Global stock markets experienced a sharp selloff following President Trump’s statements to Norway regarding his desire to control Greenland, citing the Nobel Peace Prize as a motivating factor. In response, Trump threatened escalating trade tariffs on the U.K. and E.U. if they did not comply. Analysts suggest that the prospect of renewed trade wars between the U.S. and Europe is driving down equities worldwide. Safe-haven assets like gold have surged as a result, while market watchers assess the potential impact of tariffs and geopolitical tensions.

Read the original article here

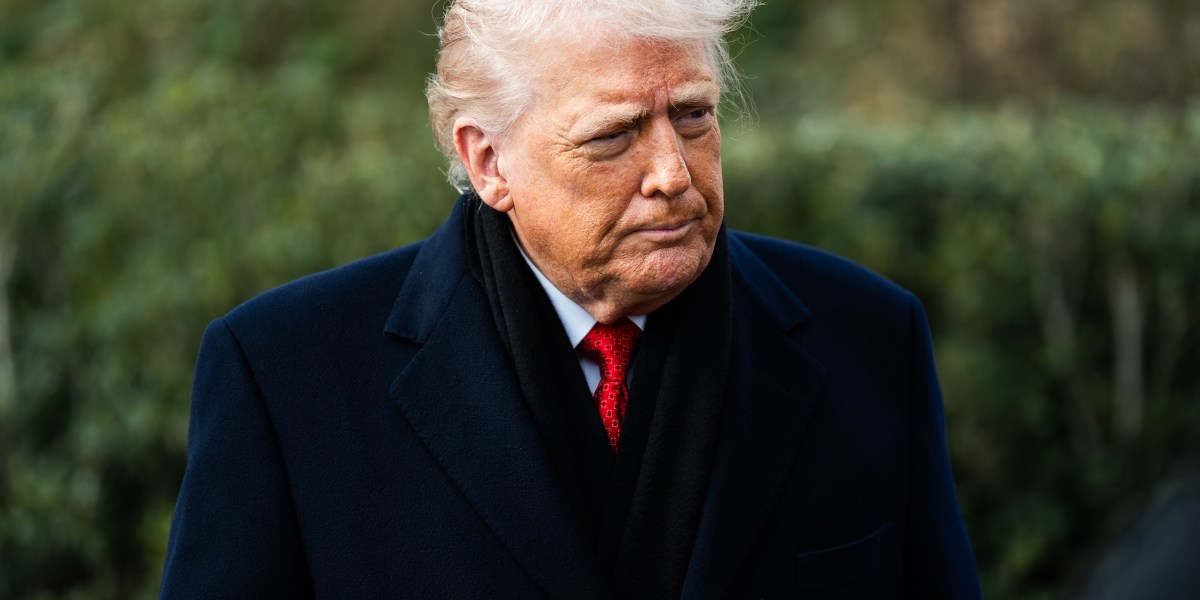

Stocks sell off globally as traders digest Trump’s message saying he wants Greenland because Norway “decided not to give me the Nobel”: the world, once again, seems to be holding its breath. The news that triggered this reaction? Former President Trump, apparently still stewing over a missed Nobel Peace Prize, allegedly texted the Norwegian Prime Minister, linking his desire to acquire Greenland to the award snub. The article states he wrote, in essence, that because of this perceived slight, he no longer felt obligated to pursue solely peaceful actions. This is, to put it mildly, not the kind of thing that inspires confidence in the global market.

The central issue in the news is clear and straightforward: the former president’s stated intention, stemming from his belief that Norway influenced the Nobel Committee’s decision not to award him the Nobel Peace Prize, is to take over Greenland. It’s an issue that combines geopolitical absurdity with economic consequences. The irony is rich, as it seems he has confused Norway, the country that awards the prize, with Denmark, which Greenland is a territory of. The Norwegian government has no control over the awarding of the Nobel Prize, a fact that appears lost on the former president.

The market’s immediate response wasn’t a surprise. Traders, always sensitive to any hint of instability, immediately started selling off stocks. The prospect of renewed trade wars, international tension, and general geopolitical chaos is a recipe for volatility, and investors always tend to react defensively. This sort of behavior is hardly unusual, as any significant change or disruption to the current global status quo will always cause a market shift.

The underlying reasoning behind the former president’s alleged stance is even more concerning. The implication that he would pursue aggressive actions, such as potentially taking over Greenland, as a form of revenge for not receiving a prize speaks volumes about the logic in play. This is not simply a matter of hurt feelings; it’s a display of a worldview where personal grievance trumps rational decision-making and consideration for global consequences. His lack of understanding about which country has oversight of Greenland also calls into question his basic grasp of international affairs, further adding to the concerns.

The situation becomes even more complicated with the fact that Greenland is a territory of Denmark, not Norway, a basic fact that the former president appears to have overlooked. Furthermore, Greenland is under the protection of NATO. This highlights an ignorance of existing alliances and political structures.

The reactions within the article are also understandable. Those who have been consistently critical of the former president’s actions see this as yet another example of his reckless behavior, his apparent disregard for established norms, and his tendency to act on impulse. The frustrations expressed are a reflection of a deeply divided political landscape. The comments also show strong reactions to the former president’s approach and its potential impact on international relations and global economic stability.

The broader implications of this situation are worth noting. Beyond the immediate market sell-off, there are concerns about the future of international cooperation, the potential for increased global instability, and the impact on the U.S.’s standing in the world. As some comments suggest, the fact that such a situation is even conceivable highlights the unique nature of the current political environment.

This whole scenario is a perfect illustration of how unpredictable behavior, a lack of understanding of basic facts, and a focus on personal grievances can have far-reaching consequences. For the stock market, the situation is a call for caution and a reminder of the need to carefully analyze the potential risks. In a world already facing numerous challenges, the prospect of a world leader pursuing action based on personal slights is, to say the least, unsettling.