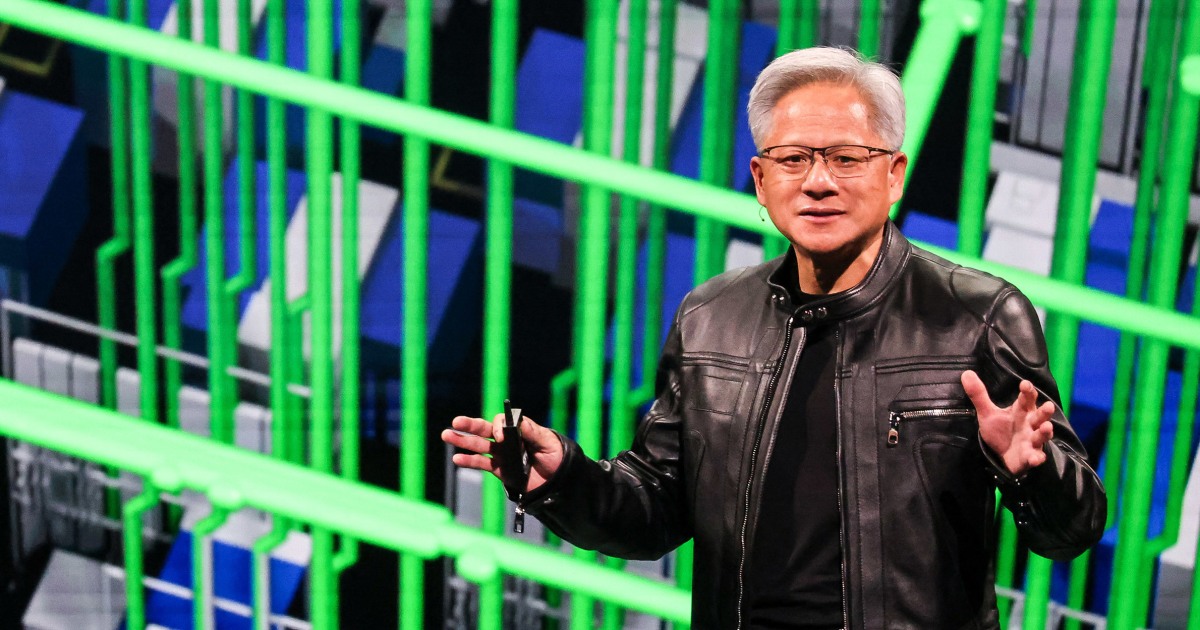

Nvidia achieved a historic milestone, becoming the first company to reach a $4 trillion valuation. This surge was fueled by robust demand for its AI infrastructure, with the company experiencing significant revenue growth, including a 70% increase in the first quarter of 2025 alone. Nvidia’s rapid ascent, driven by its central role in the AI revolution and the use of its chips by tech giants like OpenAI, Amazon, and Microsoft, propelled its shares dramatically higher. Despite facing challenges like Chinese export restrictions, Nvidia’s CEO, Jensen Huang, has navigated the company through explosive growth, making him a global figure in the AI landscape, frequently meeting with world leaders.

Read the original article here

Nvidia becomes the first company to be worth four trillion USD. That’s a mind-boggling number, isn’t it? It’s hard to wrap your head around, especially when you consider that just a handful of years ago, Apple hitting the one trillion mark was considered a monumental achievement. Now, we’re talking about a company, primarily known for its graphics cards, reaching this astronomical valuation. It makes you wonder what the future holds.

Nvidia becomes the first company to be worth four trillion USD, and it’s hard to believe how far the company has come. Imagine telling someone back in 2015 that their “graphics card dudes” would be worth this much. You’d probably get a skeptical look, maybe even a chuckle. It really puts things into perspective, especially when you reflect on the price paid for a 3090 during the COVID-19 pandemic. It feels like it was all worth it.

Nvidia becomes the first company to be worth four trillion USD, and the implications are vast. This is a valuation that surpasses the GDP of entire countries like California, France, or Canada. The sheer scale of it is difficult to comprehend. Thinking about how long it would take to spend that much money gives you a sense of its magnitude. One million seconds is about 11 days; one billion seconds is more than 31 years; and one trillion seconds…that’s over 31,000 years! Imagine the good that could be done with that level of wealth.

Nvidia becomes the first company to be worth four trillion USD, and the natural question is, what does this mean for the average consumer and their employees? Will prices drop? Will the employees see significant benefits? The skepticism is palpable. It’s a bit of a cynical take, but a valid one in the current market. Some would say this is just another example of the stock market’s often-bizarre valuations.

Nvidia becomes the first company to be worth four trillion USD, and it is evident that the company is riding a wave of massive growth driven by the explosion in AI server demand. The company is essentially powering the future with their GPUs being used in the AI farms.

Nvidia becomes the first company to be worth four trillion USD, a company that is still charging astronomical prices for its products. Even though the products are worth the price, that is still a lot of money.

Nvidia becomes the first company to be worth four trillion USD, and one can’t help but reflect on the history of this tech giant. Some have been loyal customers since the late 90s. They were buying Nvidia products before the company became a household name. The company has been around for a while, evolving from its early graphics cards like the Riva 128 to become a dominant force in AI.

Nvidia becomes the first company to be worth four trillion USD, and the market’s rapid growth and wealth concentration are concerning. Rapid growth/wealth consolidation like this has many thinking that it is not a good thing. With all of the current political uncertainty, it has the makings of a “house of cards” at this point.

Nvidia becomes the first company to be worth four trillion USD, and it’s worth acknowledging that inflation also plays a role in these valuations. The dollar’s value has decreased over time, and that contributes to the impressive figures. And in 2017 the rich got richer, and continue to do so now.

Nvidia becomes the first company to be worth four trillion USD, and the future might be more about AI. While the company may have gotten here because of PC gaming and tech enthusiasm, the company is now a mainstay because of AI. The company is the one that powers the current AI boom.