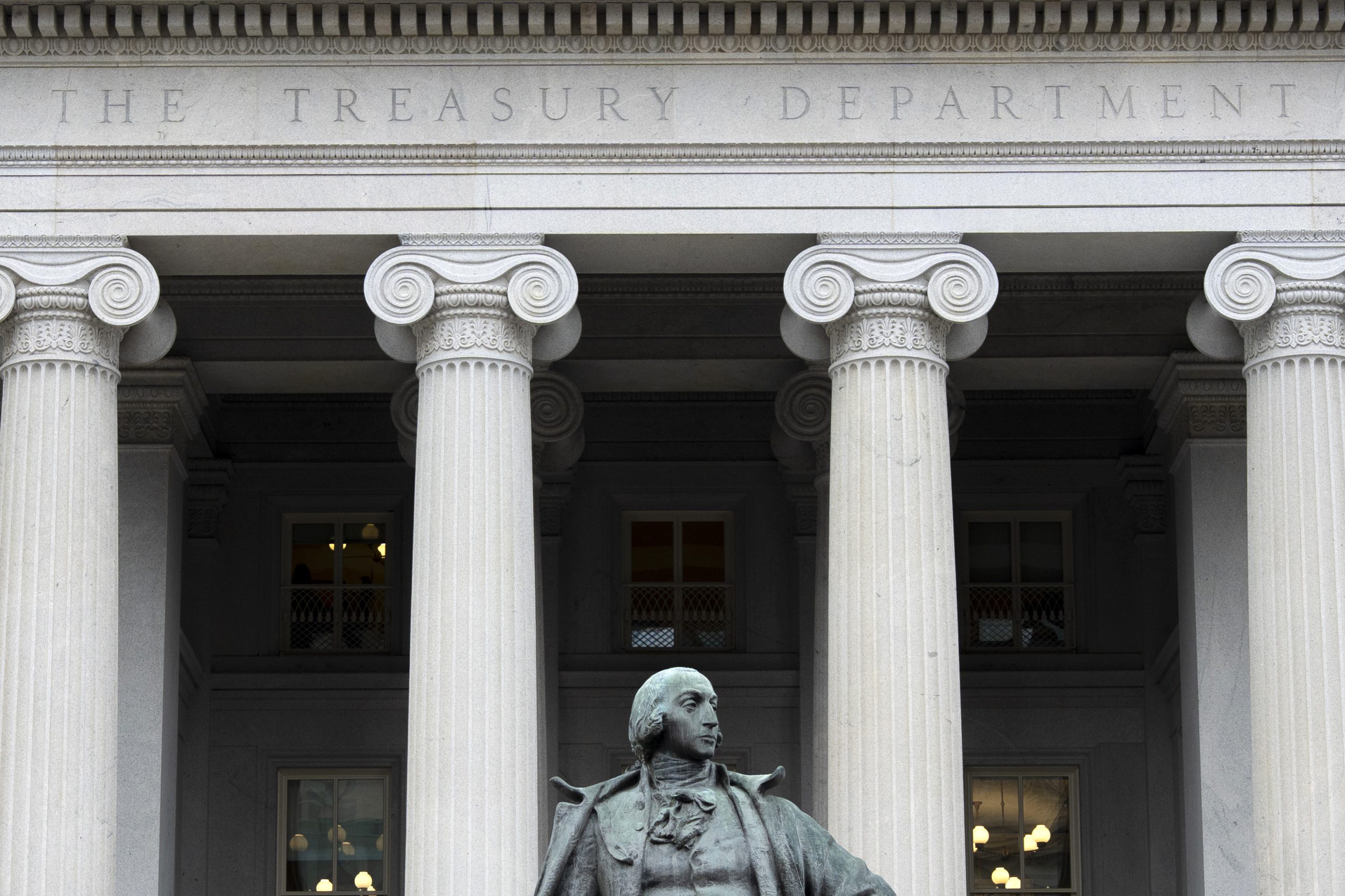

Moody’s downgraded the U.S. government’s credit rating from Aaa to Aa1, citing escalating debt and repeated failures to address it across administrations. This makes the U.S. the first to lack a top-tier rating from all three major agencies in over a century, following similar downgrades by S&P and Fitch. Moody’s projects a growing federal deficit, reaching nearly 9 percent of GDP by 2035, fueled by rising interest payments and entitlement costs. The agency also warned that extending the 2017 tax cuts would exacerbate the deficit, highlighting political gridlock as a significant barrier to fiscal reform.

Read the original article here

The United States has completely lost its perfect credit rating for the first time in over a century. This unprecedented event is a significant blow to the nation’s financial standing and carries profound implications for the global economy. The loss of this coveted rating, a symbol of fiscal strength and stability, signals a serious deterioration in the country’s financial health. The long-term consequences of this downgrade remain uncertain, but the immediate impact is likely to be felt across various sectors.

This development is particularly jarring given the nation’s historical position as a global economic powerhouse. For generations, the US has enjoyed a reputation for fiscal responsibility, enabling it to borrow money at favorable interest rates and maintain a strong currency. This rating reflects not just a financial assessment, but a deep-seated confidence in the country’s economic stability. The erosion of that confidence is a deeply troubling sign.

Many are pointing to years of unsustainable fiscal practices as the root cause of this crisis. Decades of increasing national debt, coupled with persistent political gridlock hindering meaningful fiscal reforms, have gradually weakened the nation’s financial foundation. The inability to address these long-standing issues is now manifesting in this stark and undeniable consequence.

The timing of this credit downgrade is particularly unsettling given the current political climate. With deep partisan divisions hindering cooperation on crucial fiscal matters, the path forward appears shrouded in uncertainty. Addressing this crisis requires a bipartisan commitment to fiscal responsibility and a willingness to make tough decisions, but achieving such unity seems increasingly unlikely in the near future.

The implications of this downgrade extend far beyond domestic concerns. The US dollar’s status as the world’s reserve currency could be challenged, potentially leading to increased inflation and volatility in global financial markets. Foreign investors may become hesitant to invest in US assets, further impacting the nation’s economic prospects. This could have a knock-on effect on global trade and investment patterns, causing ripples throughout the international financial system.

While some attempt to downplay the significance of this event, others see it as a stark warning sign. This moment demands a thorough reevaluation of the nation’s fiscal policies and a commitment to long-term sustainable practices. The path to recovery will require significant reforms, including addressing the national debt, controlling spending, and potentially increasing tax revenue. The current trajectory is unsustainable and needs to be corrected, and quickly.

The situation highlights the critical need for responsible governance and a renewed focus on fiscal prudence. The challenges ahead are immense, and the consequences of inaction are far-reaching. Restoring the nation’s financial health will require a concerted effort across all levels of government and a commitment to fostering a sustainable economic future.

The sheer magnitude of the national debt presents a formidable obstacle to overcome. Addressing this issue requires a comprehensive strategy encompassing spending cuts and revenue enhancements. Finding the right balance between these two approaches is crucial to ensure economic stability without unduly burdening citizens. This necessitates careful consideration and a willingness to compromise across the political spectrum.

This situation underscores the interconnectedness of domestic and global economies. The stability of the US economy plays a significant role in maintaining global financial stability. The consequences of a US economic downturn are far-reaching and would impact economies worldwide. International cooperation and a coordinated approach to addressing this challenge are essential.

Ultimately, regaining a perfect credit rating will be a long and arduous process. It will demand a concerted and sustained effort from policymakers, businesses, and citizens alike. The immediate challenges are substantial, and the long-term consequences of this downgrade will be felt for years to come. The road to recovery requires not only fiscal responsibility but also a renewed sense of national unity and purpose.