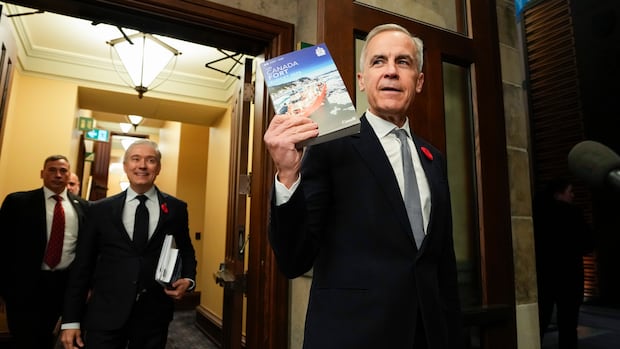

Finance Minister François-Philippe Champagne unveiled a federal budget featuring significant investments in infrastructure, housing, and the military, alongside public service cuts to address economic challenges. The budget projects a deficit of approximately $78 billion for the 2025-26 fiscal year, with $141 billion in new spending over five years, partially offset by $51.2 billion in cuts. Key highlights include investments in high-speed rail, ports, and critical minerals, as well as a reduction in immigration, and a potential end to the emissions cap. The government aims to foster business development through tax incentives and has allocated substantial funds for the Canadian Armed Forces.

Read the original article here

Carney’s 1st budget calls for billions in new spending to prop up tariff-hit economy, and it appears to be largely what was expected, emphasizing capital spending and some targeted tax cuts. It seems a clear line has been drawn between capital and operational spending, with initial cuts planned for some services and staffing. The big question now revolves around getting this budget passed in Parliament.

Given the current minority government situation, with the Liberals needing support from other parties, the path forward is complex. The opposition parties’ current positions suggest that forcing an immediate election might not be in their best interest, making it likely the budget will pass somehow, perhaps through abstentions. It seems like a situation where everyone, from the Liberals to the Conservatives, the NDP, and the Bloc, needs to work together to benefit Canada. Some believe Carney’s approach aligns with what a Conservative leadership might have wanted: cutting federal jobs. It’s perceived as a pragmatic approach, focusing on economic experience, which seems to be the main reason he was elected.

The budget also includes measures to promote “low-carbon” liquefied natural gas (LNG), reflecting a strategy of selling Canada’s resources to the world. The thinking is, why not leverage what we have, expand export capabilities, and become a more significant player on the global stage? While the budget may be a response to the need to address economic challenges, the focus on capital expenditures might be palatable to many, especially Conservatives, with the added benefit of cutting operational expenses this year. This approach would be preferable to a more extreme, potentially damaging, conservative approach that emphasizes spending cuts over long-term economic gains.

However, the budget projects modest economic growth, around one percent annually over the next two years, which, considering the population growth, doesn’t bode well for future economic stability. Concerns exist about the capacity to accommodate immigration growth without adequate infrastructure, housing, and job creation.

There are mixed reactions to the budget. Some believe the budget is good, particularly considering the circumstances, but the lack of consultation with other parties and the emphasis on the “Trudeau bad” mantra has some questioning the approach. There are criticisms around the effectiveness of tax cuts in promoting productivity, and the potential impact of tariffs. Others worry about inflation.

The budget’s success hinges on execution. The key question is whether these new projects will spur enough economic growth. It’s a significant improvement over the previous government. Despite any hesitation, if the budget doesn’t pass, it could trigger another election, a prospect many parties might not favor due to the current poll standings. This would put the Conservative party in a tough spot. In the end, it seems the deficit, and the increase in capital expenditures, has to remain under a certain percentage of the Gross Domestic Product in order to keep the debt-to-GDP level in check, a major factor in the health of any economy.