Following Jimmy Buffett’s death, his widow, Jane Buffett, has filed a lawsuit against his financial advisor, Richard Mozenter, alleging mismanagement of the singer’s $275 million trust. Jane Buffett claims Mozenter breached his fiduciary duty by withholding information and charging excessive fees. The dispute has escalated, with both parties seeking the other’s removal as trustee and filing lawsuits in different states, mirroring a similar conflict in Tony Bennett’s estate. Jane Buffett’s filing in Florida aims to consolidate the legal battle and seeks Mozenter’s removal, claiming the relationship is untenable.

Read the original article here

Jimmy Buffett’s widow accuses her financial advisor of breaching his fiduciary duty in a situation that has quickly become a high-profile financial dispute, showcasing the complexities that can arise even after meticulous estate planning. It appears that the late singer’s wife, Jane Buffett, is locked in a legal battle over the management of a massive $275 million trust, a situation that highlights the critical importance of selecting trustworthy advisors and ensuring transparent financial practices, even when enormous sums are at stake.

Jane Buffett’s central accusation centers on the alleged failure of her financial advisor, who has been identified as Mozenter, to uphold his fiduciary duty. This is no small claim, it essentially suggests a violation of the core principles of financial management: acting in the best interests of the client and providing complete transparency. Specifically, the filing claims Mozenter repeatedly failed to provide Jane with fundamental information about the trust’s holdings and investment strategies. This lack of clear communication, according to the allegations, makes it difficult for Jane to understand how her late husband’s estate is being managed, a troubling situation for anyone, especially a widow navigating a significant financial inheritance.

Adding to the accusations, the filing alleges that Mozenter charged “unreasonable fees and costs” for the services provided. This raises the question of whether the advisor’s compensation was commensurate with the level of service and expertise offered. For an estate of this magnitude, fees can be substantial, and the transparency of these charges is paramount. It suggests a breakdown in trust and potentially a financial burden that is not only unwelcome, but also potentially harmful to the beneficiaries of the trust.

It’s easy to see how a situation like this can quickly spiral into a complex legal battle. The sheer size of the trust and the potential for conflicting interests create a landscape ripe for disagreement. Estate planning, particularly when dealing with substantial wealth, is not simply about the mechanics of transferring assets; it’s about ensuring the wishes of the deceased are honored and that beneficiaries are treated fairly. This situation underscores the potential pitfalls of not having airtight estate planning and clear lines of financial oversight.

It’s important to remember that trusts are carefully constructed legal instruments designed to protect and manage assets, often for the benefit of specified beneficiaries. In this case, the trust likely outlines the rules for how the assets are to be managed and distributed. Jane Buffett’s accusations directly challenge the administration of this trust, implying that the established guidelines are not being followed or that the trustee’s actions are not in the best interests of the beneficiaries.

The situation highlights the power dynamic in these kinds of situations. While it’s easy to focus on the immense wealth involved, it’s important to remember that a financial advisor has significant power over a trust’s assets. This is why it is so essential to choose an advisor who is not only competent but also trustworthy and transparent. An advisor should provide detailed reporting, answer questions fully, and always act in the best interests of the client. The absence of these things fuels the kind of distrust that has brought this matter to a courtroom.

