President Trump announced a further 84% tariff on all Chinese imports, bringing the total to at least 104%. This escalation follows Beijing’s vow to resist, intensifying the ongoing trade war between the US and China. The White House contends that China’s retaliatory actions are misguided and that a deal remains possible, despite the lack of current negotiation. Both nations appear committed to their respective positions, signaling a continued period of trade conflict.

Read the original article here

Trump’s announcement of an additional 84% tariff on Chinese imports is sending shockwaves through the American economy and sparking widespread debate. This dramatic escalation of existing tariffs, potentially pushing the total to well over 100%, raises serious concerns about the impact on consumers and businesses. The immediate reaction from many is one of disbelief and anxiety.

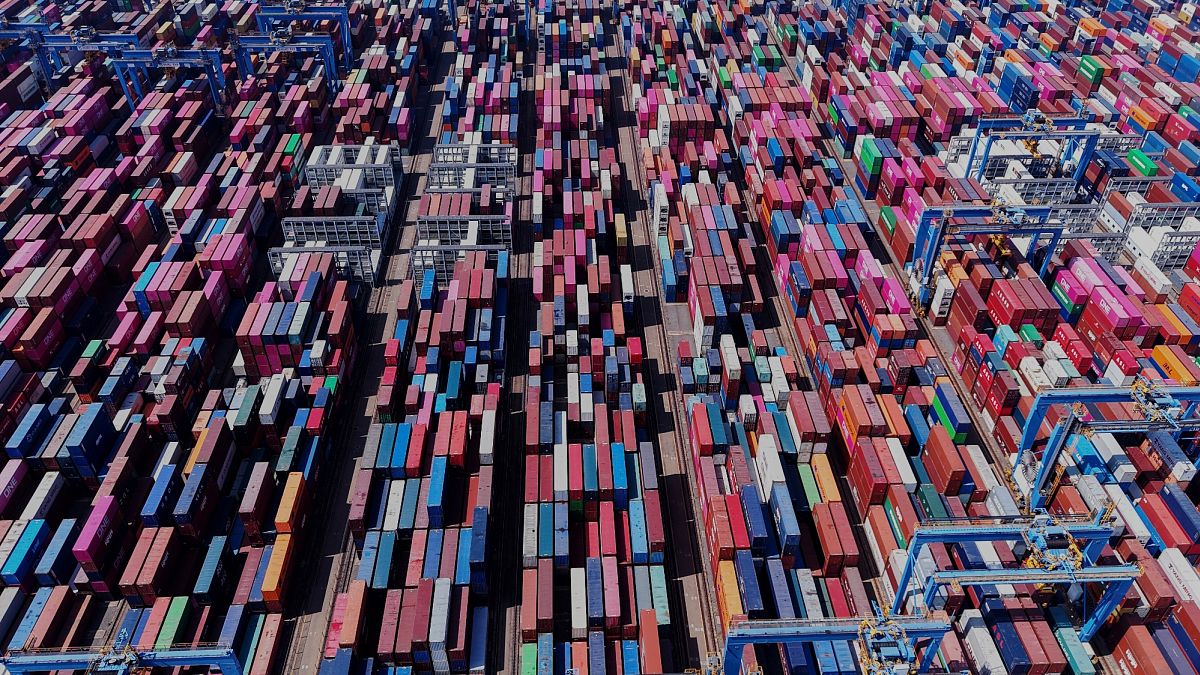

The sheer magnitude of this proposed tariff increase is staggering. It’s not just a minor adjustment; it’s a massive hike that could significantly increase the price of countless everyday goods imported from China. This isn’t some niche market we’re talking about; it’s a significant portion of the products found on the shelves of nearly every store in the country.

This action immediately impacts the average American household. With a significant percentage of household goods originating from China, the added cost will directly translate to higher prices at the checkout counter. For families already struggling to make ends meet, this increase could be devastating, potentially forcing them to make difficult choices between necessities.

Concerns are amplified by the lack of a clear plan for mitigating the negative consequences of this policy. While the stated goal is to boost American manufacturing, there’s little evidence of concrete initiatives to create the necessary jobs and infrastructure to replace the influx of Chinese goods. Instead, consumers are left facing increased costs without a readily available alternative.

This move also casts a shadow on the future economic outlook. The unpredictable nature of these tariff decisions creates uncertainty, making it difficult for businesses to plan effectively. This instability could further contribute to a looming recession, as businesses grapple with rising input costs and reduced consumer spending.

The potential for further escalation is equally worrisome. While the 84% figure is shocking, there’s concern this might only be the beginning. China’s potential retaliation could lead to a tit-for-tat trade war, resulting in even more significant economic damage for both countries.

The situation is further complicated by the lack of clarity around the administration’s overall strategy. The justification for such drastic measures remains ambiguous, leading to confusion and skepticism. Many question the long-term viability of such a protectionist approach, especially when compared to China’s more strategically focused, long-term economic planning.

The stock market’s reaction serves as a stark indicator of the prevailing sentiment. The immediate drop in the Dow demonstrates a clear lack of confidence in this decision and its potential consequences for overall market stability. It’s evident this is not a targeted, carefully considered approach but rather a broad stroke that risks significant collateral damage.

There’s a growing feeling that the political motivations behind this decision outweigh any economic rationale. Some believe this move is politically motivated rather than economically sound, and designed more to appeal to a specific voter base than to improve the nation’s economic well-being.

Beyond the economic implications, the larger geopolitical consequences are concerning. This escalation could further strain already tense relations between the US and China, potentially creating wider global instability.

Many Americans feel increasingly frustrated and helpless in the face of this seemingly reckless economic policy. The potential for substantial personal hardship as a result of these tariffs is a significant concern that cannot be ignored. The lack of a clear plan to ease the burden on ordinary citizens is making many question the wisdom of the policy.

In conclusion, the looming 84% tariff on Chinese imports represents a significant gamble with potentially devastating consequences for the American economy and global relations. The lack of clear planning and the potential for escalation raise serious concerns, leaving many to question the administration’s overall economic strategy and the ultimate cost of this controversial decision.