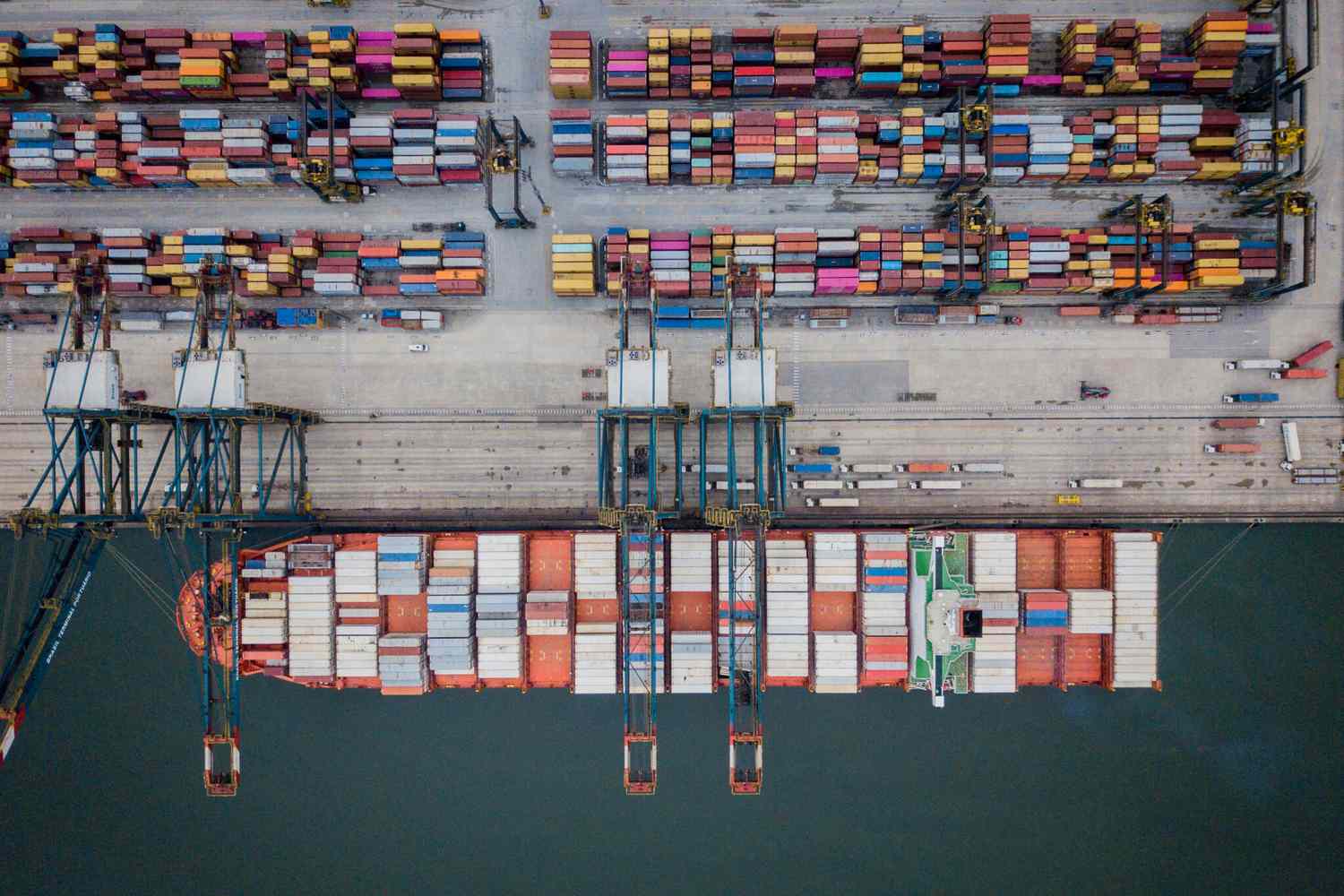

China is heavily investing in Latin American infrastructure, particularly ports, to secure its supply of agricultural products like soybeans, shifting trade away from the United States. This investment is exemplified by projects such as the Port of Chancay in Peru and expansions at the Port of Santos in Brazil. Consequently, while Latin American exports to China are booming, U.S. port traffic, especially for soybean exports, has significantly declined. Despite a recent trade agreement between the U.S. and China, the shift is negatively impacting American farmers, who face an uncertain future in the global soybean market.

Read the original article here

China is investing billions in Latin America, potentially sidelining U.S. farmers for decades to come, and the situation is more complex than a simple win-lose scenario. It boils down to a fundamental shift in global power dynamics, with China strategically positioning itself as a key trading partner and investor in a region traditionally viewed as under the U.S.’s sphere of influence. This isn’t just about agricultural products; it’s about long-term economic influence and how that translates to political sway.

Think about it: the United States has reduced international funding and aid in various parts of the world, creating a vacuum that China is readily filling. This isn’t some clandestine operation; it’s basic economics. China offers attractive business proposals, investments in infrastructure, and a willingness to engage in long-term projects. They’re not necessarily forcing anyone to do anything; they’re simply providing options that are appealing to many Latin American nations. The US has, in some ways, struggled to compete with that.

The impact on U.S. farmers could be significant. China is already a major importer of agricultural products, and Latin America is a significant producer. As China invests in infrastructure like ports and agricultural production in countries like Brazil, Argentina, and others, they naturally create a situation where they can source more products directly from those nations, reducing their reliance on American exports. This shift isn’t just a matter of price or quality; it’s about establishing secure supply chains and diversifying their sources to become less dependent on the U.S.

Some argue that markets always shift with demand and prices, and that the U.S. can still compete. While that’s true in part, this isn’t just about a simple trade war; it’s about long-term strategic positioning. China’s investments aren’t short-term; they’re designed for the long haul. They’re thinking in terms of decades, even centuries, building relationships and infrastructure that will solidify their economic influence.

The perception of America plays a role too. The U.S. can come across as an unreliable partner, imposing tariffs one day and then changing policies the next. And, let’s be honest, America’s offerings to Latin America haven’t always been positive. Meanwhile, China often comes with offers that are hard to refuse. The U.S. has often been seen as offering coups and bombings. China offers infrastructure and investments.

The consequences could be felt in a variety of ways. U.S. farmers may face reduced export opportunities. Other countries and companies may buy up U.S. farms and bring in their own workers. The shift could impact the overall economic health of the U.S. agricultural sector, potentially leading to job losses and a decline in the economic well-being of rural communities. The loss of soft power is another factor; when the U.S. reduces its presence in a region, China is quick to fill the void.

Some people feel that the U.S. has focused on other priorities, like trade wars and domestic politics, while China has been quietly and effectively building its economic presence in Latin America. In their minds, China’s increasing influence is a long-term strategic victory, while the U.S. risks losing its position as a global leader.

It’s tempting to oversimplify this as a story of good versus evil or winning versus losing, but that isn’t the case. This is a complex situation, driven by a combination of factors. China is taking the opportunity to fill a void and pursue their own strategic interests. The U.S. has to navigate a complicated economic and political landscape. This situation demands careful consideration of economic realities, strategic interests, and the potential long-term impacts on both U.S. farmers and the global balance of power.