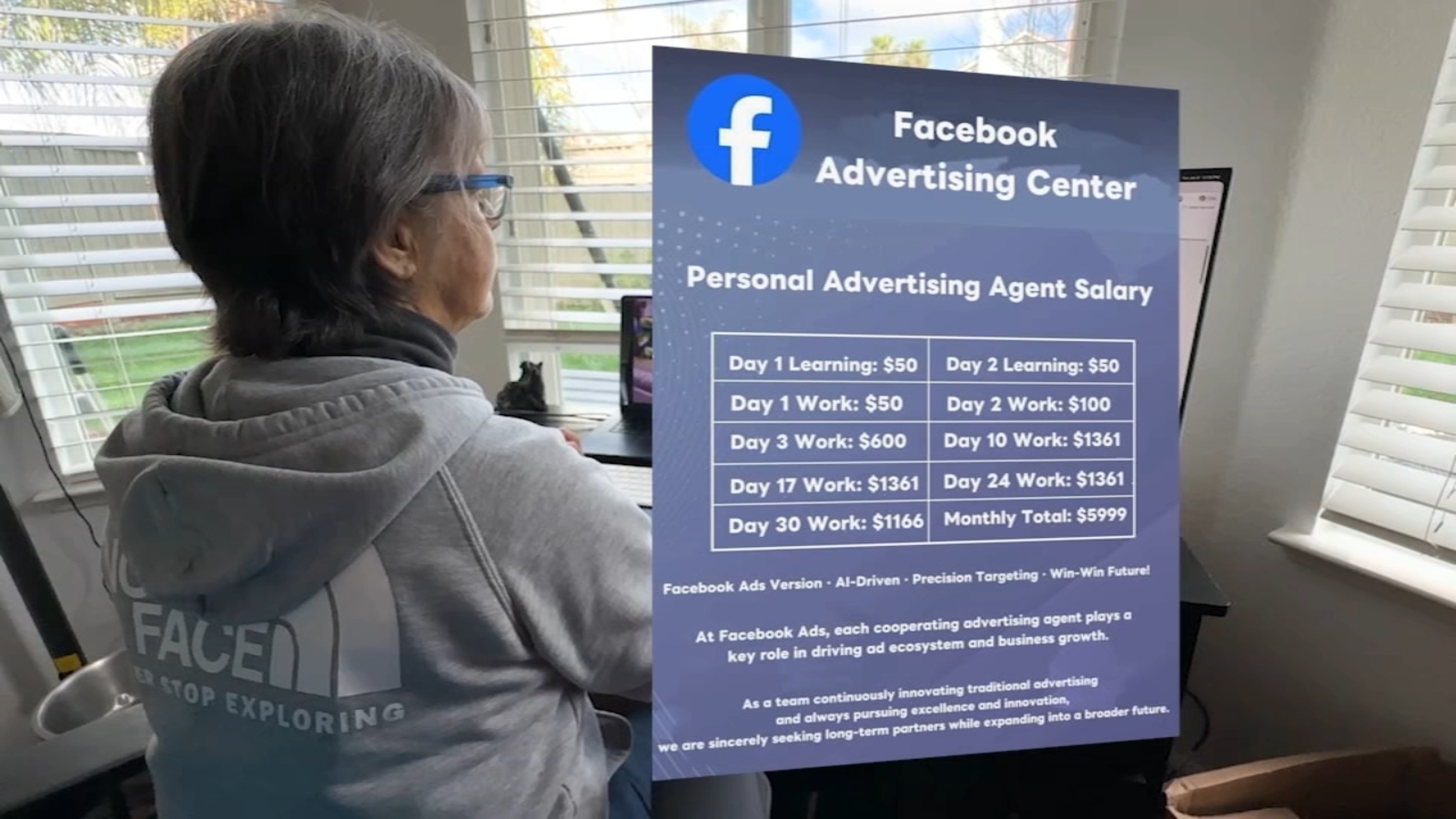

A Brentwood woman lost her life savings of $176,000 after accepting a remote job she believed was with Facebook. Scammers used advanced AI tactics to lure her into the fake opportunity, promising easy money through ad placement. The victim was coached by a “mentor” who communicated primarily through WhatsApp, and the fraudulent app even displayed her actual Facebook messages to appear legitimate. After placing ads and seeing large profits, the scammers demanded more money before she realized it was a scam, eventually losing all her savings.

Read the original article here

Bay Area software rep. lost $176K of savings after accepting remote job she thought to be with FB. The story of a Bay Area software representative losing a substantial $176,000 in savings to a supposed remote job with Facebook is, frankly, astounding. The details surrounding this incident read like a checklist of “red flags” that should have sent alarm bells ringing from the outset. How someone, particularly a software representative, could fall for such a scheme is the core question.

The fundamental issue boils down to a failure to grasp a basic tenet: you never pay to get a job. Any legitimate employer, especially a company like Facebook, will pay *you*. The very notion of transferring funds into a crypto platform, communicating primarily through WhatsApp, and then being told to spend your own money to place ads is a screaming indication of a scam. It’s truly baffling how this wasn’t immediately recognized as illegitimate.

This “training mentor” who communicated primarily through WhatsApp, the insistence on wiring money into a crypto platform, and the instructions to use that money within a Facebook “app” should have raised immediate concerns. The victim’s own words, “I used to think I was smart… but they tricked me!” highlight the vulnerability that was exploited. It’s a sad realization that someone who thought of themselves as intelligent could fall victim to this, yet it underscores the sophistication of these scams, and the importance of critical thinking.

The financial losses are staggering, and the advice to sell personal belongings to recoup the losses is frankly insulting. It’s a clear indication that the scammers were not interested in helping her succeed; rather, they were looking to extract as much money as possible. The fact that the victim was asked to perform such actions further illustrates the brazen nature of the scam and the complete lack of any ethical considerations from the perpetrators.

Several indicators that should have been immediately apparent were ignored. The lack of face-to-face interviews, the use of broken English, and the absence of the recruiter on LinkedIn are just a few of the glaring problems with this situation. These details should have caused suspicion and prompted the job seeker to stop the process immediately.

The fact that the victim used her actual Facebook credentials to log into this fake app, which then displayed her real Facebook messages, is almost unbelievable. Even with the app looking legitimate, it should have been apparent that the whole premise was a scam. This is a crucial point in the article: the user logged in using the same information as the real app. This demonstrates how susceptible people are to scam attempts that are made to look authentic.

The lack of critical thinking is the central issue. It’s essential to scrutinize every detail, verify information, and ask questions. In this case, the apparent greed was too strong to allow for cautiousness. The fact that this was a remote position also adds to the difficulty of verifying the legitimacy of the offer. A software rep should have been more careful; they are trained to find, scrutinize, and analyze information.

The victim stated the scams are becoming more sophisticated, but in this case, the scam was far from advanced. The core elements – demanding money upfront, using unusual communication methods, and promising excessive returns – are all classic warning signs. If anything, the lesson here is that people need to be more aware of how easy it is to be scammed and of the need to approach online opportunities with a healthy dose of skepticism.

This unfortunate episode serves as a stark reminder of the importance of financial literacy, critical thinking, and the dangers of greed. While sympathy is warranted for the victim, it’s difficult to ignore the numerous red flags that were overlooked. The amount of money lost is significant, but hopefully, the lesson learned will prevent others from falling prey to similar scams in the future. The fundamental principle that you should never have to pay for a job is the most vital takeaway.