Contrary to predictions of wealthy residents fleeing New York City after Zohran Mamdani’s mayoral victory, luxury home sales actually surged in November. Reports from Olshan Realty and Douglas Elliman indicate a significant increase in sales of properties valued at $4 million or more. Real estate professionals like Donna Olshan and Noble Black dismissed the exodus predictions, citing the city’s enduring appeal despite potential tax increases. This suggests the city’s cultural and influential environment continues to outweigh any concerns about changes in local government.

Read the original article here

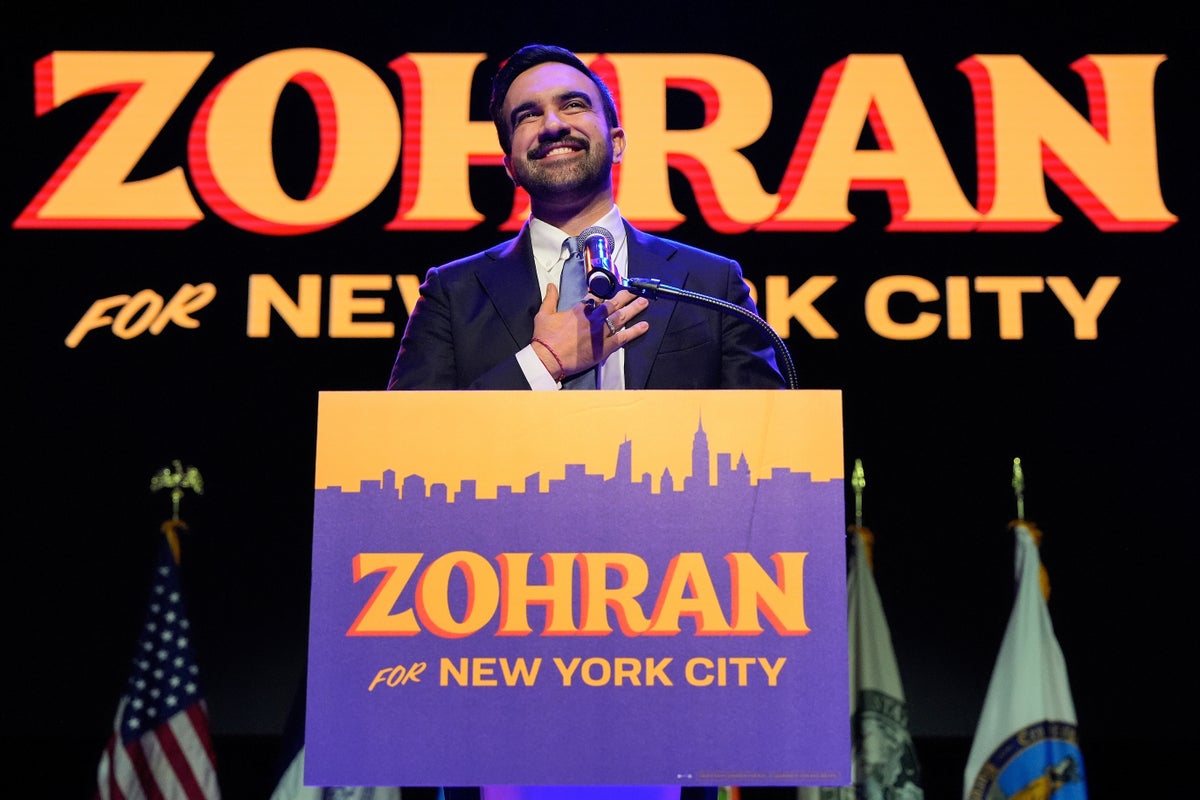

The Mamdani effect? Sales of luxury homes spike in the Big Apple, and it’s got everyone talking, hasn’t it? It seems there’s a bit of a contradiction playing out in the New York City real estate market. The narrative before the election was rife with predictions of wealthy residents fleeing the city if certain policies were enacted. Yet, as the dust settles, we’re seeing an increase in luxury home sales. It’s a fascinating paradox, and it prompts some interesting questions about the motivations of the ultra-wealthy.

The narrative surrounding potential tax increases, particularly those associated with candidates like Mamdani, often painted a picture of panic and mass exodus among the affluent. The fear was that higher taxes would drive them to greener pastures, taking their money and, perhaps, their influence with them. However, the data isn’t necessarily aligning with this pre-election prediction. With sales spiking, it appears someone is still buying those luxury properties. It’s worth remembering that for every seller, there’s a buyer, and in the world of high-end real estate, that buyer is likely another affluent individual.

So, what’s really happening? Are the wealthy simply replacing one another? Are they adapting to the new reality? Or perhaps, the initial fears were overblown? It’s easy to get caught up in the hyperbole, but maybe the impact of proposed tax increases, such as those that were a part of Mamdani’s platform, isn’t as life-altering for the super-rich as they’d have us believe. These individuals are often already accustomed to high costs of living and may value the amenities and opportunities that a city like New York provides. The potential tax increase could be seen more as a minor inconvenience rather than a reason to uproot their lives and move to the suburbs or another state.

It’s also important to consider the dynamics of the real estate market itself. Those selling luxury homes aren’t necessarily fleeing the city. They may be relocating for various reasons, unrelated to the political climate. Equally, the buyers aren’t just there to take advantage of any possible change in policy. They might be investors, individuals looking to upgrade, or people simply wanting to take advantage of a property market on the rise. We should also acknowledge that the existing property market favors high-end purchasers who are capable of purchasing more valuable properties.

Furthermore, we must address the potential for manipulation within the narrative. The focus on rich people “fleeing” can sometimes be a tactic to influence public opinion and discourage policies aimed at wealth redistribution. The claim that those taxes would devastate the rich can be simply a lie, used to protect their economic interests. The “fleeing” narrative can overshadow the needs of the vast majority of New Yorkers who are grappling with affordability and housing shortages.

It’s worth mentioning that New York City has a lot to offer those who can afford it. It’s a global hub for business, culture, and entertainment. The city offers access to world-class institutions, dining, and shopping. The benefits often outweigh the added costs, particularly in the current economy. For many, the lifestyle is worth the price, and a slight tax increase isn’t enough to outweigh the perks.

Ultimately, the data suggests a more complex picture than the simple narrative of mass exodus. Luxury home sales are up, demonstrating that the appeal of living in New York City endures even with proposed tax changes. The wealthy are still buying, which means some people will sell, but that doesn’t necessarily indicate a mass relocation. Some are selling, others are buying, and the market turns. It is very likely that some rich republicans do like democratic socialism, a reality often overlooked in the sensationalized headlines. The truth probably lies somewhere in the middle, and it is a reminder to critically assess the stories we are told and to appreciate the nuances of a constantly changing urban landscape.