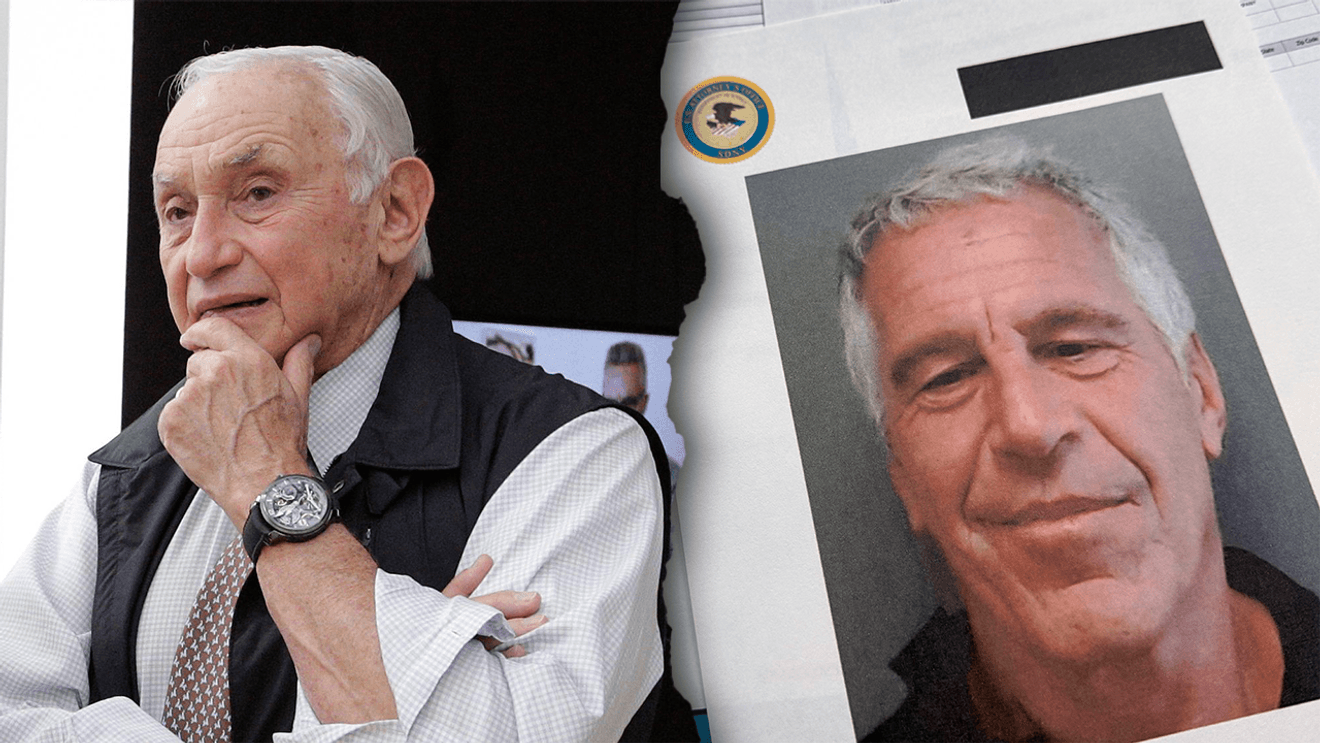

Lawmakers questioned Columbus billionaire Les Wexner about his extensive financial relationship with Jeffrey Epstein, who died in federal custody facing sex-trafficking charges. During a deposition at his home, Wexner stated he was unaware of Epstein’s illegal activities and claimed he cut ties with him nearly 20 years ago after discovering Epstein had stolen substantial sums. While Wexner asserted he was never on Epstein’s private plane and only visited his island once, some lawmakers found his claims of ignorance regarding Epstein’s conduct not credible. Wexner, who initially hired Epstein to manage his finances, expressed deep regret and embarrassment for being “duped by a world-class con man.”

Read the original article here

The sheer scale of the financial dealings between Les Wexner and Jeffrey Epstein, as revealed by a House panel, is staggering. The claim that Wexner provided Epstein with “about a billion dollars” over the years raises immediate and significant questions about the nature of their relationship and the flow of wealth. It’s hard to fathom such an enormous sum being transferred without a clear understanding of its purpose and implications, especially given the eventual revelations about Epstein’s criminal activities.

