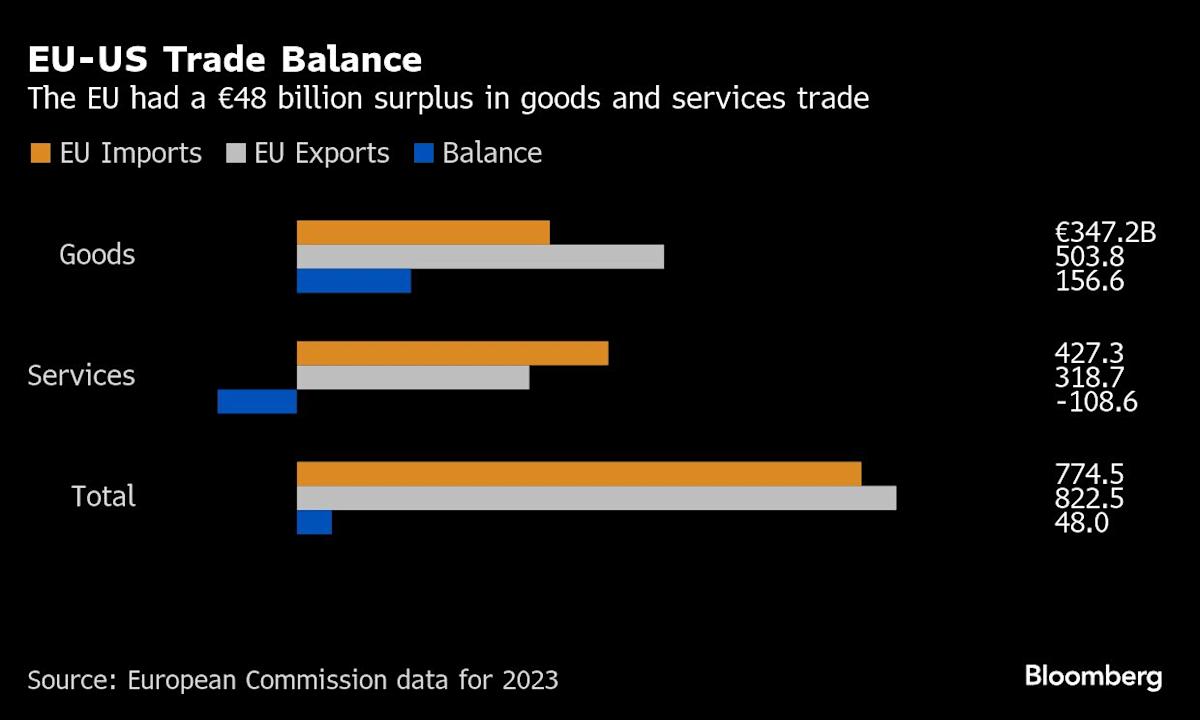

Facing stalled trade negotiations with the U.S., the European Union plans to impose approximately €100 billion in retaliatory tariffs on American goods. These tariffs would target various sectors, including industrial goods, agricultural products, and notably, Boeing aircraft. The proposed levies aim to counter existing U.S. tariffs and address what the EU views as an uneven playing field, particularly concerning Airbus. This action follows minimal progress in talks and reflects the EU’s increasing concern over the significant portion of its exports now subject to U.S. tariffs.

Read the original article here

The EU’s threat to impose tariffs on Boeing aircraft and American cars if ongoing trade talks fail is a significant escalation in the transatlantic trade dispute. This isn’t just a tit-for-tat response; it’s a strategic move with potentially far-reaching consequences. The EU’s willingness to target specific sectors highlights their determination to secure a favorable outcome.

The impact on Boeing, despite its substantial backlog, shouldn’t be underestimated. While the company might be able to absorb some cancellations, the loss of EU orders would certainly affect its stock price, which is influenced as much by market sentiment as by actual performance. Furthermore, the broader reputational damage stemming from a major trade conflict cannot be ignored.

Similarly, the effects on American car manufacturers selling in the EU are likely to be substantial. Although some American car brands have successfully established a presence in Europe, with models tailored to European tastes, the imposition of tariffs could significantly diminish their competitiveness. This impact would be felt not just by major players but also by the smaller, niche brands that rely on European sales to bolster their revenue streams.

The EU’s strategy seemingly prioritizes specific sectors and avoids a broader, more damaging confrontation. Targeting Boeing and American cars allows the EU to signal its resolve while potentially minimizing collateral damage to its own economy. The targeted approach also has a practical element; American cars and Boeing planes are items of significant visibility for the consumer, making the tariffs more immediately impactful.

While some argue that replacing American software and technology companies would be a monumental undertaking, potentially causing widespread chaos, others believe the EU has underutilized its own technological capabilities. The suggestion to focus on the service sector and the tech giants, often referred to by their initialism, is significant. However, many of the tech platforms have such deep integration into various aspects of daily life in Europe that their disengagement would be far-reaching and potentially disruptive. This underscores the complexities inherent in targeting the FAANG companies. The alternative is a longer, more gradual route of fostering homegrown European alternatives, a plan which would take many years to mature.

The concerns about the viability of Boeing, coupled with arguments that American-made cars aren’t particularly popular in Europe, may ultimately prove to be inaccurate. Both sectors could suffer from significant market share loss as the tariffs take effect, impacting the overall perception of American products in the EU. It’s worth noting that Airbus also produces planes in the US, meaning that the tariff impact cuts both ways.

Some see the current conflict as a power play, with the EU needing to demonstrate a credible threat and the US pushing for unilateral gains. This backdrop creates the need for robust and persistent engagement in trade talks, with both sides needing to show a willingness to compromise. While this approach might seem risky, it might be a more strategic approach than attempting a more extreme measure and facing immediate backlash.

The EU’s approach, while measured, is not without its risks. The potential for escalating the conflict into a wider trade war remains a very real possibility. However, the EU’s decision to focus on specific sectors signals a strategic intent to achieve its negotiating objectives. The effectiveness of this approach will depend greatly on the willingness of both sides to engage constructively in the ongoing trade talks. The outcome will significantly impact both the transatlantic relationship and the global economic landscape.

The overall picture is complex. The threat of tariffs is not just about revenue or trade numbers; it is about geopolitical leverage and national interests. While the current situation is fraught with potential for conflict and disruption, the possibility of a negotiated settlement which preserves the commercial opportunities of the US and the EU remains the most desirable, albeit potentially elusive, outcome.