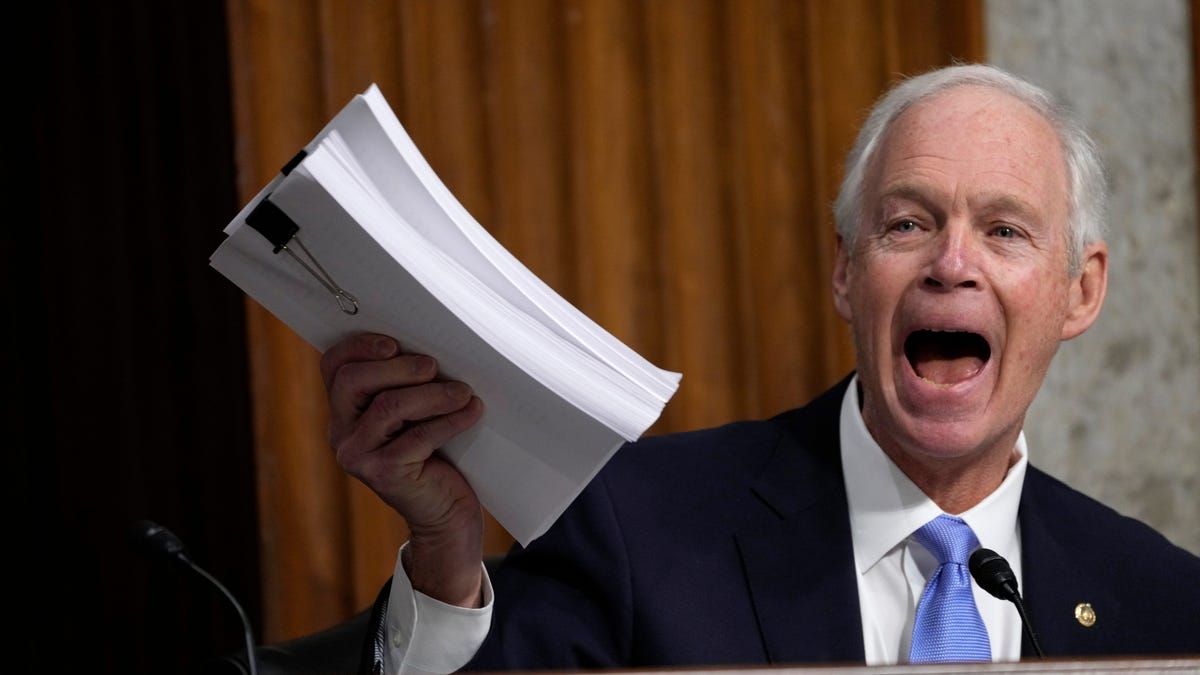

Senator Ron Johnson, along with other Republican senators, strongly opposes President Trump’s proposed bill due to its significant impact on the national debt, projected to increase by $3.3 trillion over the next decade. The bill, narrowly passing the House, faces substantial opposition within the Senate GOP, with Johnson asserting that sufficient votes exist to block its passage unless substantial spending cuts are implemented. Key Republican concerns include the bill’s effect on the deficit and a $4 trillion increase to the debt ceiling. Without significant changes addressing these concerns, the bill’s future in the Senate remains uncertain.

Read the original article here

A Republican senator recently declared that a proposed tax bill, championed by President Trump, faces significant opposition within the GOP. The senator boldly asserted there are enough Republican votes to halt the bill’s progression. This statement, however, has been met with considerable skepticism.

The bill, having narrowly passed the House, carries a hefty price tag, projected to add trillions to the national deficit over the next decade. This significant financial implication has understandably sparked alarm among several Republican senators.

The senator’s prediction, made during a television interview, points to a potential internal rebellion within the Republican party. He argued that enough senators disagree with the bill’s fiscal impact and are prepared to block its advancement until substantial spending cuts are implemented to address the deficit concerns.

However, past behavior casts doubt on the reliability of such claims. History suggests that Republican senators, despite voicing dissent, often ultimately fall in line with the party leadership and President Trump’s agenda.

Many observers are cynical, pointing out the inherent contradictions between Republican rhetoric and actions. Public statements of opposition are frequently followed by votes in support of the very bills they previously criticized. This pattern raises questions about the sincerity of the stated opposition to the tax bill.

Skeptics suggest the current opposition is largely performative, a calculated move to appear responsive to public concerns without jeopardizing the bill’s chances. The potential for a significant shift in Republican voting patterns remains low.

The underlying expectation is that, despite the senator’s strong words, the majority of Republican senators will ultimately vote in favor of the bill. This perception stems from a history of Republican senators prioritizing party loyalty and supporting the President’s initiatives, even when those initiatives are unpopular or fiscally irresponsible.

The possibility of a genuine revolt within the Senate GOP caucus is viewed with considerable uncertainty. The senator’s claim, although intriguing, is viewed as a hopeful but unlikely scenario. The likelihood of the bill’s passage remains high.

A deeper concern lies in the potential for the bill’s passing despite its predicted negative fiscal consequences. This highlights a systemic issue within the legislative process and the seemingly unshakeable influence of the President on his party.

Some argue that the entire political theater surrounding the bill is designed to create the illusion of a robust debate and a fair process while ultimately delivering a predetermined outcome favorable to the President and his allies. The narrative of a close call, punctuated by dramatic pronouncements of opposition, allows the party to maintain the veneer of internal conflict while passing legislation they were always inclined to support.

Despite the senator’s statement, many believe the bill’s fate hinges on external factors as much as internal opposition. The President’s influence over the senate, the perceived political advantages of passing the bill, and the general trajectory of political developments could all play a larger role than the stated opposition.

In the end, the senator’s words offer a glimmer of hope for those who wish to see the bill blocked. However, considering past behaviors and the larger political context, a pessimistic outlook seems more realistic and justifiable. The skepticism surrounding the senator’s prediction underscores the deep-seated distrust of Republican politicians and their actions. The focus shifts from the pronouncements of opposition to the actual voting behavior which will ultimately dictate the bill’s fate.