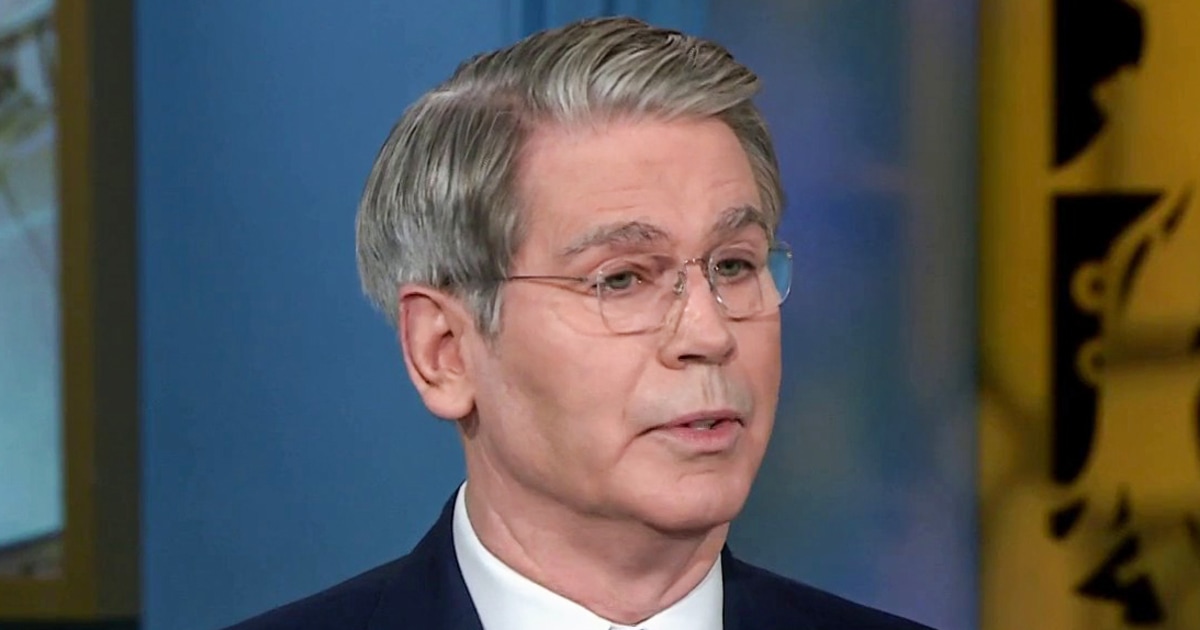

Treasury Secretary Scott Bessent expressed strong optimism for the U.S. economy in 2026, citing President Trump’s trade deals, tariff agenda, and the recently passed domestic policy package as key drivers. He acknowledged some economic pressures, particularly in the housing sector and the impact of the government shutdown. Bessent also discussed healthcare cost reductions anticipated under the Trump administration. In addition, Bessent advocated for ending the Senate filibuster and voiced support for a U.S.-backed peace deal between Russia and Ukraine.

Read the original article here

Treasury secretary says there won’t be a recession in 2026. The initial reaction seems to be a collective eye roll, and honestly, I can’t blame anyone. There’s a certain cynicism that naturally arises when you hear such pronouncements from those in charge, especially when the economic winds seem to be blowing in a different direction. It’s almost a knee-jerk response to assume the opposite, isn’t it? The implication is that if the Treasury Secretary says there won’t be a recession, then, by some unspoken law of the universe, a recession is practically guaranteed.

Treasury secretary says there won’t be a recession in 2026. The skepticism only deepens when you consider that many feel a recession is already underway. There’s a prevailing sentiment that the economic realities are being masked or that the data is being manipulated to paint a rosier picture than reality allows. The worry is that the authorities are withholding information, “hiding the data,” as some put it, to avoid public panic. This lack of transparency, the argument goes, actually creates more distrust and fuels the very anxieties they’re trying to quell.

Treasury secretary says there won’t be a recession in 2026. Furthermore, it’s clear there’s a strong belief that the administration is simply trying to deflect blame and maintain control of the narrative. The idea is that the pronouncement is less about economic forecasting and more about political maneuvering. If a recession does happen, it’s already pre-emptively assigned blame to the opposition or external factors, like those pesky immigrant cows. It’s almost as if the declaration is a tactic to shape public perception, rather than a genuine economic assessment.

Treasury secretary says there won’t be a recession in 2026. There is a palpable frustration about rising costs, particularly in essential areas like healthcare and groceries. The increasing financial strain on families and individuals is very real, and the assertion that there won’t be a recession feels tone-deaf to many. A significant increase in healthcare premiums, for example, is making individuals worry about affording anything extra at all. The sentiment is that these rising costs are already squeezing people, and the denial of an economic downturn feels dismissive of their struggles.

Treasury secretary says there won’t be a recession in 2026. Another recurring theme in the discussions is the concern about how the administration handles economic indicators and data reporting. There’s mention of “gaming the numbers” and a clear distrust of the figures being released. The suspicion is that economic data might be selectively released or presented in a way that obscures the true state of the economy. The fear is that the administration is trying to control the narrative, even if it means sacrificing transparency.

Treasury secretary says there won’t be a recession in 2026. The comparison to historical instances of downplaying economic warnings is striking. It is said that authorities have ignored or downplayed warning signs, with some even drawing parallels to historical instances of denial and misdirection. This perspective paints the current pronouncements as just another instance of a familiar pattern, making the public even more distrustful of the official assessment. The idea is that history is repeating itself and that we’re headed for a downturn, regardless of what the Treasury Secretary says.

Treasury secretary says there won’t be a recession in 2026. There is also a strong sense that the official position is largely a matter of political posturing, designed to create a sense of confidence, even if it’s based on dubious foundations. The reasoning is that the Secretary’s role is to project optimism, regardless of the underlying economic conditions, and that any contrary assessment could trigger a self-fulfilling prophecy, causing people to hold back on spending and thus exacerbating a potential downturn. In this context, the declaration is seen not as an honest forecast, but as a strategic tool.

Treasury secretary says there won’t be a recession in 2026. The comments reveal a general lack of trust in the individual making the statement. This is not necessarily about the individual’s competence, but a broader feeling that those in positions of power are not acting in the best interests of the public. This lack of trust, combined with the perception of manipulation and disregard for economic realities, creates a situation where any announcement is met with immediate suspicion. This environment of distrust makes it difficult for any administration to communicate effectively, regardless of their actual economic forecasts.

Treasury secretary says there won’t be a recession in 2026. Interestingly, there’s even a bit of dark humor running through the thread, as people express cynicism about how the data is being handled. The fact that the Treasury Secretary is saying this, in the minds of some, almost guarantees that a recession is on the horizon. It all boils down to a fundamental distrust of the government’s economic pronouncements and a feeling that they are intentionally withholding information from the public. It’s a sentiment shaped by a combination of economic anxieties, political distrust, and a healthy dose of cynicism.