When we consider the typical motivations behind financial transactions, particularly among the extremely wealthy, the idea of giving away such a colossal amount of money without expecting a direct or indirect benefit seems highly improbable. The narrative that Wexner hired Epstein, a figure with no apparent financial expertise, to manage his affairs, and then seemingly granted him unchecked authority, strains credulity for many. This raises the suspicion that the true nature of the exchange was far more complex, and perhaps far more insidious, than a simple client-advisor relationship.

The assertion that Wexner, or any wealthy individual, would repeatedly transfer vast sums of money to someone without a clear understanding of how it was being used is difficult to accept at face value. The sheer amount involved suggests that these were not casual loans or gifts, but rather transactions with a purpose, however concealed that purpose might have been. The idea that Epstein, over two decades, was somehow “stealing” from a self-made billionaire without detection feels like a convenient, albeit implausible, explanation.

The possibility that Epstein leveraged his access to Wexner’s finances for his own illicit purposes, potentially including the acquisition of assets like an island, highlights the critical importance of tracing the money. A thorough forensic accounting investigation, though likely complex and time-consuming, is essential to uncovering the full extent of these transactions and understanding where this immense wealth ultimately ended up. The implications of such a vast financial pipeline supporting Epstein’s activities are deeply concerning.

The narrative surrounding Wexner’s involvement with Epstein has always lacked a logical core for many observers. There’s a significant disconnect between the known activities and apparent expertise of Epstein and the idea that he was entrusted with managing a billionaire’s finances to the tune of a billion dollars. If Epstein possessed genuine financial acumen, its absence in his own financial dealings and investments would be easily discoverable, further casting doubt on the credibility of the explanation offered.

The sheer magnitude of the funds discussed – “about a billion dollars” – feels almost like a punchline to a dark joke about the excesses of the ultra-wealthy. It’s the kind of figure that shifts the conversation from personal finances to something akin to national economies. This highlights a broader concern about the unchecked power of individuals who can wield resources on such a scale, potentially outside the purview of normal oversight.

This revelation, while disturbing, could also be interpreted as a sign of impending accountability. When individuals are cornered and face scrutiny, they may resort to increasingly implausible excuses. The claim of simply giving vast sums of money because it was asked for, without any deeper understanding or expectation, appears to be a desperate attempt to distance oneself from complicity, even if it leads to self-embarrassment through its sheer lack of believability.

The question of who benefits from such immense financial transfers is paramount. It’s difficult to reconcile the idea of a billionaire being so generous without a reciprocal benefit, whether direct or indirect. The notion that Wexner was a primary, if not the sole, financial engine supporting Epstein’s operations is a deeply troubling possibility that warrants rigorous investigation.

One can only speculate about the origins of Wexner’s immense wealth and the justifications for its disbursement. While there are many reasons for charitable giving or investment, the context of Epstein’s criminal enterprise casts a dark shadow over any such explanation. The possibility that such wealth might be redirected to facilitate criminal activity, rather than contribute to public good or productive enterprise, is a grim prospect.

The financial industry’s role in facilitating these transactions is also a crucial aspect of the ongoing investigation. Reports suggest a potential culture of complacency or deliberate oversight at major financial institutions, which allowed for suspicious transactions involving billionaires like Epstein to go unnoticed or unflagged for years. This suggests a systemic issue that extends beyond individual actors.

The suggestion that individuals might prefer to funnel vast sums to associates involved in illicit activities rather than fulfill their tax obligations is a cynical, yet not entirely unfounded, observation about wealth and its custodianship. The allure of secrecy and the avoidance of scrutiny can be powerful motivators.

The sheer stinginess often attributed to billionaires, who meticulously manage their fortunes and scrutinize every expense, makes the idea of casually parting with a billion dollars particularly incongruous. The meticulousness with which they often pursue even minor financial discrepancies stands in stark contrast to the purported casualness of such a massive transfer.

The comparison between Wexner’s substantial donation to Ohio State University, which resulted in his name emblazoned on a building, and his dealings with Epstein, where the presumed “return” was far more sinister, draws a stark and disturbing parallel. It highlights the different forms of “value” sought and the vastly different consequences of those pursuits.

The fate of Epstein’s immense assets following his death and incarceration remains a lingering question. If he was indeed a billionaire, and his partner also faced legal repercussions, the dispersal of his wealth is a critical piece of the puzzle. The potential that these funds might have been absorbed by the state or government, or disappeared entirely, underscores the opaque nature of such financial dealings.

