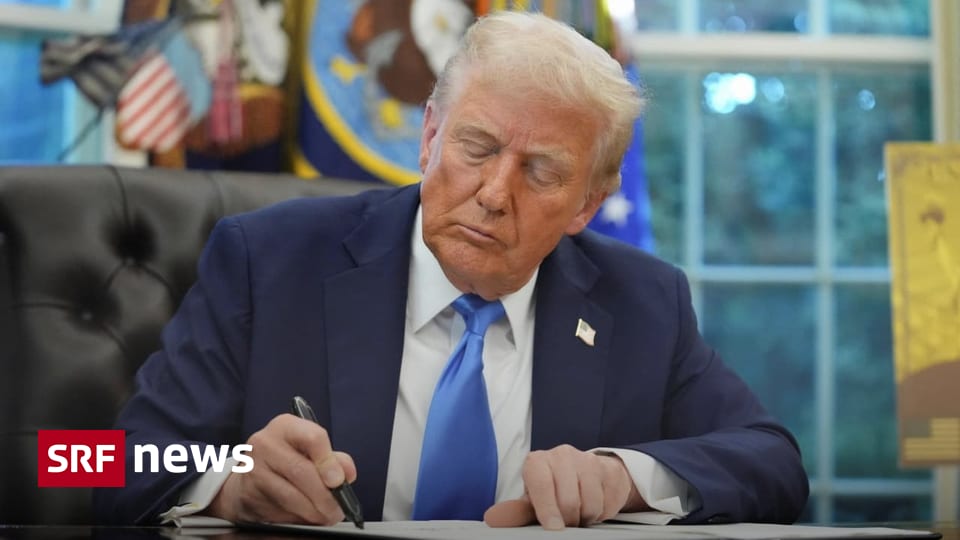

President Trump has announced an additional 100% tariffs on imports from China, set to take effect no later than November 1st, citing China’s trade policies as the reason. This action is a direct response to China’s tightened export controls on rare earth elements, which Trump labeled “extraordinarily aggressive” and “unprecedented.” The US President also hinted at potential export restrictions on key software to China and questioned a planned meeting with President Xi Jinping. The announcement has already negatively impacted the stock prices of US chip manufacturers.

Read the original article here

Trump wants to impose additional 100 percent tariffs against China, and that’s the core of the story. It’s like a repeat performance, a sequel we’ve already seen before, and frankly, it doesn’t seem like the plot has changed much. The potential impact, however, is what has everyone on edge. We know from past experience that this kind of move can be a real economic headache, especially for American consumers. Increased tariffs mean higher prices on goods, and that hits everyone’s wallet.

Considering his previous tariff hikes, which were already significant, this proposed 100 percent increase raises the stakes considerably. The reaction? Well, it’s mixed. Some see it as a way to pressure China on trade issues, while others worry about the consequences. There’s a definite sense of deja vu, with many wondering if it will actually achieve the desired results, or just backfire again. The idea that this will teach China a lesson feels simplistic, particularly since China is already preparing for a de-Americanisation.

Let’s not forget the deal with chipmakers like Nvidia and AMD. This allowed them to sell advanced AI chips to China, which might seem counterintuitive alongside the tariff talk. The arrangement itself has raised questions about legality and national security. It’s a sign of a deeper game being played, perhaps, than just tariffs and trade imbalances. This deal is a reminder that global trade is complex, often involving unexpected partnerships and compromises.

It’s easy to see that this could be a serious miscalculation. It could disrupt supply chains, hurt businesses, and ultimately hurt the average American. It’s a gamble, and the potential losses are high. The U.S. might find itself losing ground while China, with its own strategies in play, could maneuver to its advantage. This trade war isn’t a quick sprint; it’s a marathon. And the US isn’t handling the race all that well.

The potential for retaliation from China is huge. They’ve shown they’re willing to respond in kind, and a retaliatory trade war could be devastating. We’ve already seen them play the rare earth minerals card, and that could just be the beginning. It’s not just about the immediate costs; it’s about the long-term effects on relationships, industries, and the global economic landscape. This is not a move that’s likely to make friends in the world, and it is, in the end, a move that can only hurt Americans.

The conversation surrounding this proposal is filled with skepticism, frustration, and a healthy dose of cynicism. There’s the underlying question of whether this is about economics, or something else. It’s a sign of a complex political and economic environment. It suggests that a simple “fix” isn’t within reach and highlights the deep-seated issues in the U.S.-China relationship.

Ultimately, the decision to impose additional 100 percent tariffs carries significant risks. It’s a move that could have wide-ranging effects. The repercussions could be felt for years to come, from the markets and businesses to everyday Americans who will see prices rise. This is a high-stakes game, and the outcome is far from certain.