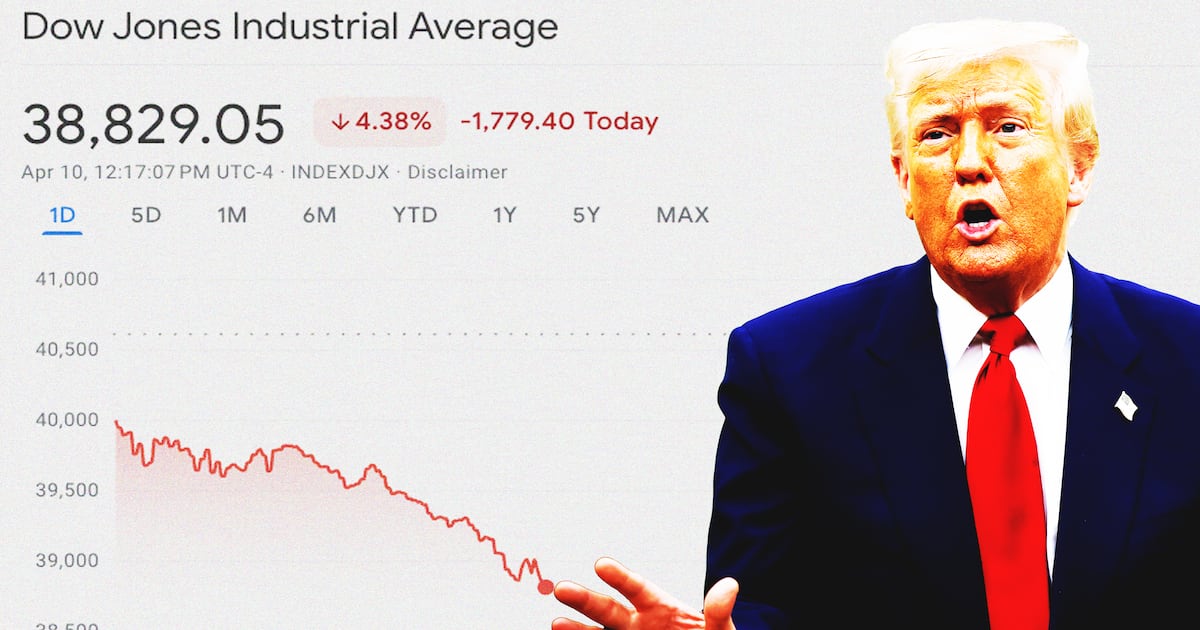

Despite a better-than-expected inflation report, the stock market experienced a significant downturn on Thursday, with the Dow Jones Industrial Average falling nearly 1600 points and the S&P 500 dropping over 4.8 percent. This sharp decline reflects market skepticism regarding the long-term impact of President Trump’s recent tariff decisions, even after a temporary pause was announced. Economists emphasize that the uncertainty surrounding trade policy, rather than current inflation data, is the primary driver of market volatility. Consequently, major companies like Tesla and Apple experienced substantial losses.

Read the original article here

Markets Don’t Believe Trump Is Done With His Tariff Chaos

Markets are rightly skeptical that the recent temporary reprieve from Trump’s tariff policies signifies a true end to the economic uncertainty he created. The damage is already done, and the possibility of renewed tariff chaos looms large, preventing any real market stability.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the recent pause isn’t a full reversal. Tariffs on key goods from China, impacting sectors like clothing and technology, remain in effect, continuing to inflate prices for consumers. The temporary delay only postpones the problem, suggesting a resumption is likely if Trump remains unchecked.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the economic repercussions of the tariffs are already deeply entrenched. Businesses, unsure about the long-term implications of unpredictable trade policies, have already shed jobs and seen profits plummet. The price increases stemming from previous tariff actions haven’t magically disappeared; consumers continue to bear the burden. One example cited was a car manufacturer laying off 600 employees immediately following a recent tariff announcement.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because Trump’s actions aren’t just erratic; they’re deeply damaging to international trust. Countries are reconsidering their reliance on the US as a stable trading partner. This loss of confidence is potentially far more devastating in the long run than any short-term market fluctuation. The US’s reputation for reliable trade is tarnished, and international partnerships are being sought elsewhere.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the potential for further market manipulation remains. There are strong suspicions that Trump might use tariffs as a tool to influence markets for personal gain, enriching himself and his allies while the economy suffers. Such suspicions, whether founded or not, deeply undermine investor confidence and fuel market volatility.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the current 145% tariff on Chinese goods is a significant and ongoing threat. This level is essentially an embargo for many businesses, leading to widespread disruptions in supply chains and soaring prices. Even the seemingly smaller 10% tariff imposed on other countries remains a significant factor, significantly impacting trade relationships built over years.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because Trump’s behavior is inherently unpredictable. He operates outside of rational economic decision-making, prioritizing chaos and personal gain over stability and long-term economic health. The market, prioritizing stability, can’t afford to gamble on whether Trump will suddenly reinstate the tariffs or inflict new ones.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because even if a Democratic administration were to take over, the damage to international trust is substantial and will take years to repair. Many foreign investors are already exploring alternative trading partners and are unlikely to easily return to the US market, despite any policy shifts. The era of easy reliance on US trade might well be over.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the recent market reaction itself, even the temporary rebounds, isn’t cause for optimism. A short-lived market increase after a significant drop is often a “dead cat bounce,” a temporary phenomenon that doesn’t reflect underlying strength. The deeper issues remain, suggesting that further significant market corrections are possible.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the long-term consequences of Trump’s actions extend far beyond immediate market fluctuations. The damage to American farmers, for example, is already apparent with decreasing exports and the shift of trade relationships to countries like Brazil. This shift is not unique to agriculture; it’s a pattern evident across various sectors.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the sheer unpredictability makes long-term planning impossible. Businesses can’t formulate reliable strategies when trade policies are subject to sudden and drastic changes. This uncertainty is damaging to investment, innovation and job creation, ultimately undermining economic growth.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because his actions are akin to wielding tariffs as a blunt instrument, rather than as sophisticated economic policy tools. He uses them as weapons to bully and harass, not as a means to foster balanced and mutually beneficial trade. This approach has led to a highly volatile and damaging environment.

Markets Don’t Believe Trump Is Done With His Tariff Chaos because the consequences are not limited to the US. His actions have initiated a chain reaction that destabilizes global trade, causing ripples through the international economic system. Many countries are now seeking alternative alliances and trade routes, reducing their dependence on the US and damaging the US’s global influence.

Markets Don’t Believe Trump Is Done With His Tariff Chaos; the uncertainty he has created permeates the entire system. Until there is a demonstrably credible shift in policy, along with a clear effort to rebuild trust, markets will continue to reflect a deep skepticism, unable to view any temporary reprieve as a lasting solution. The current atmosphere of unpredictable chaos undermines any possibility of lasting economic stability.