Nvidia and AMD have reached an agreement with the US government, involving a 15% revenue sharing arrangement from their China chip sales in order to secure export licenses. This unprecedented deal has sparked debate, with security experts expressing concerns about potential national security risks and the Trump administration’s approach. Critics have raised questions regarding the legality and precedent this sets, with some labeling it a “shakedown.” Meanwhile, Nvidia has emphasized the importance of American competitiveness in the global AI market.

Read the original article here

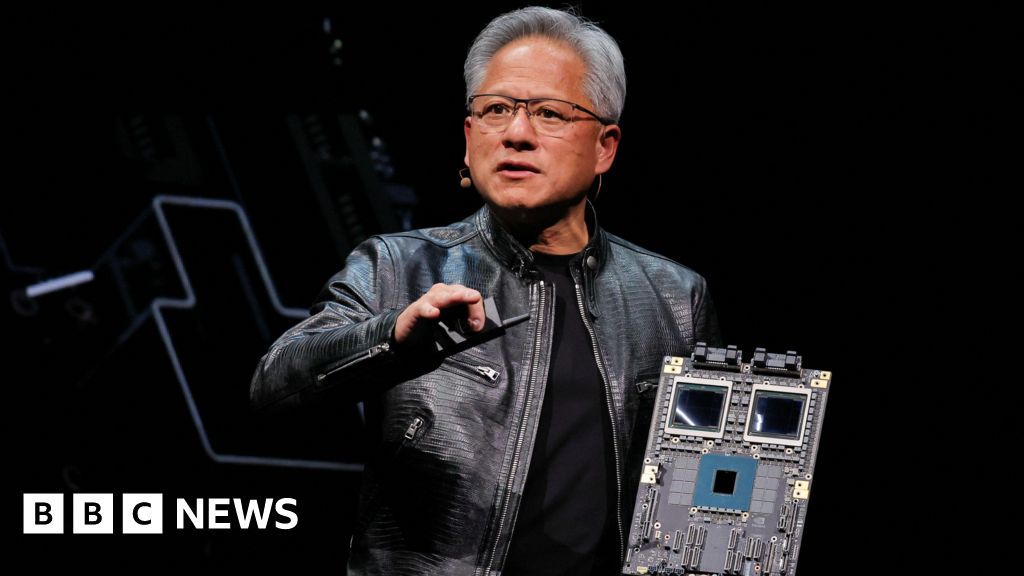

Chip giants Nvidia and AMD to pay 15% of their China revenue to the US government – that’s the headline. It’s a twist, to say the least, in the ongoing saga of the US-China tech relationship. It seems the agreement is tied to securing export licenses, essentially allowing these chip giants to keep playing in the world’s second-largest economy. You’ve got Nvidia, which had been blocked from selling certain advanced chips in China due to security concerns, and AMD, facing similar restrictions. The question is, what does this all mean?

First off, who pockets this money? Well, as far as we know, it goes straight to the US government. Which branch of government sets the taxes again? That’s a question for the history books, though it’s worth remembering who’s in charge. The way this is being handled feels a bit…unconventional. You see, the US initially put up barriers to prevent advanced chips from going to China, citing those same security concerns. Now, the solution isn’t a solid wall but more like a toll booth.

Then we have the curious question of what this really *is*. Is it a tax? Is it a bribe? Is it a shakedown? Because let’s be real, a 15% cut on revenue sounds awfully close to a tax, maybe a corporate tax, or perhaps even extortion. It’s like a protection fee to keep selling in China. And to think, we once heard calls for a smaller role for the government in business.

It’s even more complicated when we consider the geopolitical landscape. The US, it’s widely understood, appears to have conceded the 5G and EV races to China. The response is to, well, potentially damage their own chip companies? This deal, where Nvidia and AMD agree to pay a percentage, almost suggests a tacit admission that the US is willing to bend the rules to get a piece of the action in China.

The details are also interesting. This isn’t just about any chip; we are talking about specific models like Nvidia’s H20 and AMD’s MI308, the H20 chip being developed specifically for the Chinese market after US export restrictions were imposed in 2023. These advanced chips are essential for AI applications, so there’s that national security element again. Some people are saying that the revenue sharing doesn’t eliminate the initial national security issues, and it’s hard to disagree.

Some have even hinted at the possibility of shareholder lawsuits against the US government. After all, a tax can significantly impact a company’s bottom line. And it isn’t like Nvidia and AMD will be the ones footing the bill. The companies are likely to raise the prices of the chips accordingly, passing the costs to Chinese consumers. If it’s simply a cost to do business, it would be a consumption tax in all but name.

The backdrop of all of this is the increasing competition between the US and China in the tech sector. China is rapidly developing its own capabilities, including producing chips that match Nvidia and AMD in performance, even if they sacrifice electrical efficiency. Could this be a move to help Chinese companies? Maybe. The US government probably isn’t going to say as much, but that seems to be the underlying current in this situation.

The politics surrounding this issue add even more layers. There’s the fact that there are those in the past that have wanted to see companies in the US that are headed by people that have interests in China resign. The US lost the 5G and EV race to China. As for Trump, he’s mentioned that this is actually a hidden tax and that national security is now for sale. This really seems like a situation where money talks.

And what about the future? China’s EV and renewable energy industries are surging, fueled by robust government support. Can we expect the same results by putting a financial burden on our own tech companies? The best thing to do would be to increase corporate taxes, but as of right now that doesn’t appear to be the case. It does make you wonder whether the US is effectively subsidizing another country by allowing these companies to do business there. It also raises the question of the US government’s role in protecting its tech sector and its broader geopolitical strategy.

For now, the focus remains on the agreement: Nvidia and AMD paying 15% of their revenue to the US government. But it’s essential to consider the larger context. The question is not merely about the transaction itself but rather its long-term impact on the American tech industry, its relationship with China, and the security concerns that prompted this agreement in the first place.