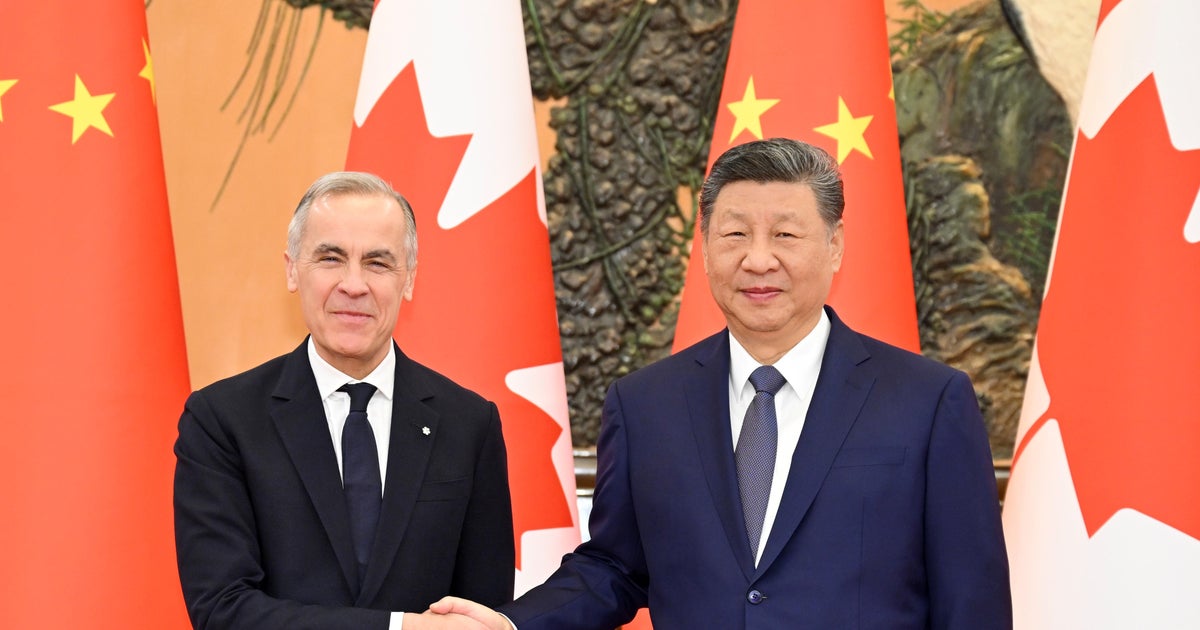

Following meetings with Chinese leaders, Canada has agreed to eliminate its 100% tariff on Chinese electric vehicles. In exchange, China will reduce its tariffs on Canadian canola seeds. The initial cap on Chinese EV exports to Canada will be 49,000 vehicles annually, increasing over five years. This agreement reflects a shift towards a more predictable partnership with China, especially as trade relations with the United States have become strained under the America-first approach.

Read the original article here

Canada agrees to cut tariff on Chinese electric vehicles in a move that significantly breaks away from the United States’ trade policies, a shift that’s already sparking a lot of discussion. It’s a clear signal that Canada is charting its own course, particularly when it comes to the burgeoning electric vehicle market. The agreement involves reducing tariffs on Chinese EVs, opening the door for consumers to access more affordable options and potentially shaking up the existing automotive landscape.

This move follows a trend of the U.S. seemingly distancing itself from traditional allies. The focus seems to be on a more isolationist approach. Consequently, it creates an opportunity for other nations to step in and forge their own partnerships. China, in particular, appears poised to capitalize on this changing dynamic, and this tariff reduction is a prime example. The U.S. auto industry had enjoyed protection for years, potentially allowing complacency to creep in, and now they may find themselves facing some serious competition.

The potential impact on the North American car market is considerable. The introduction of Chinese EVs, known for their competitive prices and impressive technology, could drive down prices across the board. Competition is a powerful thing, and it looks like consumers stand to benefit directly from this. Some believe that the build quality of these Chinese EVs is already exceeding that of some established players, adding another layer to the competitive challenge.

The shift in Canada’s stance could be seen as a natural evolution. The U.S. has made it clear that it doesn’t prioritize free trade. Now, Canada is pivoting to embrace a market that offers cutting-edge technology at attractive prices. This decision isn’t just about economic factors; it’s also about building stronger ties with nations that don’t pose a threat to Canada’s sovereignty. The implications are far-reaching.

While some worry about the US auto industry, it’s worth noting that the Canadian auto industry may not be at risk due to its existing strengths. Furthermore, the reduced tariff is initially limited, so it’s not going to completely flood the market immediately. However, it’s a clear first step in a larger strategic move.

One thing is certain: consumers are enthusiastic. The prospect of having access to affordable, high-quality EVs is exciting for many. Some people have mentioned wanting to get an EV for a long time, but cost was a major barrier. The arrival of these Chinese EVs could change that completely.

The situation has caused some strong reactions. Some commentators believe that the actions of the U.S. could be counterproductive. By pushing its allies away, the US may be accelerating a shift in global trade dynamics that favors China. The U.S. had a soft power advantage, and they have relinquished it.

While this may come as a surprise to some, it’s not for others. The US is moving backwards in a world that is clearly moving forward. With the rise of China and their EV technology, it would be almost inevitable to have them sell in Canada.

The U.S. auto industry, which has benefited from protectionist policies for years, is now facing a new reality. With Chinese manufacturers entering the market, they’ll have to adapt. It could be argued that this is a natural consequence of the American car industry’s own decisions.

Finally, it’s worth pointing out that this situation isn’t just about economics. It’s a reflection of the evolving relationships between nations in a rapidly changing world. Canada is making its move, and the ripples are being felt across the industry.