The Trump administration is actively working to undermine the Corporate Alternative Minimum Tax (CAMT), a Biden-era measure designed to ensure large, profitable companies pay a minimum 15% tax on their book profits. This effort involves issuing guidance and regulatory proposals that weaken the CAMT, potentially providing significant tax breaks to corporations and investors. Critics, including Democratic lawmakers, have raised concerns that these actions create loopholes and may exceed the administration’s legal authority, potentially allowing wealthy corporations to avoid their tax obligations. Specifically, lawmakers are scrutinizing a recent notice that significantly increased the safe harbor threshold, which could exempt companies from CAMT liability.

Read the original article here

Trump quietly dishes out more tax breaks to rich investors while slashing food aid for millions; it paints a stark picture of priorities. It’s a tale of two Americas, really, where the gilded class gets fatter while the struggling masses are left to tighten their belts, even when it comes to basic sustenance. It’s almost too predictable, a familiar script playing out again and again.

The irony, as many have pointed out, is thick enough to cut with a knife. While those at the top are reportedly raking in billions in unlegislated tax breaks – essentially, loopholes and maneuvers that benefit the wealthy without formal Congressional approval – millions of Americans are struggling to put food on their tables. Food aid programs like SNAP (Supplemental Nutrition Assistance Program) face cuts, leaving families vulnerable. How can one justify taking away from the most vulnerable while simultaneously handing out enormous financial benefits to those who already have more than they could possibly need?

Why would corporations and wealthy individuals spend millions on things like lavish events or even, in the context of the input, speculative investments like Bitcoin? The answer, at least according to one viewpoint, is simple: they’re getting a massive return on their investment in the form of these quiet, behind-the-scenes tax breaks. It’s a pay-to-play system where the players are already winning, and the rules are rigged in their favor. This creates a cycle of influence, where the wealthy’s interests are prioritized over the needs of the average citizen.

The focus on the needs of the wealthy at the expense of those who are struggling is, in essence, a betrayal of the working class. It’s hard to ignore how many of those same working-class individuals were promised a better life and upward mobility, and yet the reality is often the opposite. The situation is all the more disheartening because the promised “ladder” is being pulled up, and many of the very people who feel betrayed are also the most likely to defend these actions due to their perceived political affiliation.

The lack of any ethical compass or moral center in these decisions is also a major concern. There appears to be no hesitation, no sense of obligation to treat all citizens with fairness and integrity. It raises the question of how a society can be so profoundly divided, where the powerful can effectively ignore the suffering of others. It becomes difficult to understand how or why there is no greater resistance when the implications are so devastating to a significant part of the population.

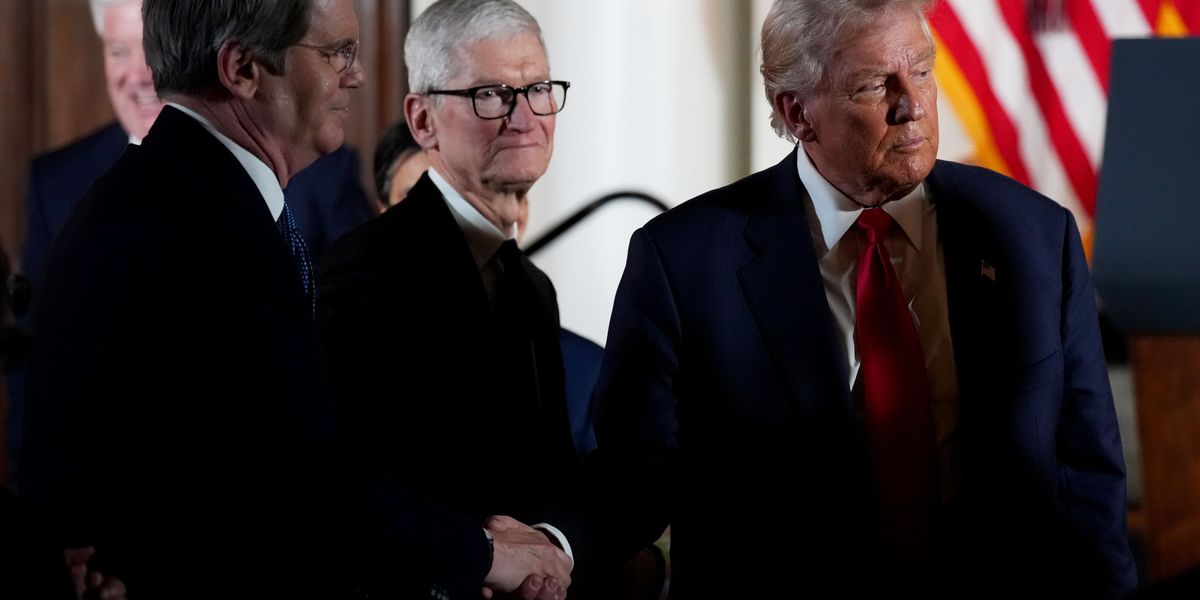

The image of a leader who seems indifferent to the suffering of others is a jarring one. It is a symbol of detachment, a clear illustration of someone who prioritizes personal interests above all else. This isn’t just a matter of policy; it’s a reflection of character, and it raises serious questions about the direction of the country.

The connections between campaign donations, government contracts, and tax breaks are deeply concerning and well-documented. What may appear to be isolated incidents or coincidences are often part of a much larger pattern of corruption and self-dealing, where the lines between public service and private gain become blurred. These ultra-rich and greedy people continue to benefit from these government contracts and tax breaks. The average citizens are constantly struggling and the wealth continues to concentrate.

The call to boycott certain corporations and individuals as a response to this situation is a logical one. Consumers can make informed choices to support businesses that align with their values and to avoid those that benefit from this system of corruption. It’s a way for individuals to reclaim some control and to signal that they are not willing to passively accept these actions.

The significant increase in SNAP recipients, coupled with cuts to food aid programs, is a clear indication of a growing crisis. While some growth can be attributed to economic factors, the ongoing crisis requires a serious response. Any society’s measure of its moral standing can be found in how well it takes care of its most vulnerable citizens.

The fact that the SNAP program could be fully funded for a decade with a fraction of the gains made by the top earners in this period highlights the systemic imbalance and injustice. It shows the vast resources at play and how they could be used to address the basic needs of a large population.

The anger and frustration of those who struggle with this system is both understandable and justified. It’s a situation where the wealthy are protected and the most vulnerable are increasingly at risk. It’s time for more Americans to have conversations and have more of an understanding of where food stamps go, rather than their own biases.

The perpetuation of this cycle depends on a population that is either unaware of what is happening or unwilling to acknowledge it. This is due to various methods, including media and disinformation. As a society, it’s vital to break through the echo chambers, to expose these realities, and to demand accountability.