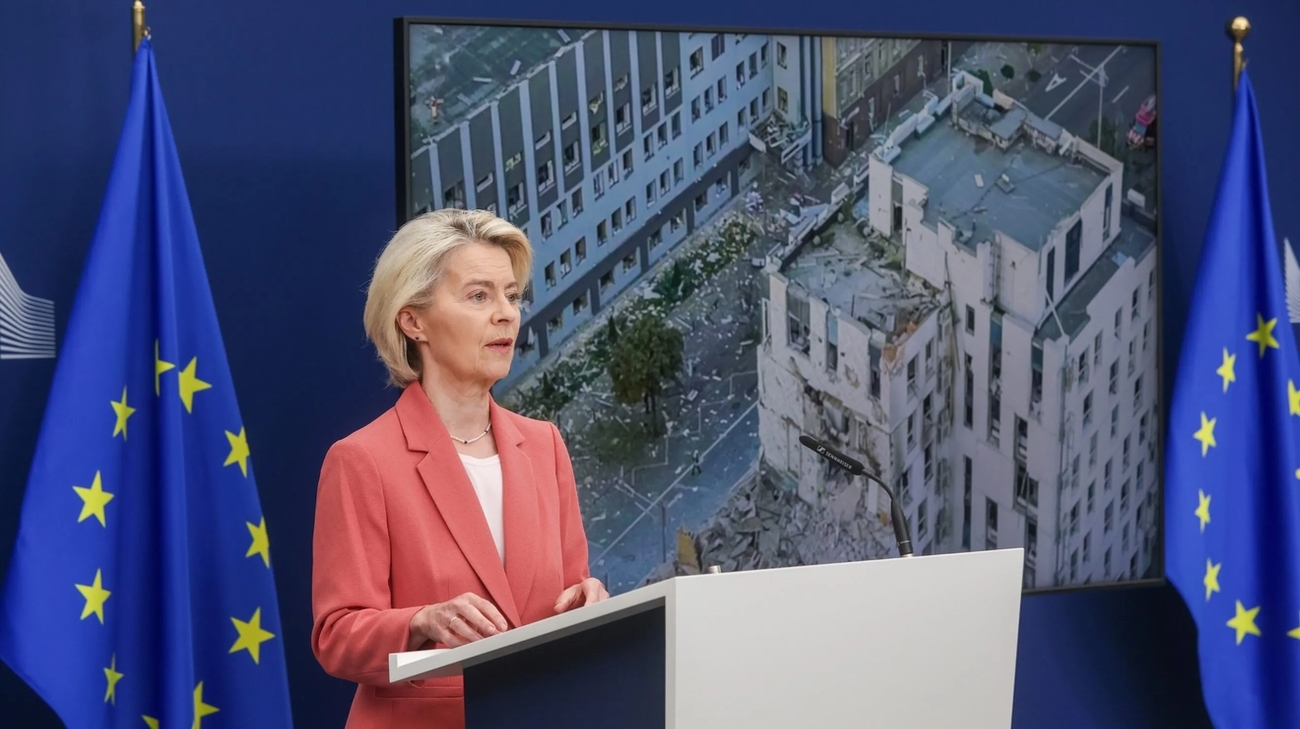

The European Commission is exploring a mechanism to channel nearly €200 billion in frozen Russian assets toward Ukraine’s reconstruction. This plan involves transferring the assets into a special fund for higher-risk investments to generate greater returns, potentially increasing pressure on Russia and paving the way for future reparations. While immediate confiscation is opposed by many EU members, the initiative, pushed by key figures within the Commission, aims to create a fund modeled on the European Stability Mechanism. The proposal has gained traction, with some countries like Belgium showing increased support, despite concerns about potential financial risks and the burden on EU taxpayers.

Read the original article here

European Commission wants to channel €200 billion of frozen Russian assets into Ukraine’s recovery – Politico, and it’s a big deal. The core idea is pretty straightforward: use the frozen assets, about €200 billion held by the EU, that belong to Russia to help fund Ukraine’s ongoing war effort and future reconstruction. The potential impact of this decision is enormous, especially given the critical needs Ukraine is facing.

Now, the scale of this is quite something. The proposed €200 billion could represent a substantial boost to Ukraine’s military capabilities. Some calculations suggest it could even double all the military aid Ukraine has received so far. This is significant because, as we all know, Ukraine needs support, and it needs it urgently. The war’s not exactly going away, and the consequences of delay are severe.

However, and this is where things get complicated, there’s a strong undercurrent of skepticism. It’s hard to ignore that there have been numerous discussions, debates, and promises of support over the past couple of years. Weapons systems have been discussed, pledged, and sometimes even delivered with restrictions, with the announcements often public but the deliveries less so. This raises the question: What makes this time different? What’s new about this specific proposal that warrants our attention? This is a very valid question.

It’s important to remember that the European Commission “wants to” do this. That’s not the same as actually doing it. The history of this conflict is full of statements, but that doesn’t automatically mean that concrete action follows, especially with the varying opinions and interests among different member states. We have seen some members being a bit less enthusiastic about taking strong action, and we all know how it is: politics, bureaucracy, and strategic calculations often get in the way.

A key point raised in the comments is the potential for using the returns generated by investing the frozen assets rather than the assets themselves. This nuance changes the game a bit. If the focus is on returns, it means the EU is looking to use the profits generated from these assets, rather than directly seizing and distributing the principal amount. The goal, as stated, is to transfer the assets “into higher-risk investments that could generate greater returns.”

This proposal highlights the long-term consequences, the need to get things done and the complexities of international law and financial stability. As one commentator points out, the idea that Ukraine needs to be rebuilt is almost premature. Some people believe that the most urgent priority should be a complete Russian withdrawal from the country, which would, in turn, require more substantial support and action to stop the conflict itself.

Another important aspect is the potential repercussions. If the EU goes ahead with this, Russia will not like it, of course. Putin has already made it very clear that they won’t take this lightly. One likely Russian response would involve legal actions and potential counter-measures to seize EU-held assets in other parts of the world.

This brings us to Euroclear, which is mentioned in the comments. Euroclear is a major financial services provider, essentially a clearing house for securities. A significant portion of Russia’s foreign reserves were held at Euroclear. If the EU were to seize those assets, it could put Euroclear in a precarious position. Russia might then attempt to pursue legal action in jurisdictions outside of Western control to recover those funds. This could severely impact Euroclear’s ability to operate on a global scale, potentially making it uncompetitive compared to similar services offered by American or Asian firms.

One crucial aspect to grasp is that this decision could raise larger questions about international trust and the attractiveness of the Eurozone for foreign investment. Other nations, particularly those with different human rights perspectives, may hesitate to invest within the Eurozone if they see their assets at risk of seizure or freezing. In the current global geopolitical environment, this has to be taken into account.

The proposal has significant ramifications both in terms of immediate consequences and the long-term future. The EU must consider all the possibilities, and the potential impact on the global economy.