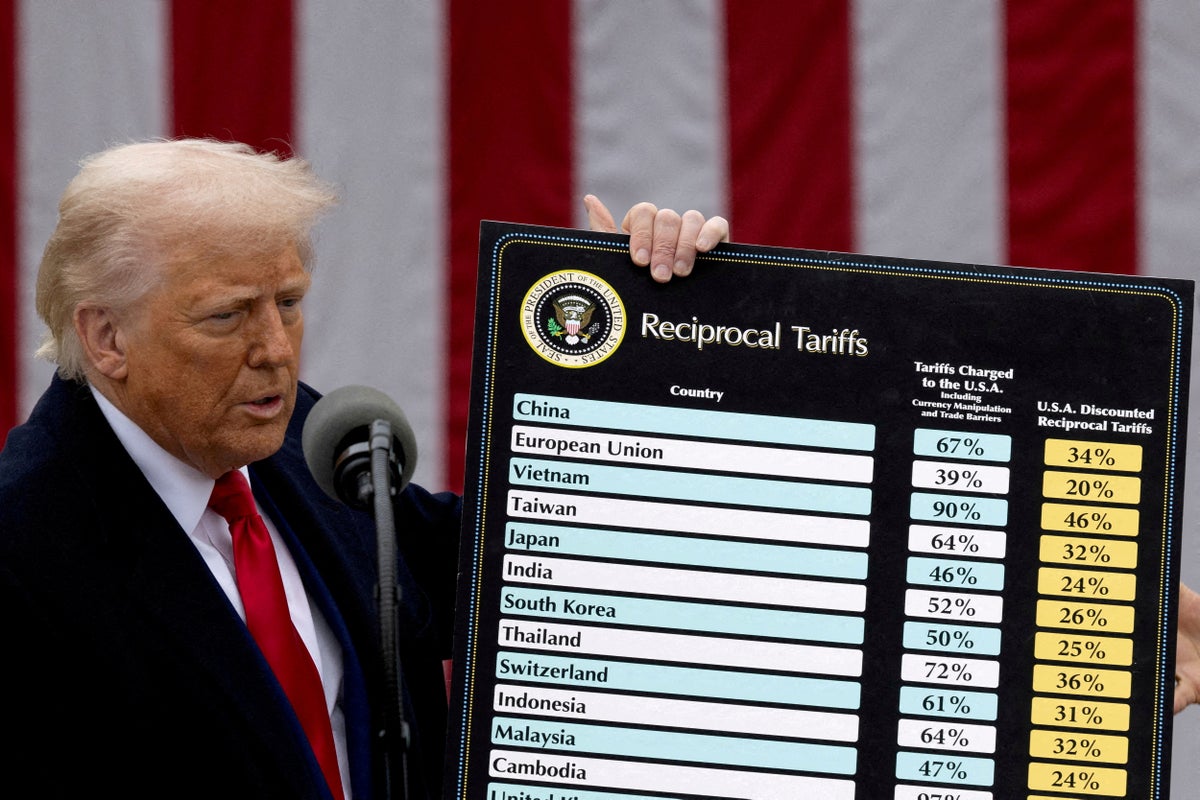

A federal appeals court recently delivered a significant setback to Donald Trump’s tariff agenda. The court ruled that the president’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs was illegal, as the law doesn’t grant the power to levy taxes. This decision largely affirms an earlier ruling, rejecting the argument that tariff imposition falls within the president’s foreign policy authority. While the court acknowledged the president’s constitutional authority, it emphasized that the power to tax belongs to Congress. The White House has stated that they will continue to work on this matter, with Trump himself criticizing the ruling and predicting the Supreme Court would allow his tariffs.

Read the original article here

Appeals court blocks Trump’s ‘Liberation Day’ orders and deems them illegal, and it’s a story that underscores the ongoing legal battles stemming from his time in office. These rulings, if upheld, could have a lasting impact on trade policies and the broader economy.

The crux of the matter is the legal status of the “Liberation Day” orders, presumably referring to actions undertaken by Trump during his presidency. The appeals court has now weighed in, declaring these orders illegal, which opens the door for potential challenges to the tariffs they implemented. It’s clear that the legal battles are far from over, especially with the possibility of the Supreme Court getting involved.

The narrative here suggests a pattern of delay, with Trump and his allies possibly employing tactics to postpone legal setbacks, possibly running until the Supreme Court could intervene. The underlying worry is that even if the tariffs are eventually overturned, the economic damage could already be done. There’s also the concern of what happens with the money generated by these tariffs, a point of contention and uncertainty.

The concern extends beyond the immediate legal rulings, however. Questions are being raised about the impact on the economy, the potential for corporations to simply pocket profits rather than lower prices, and the long-term implications for America’s standing on the global stage. The perception is that actions taken during this period have irreparably damaged the country.

The opinions expressed run the gamut, ranging from a cautious “wait and see” approach, acknowledging that the Supreme Court is the ultimate arbiter, to expressions of relief at each legal setback. There’s a sense of exasperation at the continued delays and perceived abuses of the court system.

The implications for international relationships are also significant. There’s a strong suggestion that the trade wars, the perceived unreliability of the US as a trade partner, and the cutting of aid to other countries have damaged America’s global influence.

A common theme is a skepticism that these legal setbacks will be more than temporary hurdles. There’s a palpable distrust of the Supreme Court and a belief that the situation could get worse before it gets better.

The article points out the impact on the agricultural sector, highlighting how American farmers and manufacturers have lost sales because of the trade wars and lost footing in foreign markets. Moreover, the perceived decline is compared to the decline of the British Empire, implying that the US could decline and collapse quickly.

The long-term implications of the situation are also considered. This includes the potential need for government assistance to recover business, production, and agriculture if the situation is fixed, and the dangers of further consolidation and privatization by corporations during the rebound. The article stresses the need for the new Democratic leadership to act decisively.

In essence, this situation underscores a complex web of legal challenges, economic concerns, and political maneuvering, making it a critical issue with significant ramifications.