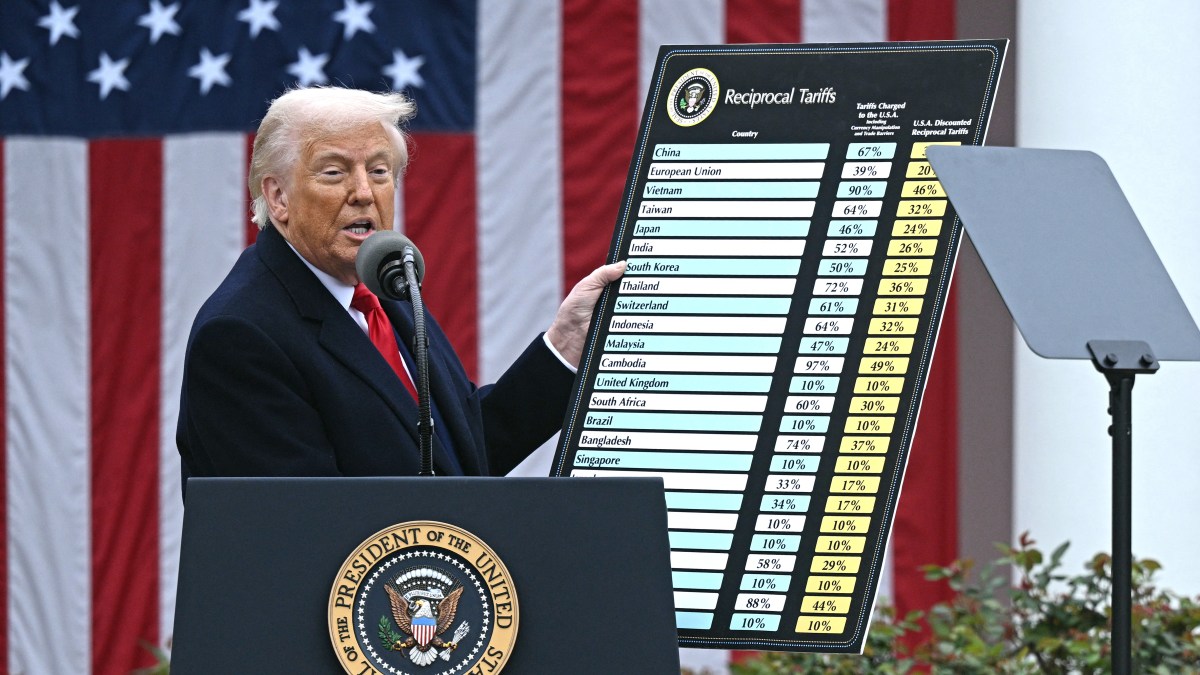

The Trump administration faces the potential of returning nearly $100 billion in customs duties, according to analysts, following a court ruling on the legality of tariffs. The US Court of Appeals upheld a lower court’s ruling, determining that Trump acted unlawfully by implementing broad import levies without Congressional approval. Although the appeals court voted in favor of the initial judgment, the tariffs remain in effect while the Trump administration appeals to the Supreme Court. These tariffs, first introduced in February, have generated approximately $100 billion in extra customs duties.

Read the original article here

Trump faces returning $100bn in tariffs after court ruling, which is a situation that’s sending ripples through the financial landscape. This potentially massive sum, stemming from tariffs imposed during his presidency, is now on the line, raising questions about who ultimately bears the financial burden. The central issue here revolves around the fact that these tariffs, essentially taxes on imported goods, were ultimately paid by American consumers and businesses through higher prices.

The complexities of the situation extend beyond a simple refund. The process of returning such a significant amount is likely to be a logistical and legal minefield. The crux of it is: if the courts rule that the tariffs were unlawful, who gets the money back? Do everyday consumers, who unknowingly absorbed the cost increase, get a slice? Or will it primarily benefit the companies that initially paid the tariffs and then adjusted their prices accordingly? There is also the matter of how this impacts businesses. Smaller companies, particularly, may have faced financial strain from the immediate tariff increases.

The scenario prompts concerns about potential exploitation. Some observers have noted a potential scheme where businesses, burdened by tariffs and facing legal battles, could sell their right to future refunds to financial entities, often at a significant discount. The implication is that some groups would profit from the tariffs in two ways: First, by the imposition of the tariffs themselves, second, by purchasing the businesses’ rights to reimbursement, ultimately receiving the full amount of any court-ordered refunds. This is a critical point, because it highlights the potential for a small number of players to profit from a situation that negatively impacts a broad segment of the population.

The fact that the money was already spent is a key issue. The government, having collected the tariffs, may have allocated the funds elsewhere, making the process of returning it even more challenging. It’s like taking money out of a complex budget and redistributing it to those who were impacted.

This could also lead to corporations, who have already pocketed profits, to have the full advantage when refunds occur. There are strong thoughts that the price increases will remain even if the tariffs go away, which is a huge problem. The government’s loss is the corporations’ gain, raising ethical questions about how the financial burden is distributed, and the potential for corporate gains.

The legal battles surrounding the tariffs also introduce uncertainty. If the courts are tied into political outcomes, it is unlikely that consumers will see a dime. The Supreme Court’s involvement could drag out the process, further complicating the timeline for any refunds and raising questions about how fair the ultimate outcome might be. This uncertainty fuels public frustration.

The financial markets could experience significant reactions to these events. With billions of dollars potentially being shifted, there is concern that this will impact the economy. There is potential for a drop in government revenue and a possible widening of the national debt. This is further complicated by corporate tax cuts, which would make a cut in tariffs less sustainable.

Looking ahead, the key question is who will ultimately shoulder the financial burden of these tariffs. Will it be the American consumer, businesses, or the government? The answer will likely shape the economic landscape for years to come, highlighting the need for clarity, transparency, and accountability in trade policy and its financial implications.