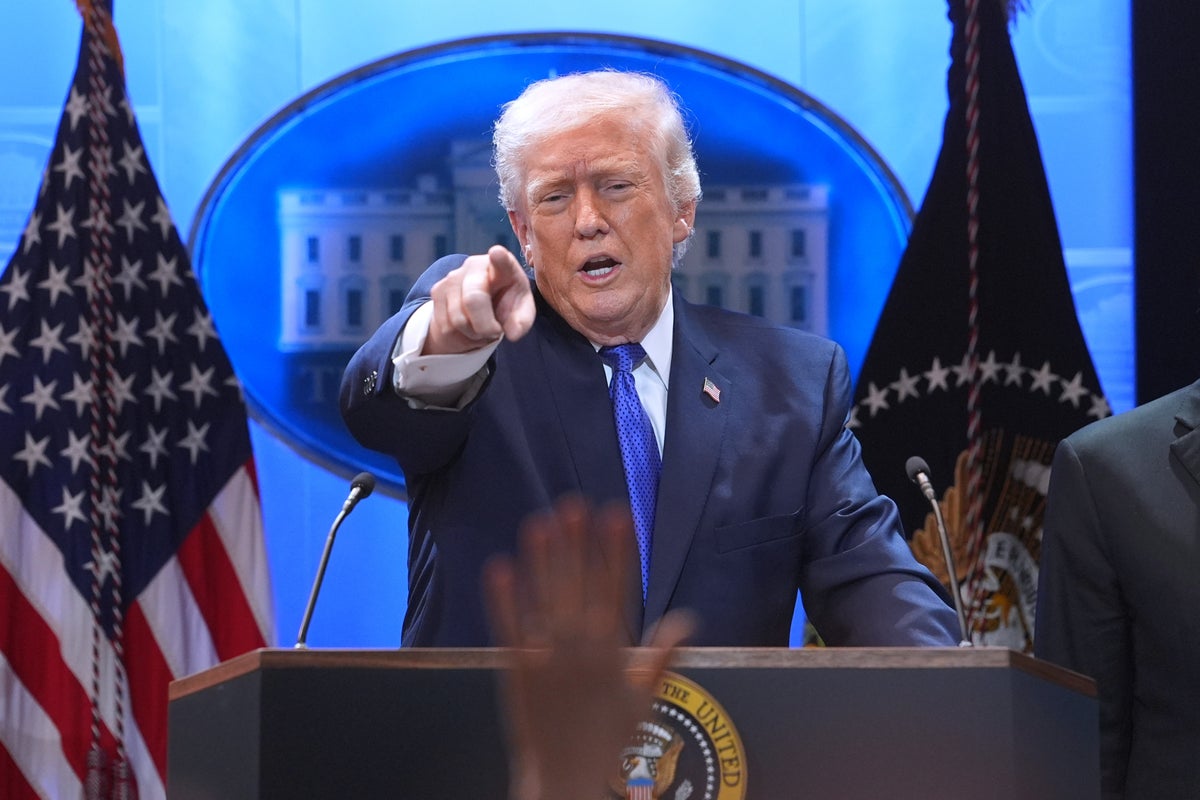

Following a Supreme Court ruling that deemed his global tariffs unlawfully imposed, President Trump vowed to raise worldwide tariffs to 15 percent. He announced this intention via Truth Social, stating the increase would be effective immediately and bypass congressional approval. This move, framed as retribution for perceived unfair trade practices, utilizes the 1974 Trade Act, which carries limitations on duration and scope. Critics, including Democratic lawmakers, denounced the tariffs as a tax on the American people.

Read the original article here

Trump has announced a sweeping plan to impose a 15% tariff on all imports worldwide, a move he intends to implement “effective immediately.” This drastic policy shift signals a significant escalation in trade tensions and promises to reshape global commerce in profound ways. The declaration, made without much preamble, suggests a willingness to bypass established diplomatic and economic norms in pursuit of his agenda.

The immediate impact of such a broad tariff increase would be felt by consumers and businesses across the globe. For Americans, this translates directly to higher prices on a vast array of goods, from everyday necessities to manufactured products. The argument often made in favor of tariffs is that they protect domestic industries and create jobs. However, critics contend that these same tariffs function as a de facto national sales tax, increasing the cost of living for citizens without direct representation or a say in the matter.

This aggressive tariff stance also raises serious questions about the balance of power within the executive branch and its relationship with the Constitution. The notion that a president can unilaterally implement such far-reaching economic policies, especially after judicial rulings that may have limited such actions, sparks debate about the very foundations of American governance and the checks and balances designed to prevent unchecked executive authority. Some view this as a push towards a more authoritarian model, where presidential whims can override established legal frameworks.

The timing and nature of these tariff vows have also led to considerable confusion and speculation. There appears to be a degree of fluidity in the proposed tariff rates, with initial discussions of 10% seemingly shifting to the 15% figure. This perceived capriciousness raises concerns about economic stability and predictability, particularly for businesses that rely on predictable trade conditions to plan and operate. The constant recalibration of tariffs can create an environment of uncertainty, making it difficult for companies to make long-term investments or manage supply chains effectively.

From an international perspective, these pronouncements are often met with a mix of concern and what some describe as weary resignation. While the initial rollout of broad tariffs caused significant global upheaval, the repeated nature of such threats may have diminished their shock value for some international actors. The perception can arise that the pronouncements are, to some extent, bluster, and that the word of the individual making them carries less weight than it once might have. This can lead to a scenario where other nations become desensitized to the threats, viewing them as a predictable, if disruptive, element of the global political landscape.

The economic rationale behind such sweeping tariff increases is a subject of intense debate. While proponents might argue that it compels other countries to engage in trade negotiations on more favorable terms for the United States, critics point to the immediate financial burden placed on American consumers and businesses. The idea that these tariffs will directly funnel money into the U.S. Treasury is a complex one, as the actual flow of funds and the ultimate beneficiaries are subject to intricate economic mechanisms. It is often argued that the costs are ultimately borne by the end consumer, and that any reimbursements for tariffs paid might disproportionately benefit large corporations rather than individual citizens.

The political ramifications of such policies are also significant. Imposing tariffs that demonstrably raise prices for ordinary citizens is generally considered an unpopular move, and it places elected officials in a difficult position. Those in Congress are faced with the choice of either supporting policies that could increase costs for their constituents to align with a particular political agenda, or standing against it and potentially facing backlash from a vocal segment of the electorate. This dynamic can create internal party divisions and complicate legislative efforts.

Furthermore, there are concerns that these tariff actions are not purely driven by economic strategy but also by personal or political motivations. Some interpretations suggest a punitive element, where trade policy is used as a tool to express displeasure or to retaliate for perceived slights. This can lead to a perception of policy being driven by emotion rather than rational economic planning, which can further erode confidence in the stability of trade relations.

The lack of consistency and the rapid shifts in policy can create significant confusion for businesses involved in international trade. Companies grappling with the implications of tariffs need clear and stable guidelines to operate effectively. When tariff rates fluctuate seemingly overnight, it can lead to missed opportunities, unexpected losses, and a general sense of disarray in planning and execution. This instability can be more damaging than the tariffs themselves for many businesses.

The ongoing debate surrounding these tariff policies underscores a fundamental disagreement about the best approach to international trade and economic policy. Whether these actions will ultimately lead to a more favorable trade landscape for the United States, or whether they will result in greater economic hardship and fractured international relations, remains to be seen. However, the announcement of a 15% worldwide tariff, effective immediately, represents a bold and potentially disruptive move on the global economic stage.