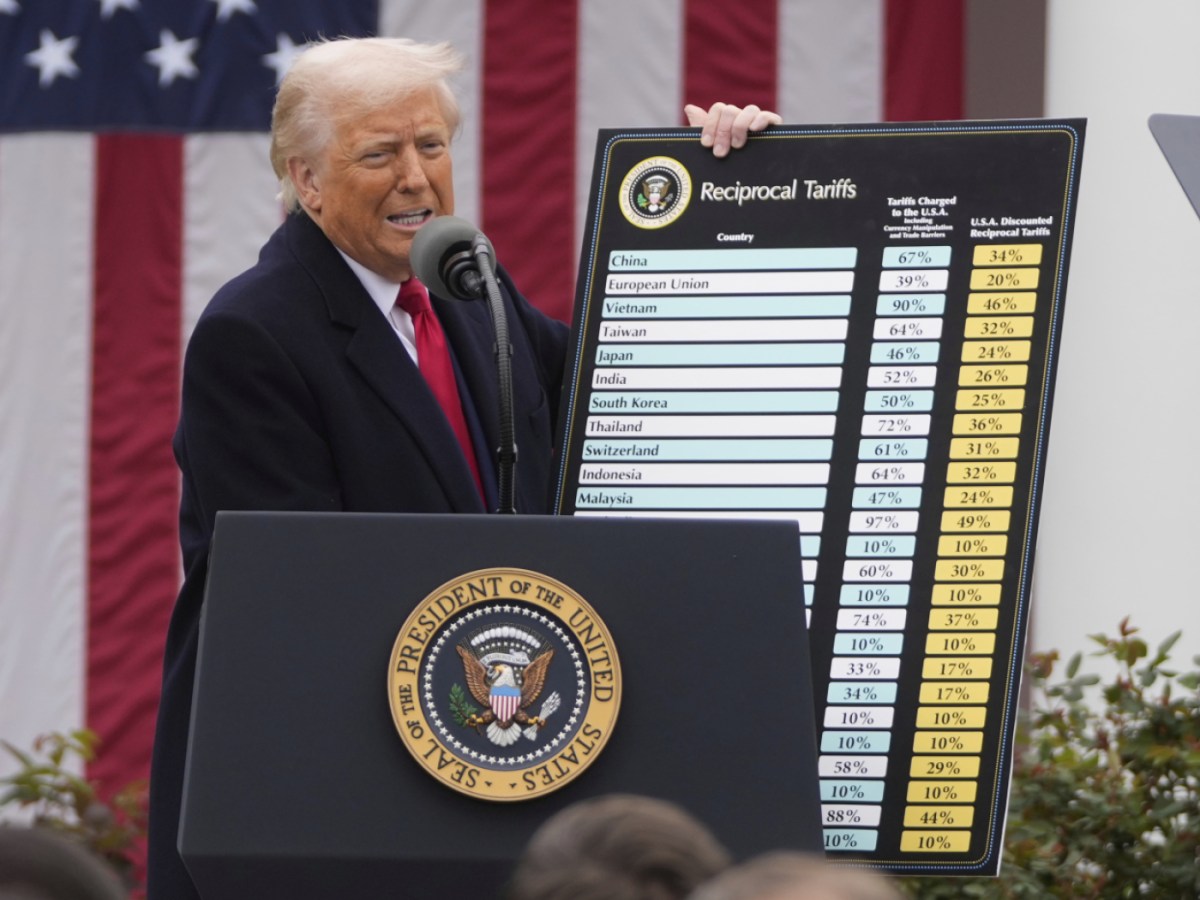

President Trump announced a 31% tariff on Swiss goods in retaliation for what the US claims are 61% Swiss tariffs on American products. This action, part of a broader trade policy shift dubbed “Make America Wealthy Again,” also includes a 20% tariff on EU goods and a 34% tariff on Chinese imports. Trump framed the tariffs as a response to unfair trade practices by various countries, with a 10% minimum tariff applied elsewhere. The announcement led to a drop in the US dollar against the euro.

Read the original article here

Trump’s decision to impose a 31% tariff on Swiss goods, while simultaneously applying a 20% tariff on similar goods from the European Union, is a baffling move that has sparked widespread criticism. The sheer arbitrariness of the numbers themselves has led many to question the underlying logic, if any exists. It’s as though a random number generator decided the punitive measures, leaving many wondering what possible economic principle could justify such a drastic disparity.

The claim that these tariffs are based on trade deficits, rather than actual tariffs levied by those countries against the US, adds another layer of confusion. This approach ignores the nuanced realities of international trade and suggests a simplistic, almost childish, understanding of global economics. It’s akin to retaliating against your local convenience store for a personal trade deficit – an act completely devoid of economic sense. The implication that this is “fair” only serves to highlight the lack of sophistication in the reasoning.

This arbitrary approach also raises concerns about fairness and consistency. The significant difference between the tariffs imposed on Swiss and EU goods is particularly perplexing, especially considering the close economic ties between Switzerland and the EU. One might expect a more uniform approach to tariffs across similar trading partners, but that clearly wasn’t the case here. The haphazard nature of the decision further fuels the perception of randomness and a lack of coherent economic policy.

The argument that this measure somehow benefits the US economy is dubious at best. Raising prices on imported goods, as these tariffs inevitably do, generally leads to increased prices for consumers and decreased demand for foreign products. This, in turn, might hurt the economies of the countries affected, but it’s hard to see how it directly benefits the US economy, especially in the long run. The potential for retaliatory tariffs further complicates the situation.

The choice to target Swiss goods also raises questions about the selection process. Many have pointed to the high value of Swiss pharmaceutical exports to the US, suggesting that the high tariff percentage could be an attempt to pressure Switzerland into making concessions on trade. This smacks of economic bullying and risks damaging long-standing trade relationships. Moreover, the focus on Swiss cheese and watches, while possibly humorous to some, does little to bolster a serious economic argument.

The reaction to these tariffs has been largely negative. Many commentators have described the decision as economically illiterate, highlighting the lack of a sound economic rationale. The widespread criticism suggests a lack of credibility and raises questions about the long-term consequences for both US and international trade relations. This lack of strategic thinking further intensifies the overall impression of incompetence and arbitrariness.

Beyond the specific economic implications, this decision has broader political ramifications. The arbitrary nature of the tariffs and the lack of transparency in the decision-making process further erode trust in the US’s approach to international relations. The idea that the entire world will simply shift its manufacturing capabilities to the US within a short time frame shows a lack of understanding of the complexities of global supply chains. Such naive assumptions undermine the credibility of the US in international forums.

Ultimately, the imposition of a 31% tariff on Swiss goods compared to a 20% tariff on EU goods stands as a prime example of inconsistent and economically unsound policy-making. The lack of transparency and the arbitrary nature of the decision only serve to fuel skepticism about the long-term economic consequences and further damage international relationships. The entire episode screams of impulsive decision-making, detached from any reasonable economic strategy.

The focus on trade deficits rather than actual tariffs applied by other countries points to a fundamental misunderstanding of international trade principles. Such a simplistic approach is bound to lead to unintended consequences, undermining the US’s position in the global economic landscape. Instead of bolstering the American economy, this action seems designed to sow discord and further destabilize already strained international relations.