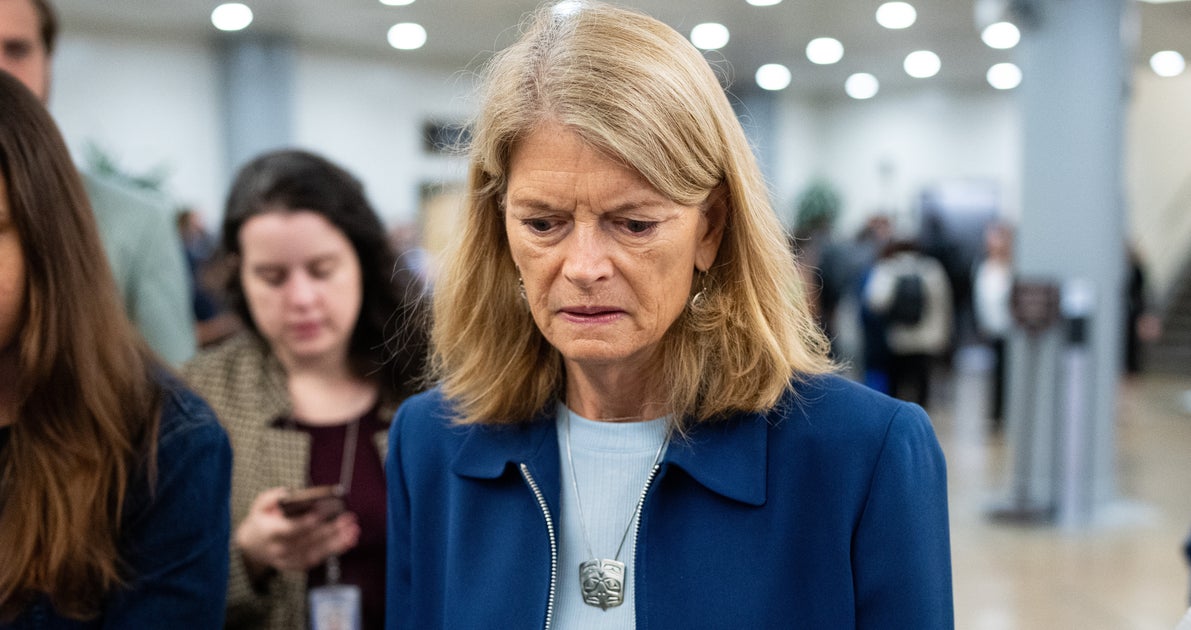

Senator Lisa Murkowski, despite expressing concerns about the devastating impact of President Trump’s tax bill, ultimately voted in favor of it. She secured several provisions specifically benefiting Alaska, such as delaying cuts to food assistance and securing funds for rural hospitals. However, the bill is expected to negatively impact many Alaskans by potentially leading to a loss of health insurance and food assistance. Murkowski’s actions sparked debate, with critics questioning her decision to prioritize Alaska’s interests even as the bill harms vulnerable populations.

Read the original article here

Despite Lisa Murkowski’s Deals, Alaskans Will Suffer Under Trump’s Tax Bill

The core issue here is that despite Senator Lisa Murkowski’s attempts to negotiate and secure concessions for her constituents, the Trump tax bill is poised to inflict significant hardship on Alaskans. It’s a harsh reality, and it’s important to understand how these legislative maneuvers will affect the people of Alaska.

One of the most immediate concerns is the impact on healthcare. The bill’s provisions, including strict work requirements and frequent eligibility checks for Medicaid, put as many as 46,000 Alaskans at risk of losing their health insurance. These cuts are just the tip of the iceberg. The bill’s cuts to Medicaid will have a ripple effect, potentially leading to reduced services at hospitals, increased costs for those with private insurance, and even hospital closures. The situation is particularly dire in rural areas, where four rural hospitals serve a significant portion of Medicaid patients. While Murkowski negotiated for additional funds, it’s unlikely to offset the massive, over $1 trillion in cuts to Medicaid.

The challenges extend beyond immediate healthcare needs. A particularly concerning aspect is that the state of Alaska lacks Level 1 Trauma Centers, meaning critically injured patients often need to be transported out of state for care. Even if the senator has assurances from Trump officials, those assurances may not apply to hospitals in neighboring states. Moreover, the state’s budget is also set to take a big hit, potentially losing over $2 billion in federal Medicaid funds over the next decade. This loss will force state legislators to make tough choices, potentially cutting funding for crucial programs like education or raising taxes. Additional concerning possibilities include the ceasing to cover of dental or home care services.

It’s hard to ignore the stark contrast between the senator’s actions and her stated views. Despite expressing that the bill is “not good enough for the rest of our nation,” she still voted in its favor. This disconnect raises questions about the true motives behind the senator’s decisions and the effectiveness of her negotiations.

The situation is further complicated by the political dynamics in Alaska. Even though Murkowski attempted to negotiate on behalf of the state, her actions are seen by many as supporting a party whose agenda will negatively affect Alaskans. This perception highlights the difficulty of balancing political allegiances with the needs of the electorate. The perception of being a “Grand Ole Puppet” is a strong indictment of her ability to represent the state’s interests.

Ultimately, the Trump tax bill presents a bleak outlook for many Alaskans. The cuts to healthcare, the strain on the state budget, and the potential for reduced services paint a picture of a state struggling to meet the needs of its residents. While Murkowski may have secured certain concessions, the overall impact of the bill will likely be negative, leaving many Alaskans to suffer the consequences. Despite Murkowski’s attempts, the harsh realities of the tax bill are set to unfold, leaving Alaskans to bear the brunt of its effects.