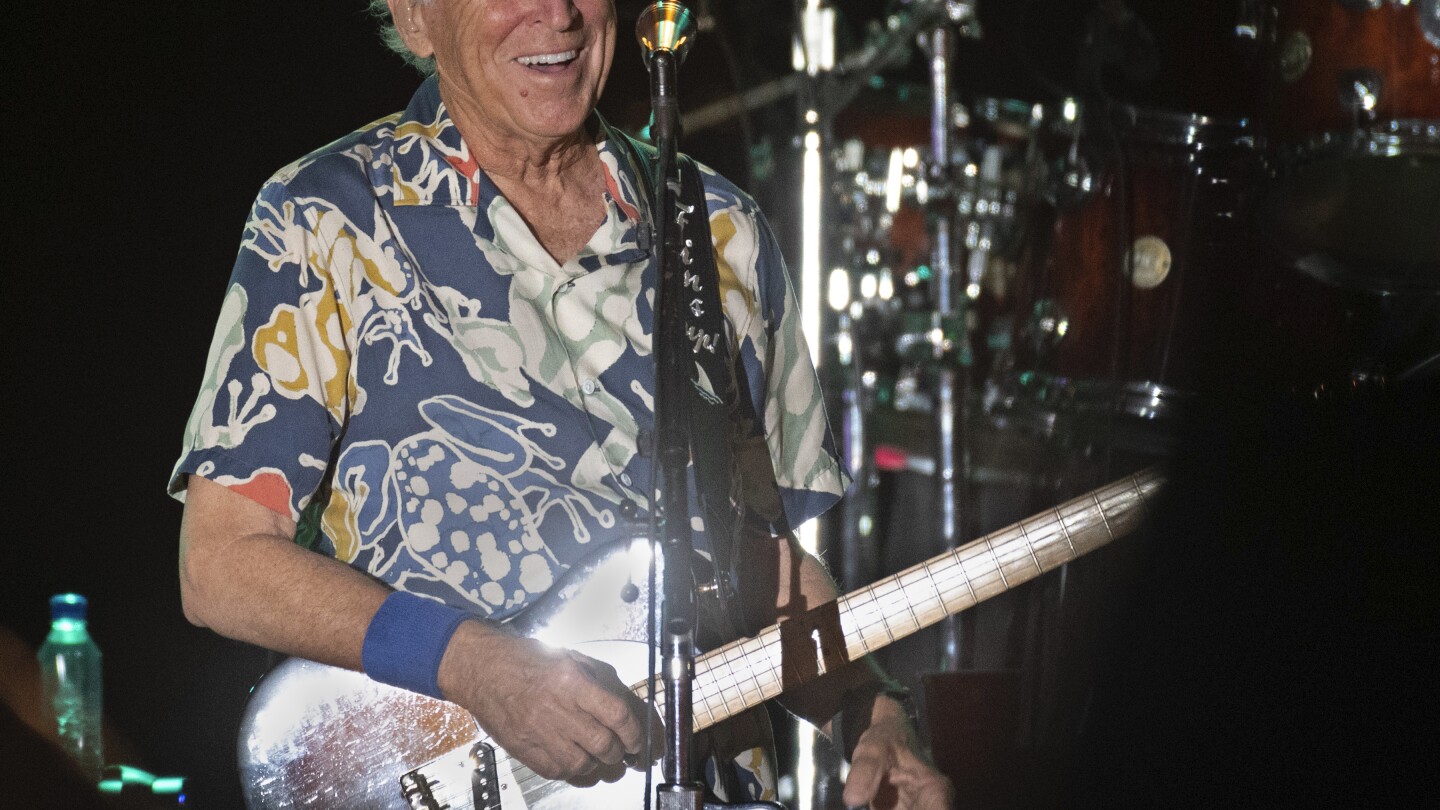

It’s interesting to consider that Jimmy Buffett was a businessman in addition to being a musician. He built a brand that allowed him to live out his dream of the beach bum lifestyle. It seems clear that he was a savvy individual. One wonders if this situation would have been different if he had more direct involvement with the financial planning or selection of advisors.

It also raises questions about the intent behind setting up the trust in the first place. Perhaps Jimmy Buffett had specific reasons for structuring his estate in this manner. Possibly, the terms of the trust were designed to protect the assets from mismanagement, provide for the long-term financial security of his family, or to manage other aspects of the estate, such as the continuation of the brand. The fact that his widow is now challenging the trustee suggests that her wishes may not align with the original intent of the trust.

The case will likely hinge on the specifics of the trust agreement, the evidence of the advisor’s actions, and the legal arguments of both sides. The outcome of this legal battle will have a direct impact on the management of the trust and the future financial well-being of those who are supposed to benefit from it. This is a dramatic example of what can happen when trust erodes in the financial world.

This entire situation is a cautionary tale. It serves as a reminder that even with meticulous estate planning, things can go wrong, and transparency and accountability are essential to prevent disputes. It’s a stark warning about the importance of selecting the right financial advisors and ensuring clear communication to protect any estate, no matter how large or small.