The persistent questions surrounding Epstein’s financial dealings and the extent of his wealth have led many to speculate about the true nature of his “business model.” The idea that his primary financial strategy was not necessarily to acquire wealth, but rather to use money to secure silence and influence regarding his criminal activities, offers a chilling perspective on the situation.

The notion that Wexner’s billion-dollar transfers were effectively payment for silence or a form of blackmail – essentially paying to keep Epstein from revealing damaging information – is a disturbing, yet plausible, interpretation of the events. The vastness of the sum suggests a significant leverage held by Epstein.

The repeated assertion that Wexner “gave” the money, rather than invested or lent it, is a crucial detail. It implies a one-sided transfer of assets, which is highly unusual in the context of business or personal finance, especially on such a grand scale. This distinction raises further red flags about the true nature of their arrangement.

The persistent questions about where Epstein’s billions ultimately went, especially after his death and the legal entanglements of his associates, remain unanswered. The official narrative often leaves significant gaps in the financial trail, fueling speculation and suspicion about the ultimate beneficiaries of his vast fortune.

The idea that Epstein possessed incriminating evidence against powerful individuals, which he could leverage for financial gain, is a widely held theory. The extensive surveillance technology found in his properties suggests a deliberate effort to gather and retain information that could be used as collateral for loans or as a means of protection.

The sheer incredulity that many people feel when confronted with the claim of a billion-dollar transfer without any apparent quid pro quo highlights a fundamental disconnect from the perceived norms of financial behavior, even among the extremely wealthy. The idea of such casual disbursement of immense wealth is almost unfathomable.

The comparison to Elon Musk’s hypothetical scenario of simply “asking for” wealth rather than building it reflects a sentiment that some individuals view wealth acquisition as a passive process, rather than one driven by innovation, value creation, or societal contribution. This perspective paints a picture of wealth as an entitlement rather than an earned reward.

The suggestion that billionaires may be “parasites” underscores a perception that some of the wealthiest individuals do not contribute to society in a meaningful way commensurate with their accumulated fortunes, but rather extract value without proportional reciprocation. This viewpoint is amplified when vast sums are seemingly disbursed with little apparent benefit.

The notion that judges and legal systems might be compromised or susceptible to influence from the wealthy further erodes public trust and suggests that accountability for financial impropriety may be elusive for those at the pinnacle of society. This breeds cynicism about the fairness of the justice system.

The idea that individuals who are adept at accumulating wealth are not necessarily intelligent or ethical in other aspects of their lives is a crucial point. Focusing solely on their financial prowess can obscure deficiencies in judgment, morality, or overall cognitive ability, leading to misplaced trust.

The self-deprecating humor in the statement, “I guess I just found a get-rich-quick scheme” in response to the idea of giving money away to become rich, satirizes the perceived simplicity and lack of effort involved in the alleged transactions. It highlights the absurdity of the situation from an outsider’s perspective.

The notion of white privilege and inherited advantage playing a role in the accumulation of wealth and the avoidance of accountability is a recurring theme in discussions about the ultra-rich. The idea that some individuals have had advantages from birth can lead to a perception of entitlement and a lack of responsibility.

The observation that “money doesn’t equal smart” is a pointed critique of the assumption that immense wealth automatically confers wisdom or sound judgment. Examples cited, like the potential for Epstein’s emails to resemble a middle schooler’s writing, suggest that financial success does not necessarily correlate with intellectual sophistication.

The meticulous negotiation and deal-making characteristic of wealthy individuals, who are constantly seeking lower prices, makes the concept of simply “giving” a billion dollars seem fundamentally at odds with their known financial behavior. The idea that they would not scrutinize such a massive outflow of funds is hard to accept.

The idea that “you pay the pimp and not the girls” is a chillingly direct metaphor for the alleged financial transactions, suggesting that the money was intended to facilitate or cover up exploitative behavior rather than support the victims.

The recurring theme of a “cover-up” and “justice denied” points to a pervasive suspicion that the full truth behind these financial dealings is being deliberately concealed. The implication is that powerful individuals are working to protect themselves and their associates from accountability.

The involvement of government bodies, such as the Senate Finance Committee and the Department of Justice, in investigating these financial transactions suggests a recognition of the serious implications of these dealings. However, the pace and outcomes of these investigations are often met with public skepticism.

The reported obstruction or redirection of investigations, particularly concerning the transfer of cases and the withholding of sensitive financial records, further fuels the perception of a deliberate effort to shield individuals from scrutiny. This raises concerns about the integrity of the investigative process.