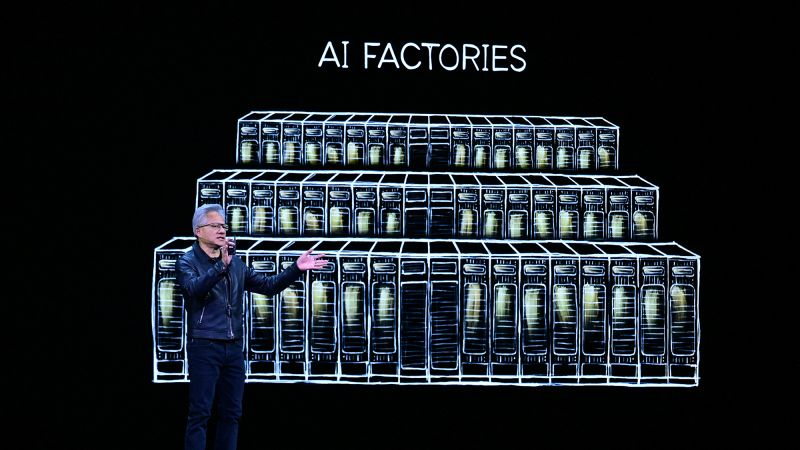

Despite Nvidia’s impressive financial results, with sales and profits surging over 60% year-over-year, concerns regarding an AI bubble persist. Although Nvidia executives, along with some Wall Street analysts, suggest these results indicate the AI market’s strength, the broader market remains unconvinced, as evidenced by the dip in Nvidia’s stock after its report. While Nvidia anticipates trillions in AI infrastructure spending and has numerous customers, questions remain about the sustainability of tech firms’ investments and the potential impact of a market downturn. Ultimately, Nvidia faces the challenge of convincing the market that an AI boom, rather than a bust, is on the horizon.

Read the original article here

Nvidia CEO dismisses claims of an AI bubble. Well, it’s not exactly surprising, is it? When the head of a company that’s become a multi-trillion-dollar behemoth thanks to the surge in AI technology, the last thing you’d expect is an admission that the whole thing might be built on shaky ground. It’s the classic “gold rush” scenario – the guy selling the shovels isn’t going to tell you the gold might run out any day now. It’s just not good for business.

Of course, if the CEO were to suggest there’s a bubble, the market reaction would be swift and brutal. Their stock price would likely take a nosedive, and that’s not a situation anyone in that position wants to find themselves in. It’s like the hot dog vendor denying a hot dog bubble exists – it’s his livelihood, after all. Or the realtor claiming it’s a great time to buy and sell, naturally. What else are they going to say? This all makes perfect sense, even though, in a way, it’s also a little bit unsettling. You have to wonder what might happen to the carefully crafted public image when the financial vulnerabilities are laid bare.

It’s similar to the recent observations made by someone on CNBC, who, while acknowledging that there might be a bubble, still urged people to buy in now because we’re supposedly in the early stages. It’s a bold move, and it’s something that feels right on the tip of the tongue when it comes to the entire AI situation. The sentiment seems to be everywhere you look, doesn’t it? The AI sector is experiencing a massive boom. Yet, even if it’s true, it’s really more of an LLM bubble instead of a full-fledged “AI bubble” at the moment.

So, the CEO of an AI company says AI isn’t a bubble. Shocking, right? The potential for bias is, of course, absolutely enormous. It’s hard to believe that they would be completely honest and forthright when their company’s financial future is so intertwined with the perception of AI. There’s no way he could admit it was a bubble, or at the very least, he’d have to make the admission in a way that wouldn’t tank the stock. It’s a calculated strategy, a gamble. We’ll have to wait and see how it plays out.

I can’t imagine how else they’d answer, and I suppose it goes the same with the Nissan CEO or the soap CEO. It’s not a bubble if you become the economy, and Nvidia is well on its way. The thought of it all seems a bit like that old *thinking gif* meme, doesn’t it? I just can’t see how it could be a bubble, in this case.

I remember seeing a koala bear driving a truck and telling a joke from the 90s, and somehow that justifies a higher valuation than the entire biotech field combined, it just doesn’t feel right. The person selling the pickaxes for the gold rush claims the gold rush isn’t over. It’s the same old story.

Let’s be clear; many people are tired of the constant chatter about AI, and some are eagerly anticipating a correction. It is cool technology, yes, but it is not the be-all and end-all that it is made out to be. We keep hearing the same lines: the gold rush isn’t over. People are still happily buying shovels.

Imagine the headline if the CEO were to come out and say, “Yeah, it’s definitely a bubbl-…oh, wait.” Their stock value would crash in an instant. This is why you’d ask the CEO of an AI company, right? Of course, he’d say that. The man who’s selling the pickaxes says there’s plenty of gold. The company that benefits most from the boom will not admit there is a bubble. Absolutely shocking!

Chips won’t be in a bubble, however, and that’s what Nvidia specializes in. Why would they lie about AI? Even in gaming, AI is creating novel content and interactions. It’s more enjoyable to have an NPC that seems somewhat conscious than one that just repeats the same old lines. So, it’s difficult to understand the fear or pessimism surrounding AI, despite the undeniable risks.

Given that, I guess everything is fine then. The pickaxe salesman says, “Gold Rush Still On, Come Buy More Axes.” I wouldn’t give it any credence if I were the CEO either, but it is a bubble, for sure. Nvidia CEO doesn’t want the money faucet turned off. Says whatever you need to hear so he can keep his yacht. What were you expecting him to say? The guy sitting on top of the bubble is denying there’s a bubble? Weird. My money will last forever. Nvidia: nuh uh Because of course he does.

We’re likely heading for a crash regardless of AI, which is part of the capitalist cycle that seems to repeat every few years. It just so happens that this time around it’s probably going to be something to do with the entire US GDP growth in the last couple of years, all being down to about 4 AI companies, all of whom are (right now) promising big and delivering small.

And, of course, it’s being funded by surveillance companies run by peculiar billionaires. It’s not an AI bubble; it’s a “build as many data centers as quickly as possible to make billions off data” disguised as a need for AI. It’s the arsonist dismissing claims of fire. What else would he say?