Former President Trump recently touted Charles Schwab’s purported $2.5 billion profit, attributing it to recent stock market volatility. This market fluctuation followed Trump’s initial announcement of reciprocal tariffs, which triggered global sell-offs before a subsequent 90-day pause (excluding China) led to a market surge. Trump’s claim linked Schwab’s gains directly to these dramatic market shifts. The video showcasing this interaction occurred amidst ongoing controversy surrounding the tariffs and their impact.

Read the original article here

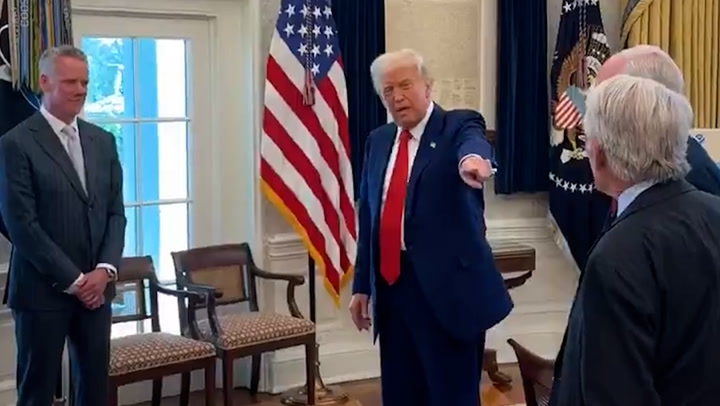

Donald Trump boasted to a group of NASCAR drivers about his friend Charles Schwab’s substantial financial gains amidst recent stock market volatility. He casually mentioned that Schwab had profited to the tune of two and a half billion dollars from the current market conditions. The sheer magnitude of this claim, coupled with the nonchalant manner in which it was delivered, is striking.

This casual bragging about Schwab’s massive windfall raises some serious questions. The implication is that this significant profit came at the expense of others – potentially smaller investors, pension funds, and ordinary individuals who may have experienced losses during the same period. The narrative paints a picture of a system rigged to favor the already wealthy, leaving those with less financial security further disadvantaged.

The fact that Trump chose to share this information with NASCAR drivers, a group known for their ties to a particular demographic, suggests a calculated move to bolster a certain image. It almost feels like a deliberate attempt to showcase connections and emphasize wealth and success as inherent aspects of his persona and his circle. The situation highlights a stark contrast between the haves and have-nots in the current financial climate.

The president’s comments naturally spark questions about the source of Schwab’s purported profits. Did it involve any insider information or actions that could be deemed unethical or even illegal? The very fact that such a large sum of money was made during times of market uncertainty inevitably casts suspicion. It underscores the inherent inequalities within financial markets and highlights the potential for unfair advantages that may exist for the very well-connected.

The president’s statement also speaks to a much larger issue concerning transparency and accountability within financial markets. The massive disparity between the gains of a select few and the potential losses experienced by many others is deeply concerning. It raises significant questions about fair market practices and whether existing regulatory mechanisms are sufficient to prevent exploitation.

Considering Trump’s public pronouncements often lack verifiable evidence and often seem designed to provoke reactions, this instance presents no exception. The claim lacks specific details, leaving it open to interpretation and speculation. This vagueness reinforces the sense of a narrative spun to create a particular impression, rather than a factual account of a complex financial event.

It is also worth considering the broader context of this anecdote. This anecdote fits into a pattern of Trump’s past behavior and public statements. His tendency to self-aggrandize, his close relationships with wealthy individuals, and his past criticisms of existing economic and regulatory systems all add layers of complexity and reinforce underlying skepticism about this seemingly boastful claim.

The timing of the disclosure also seems noteworthy. Given the ongoing political landscape and the various challenges and debates about economic inequality and financial regulations, this comment becomes even more resonant and potent, triggering discussions about wealth distribution and fair economic practices.

The lack of transparency surrounding the source of Schwab’s alleged windfall prompts speculation about potential insider trading and exacerbates the concerns surrounding unequal access to information and opportunity within financial markets. The contrast between the vast gains of a few and the potential losses of many underscores the ongoing debate about economic fairness and the regulatory environment governing these markets.

Ultimately, Trump’s casual boast about Schwab’s financial success serves as a lens through which to examine larger issues of wealth inequality, market fairness, and the power dynamics at play within the world of finance. It is a stark reminder of the wide gap between the ultra-wealthy and the rest of the population, especially during times of economic uncertainty. The story’s impact goes far beyond a simple anecdote, prompting broader conversations about the ethical implications of wealth accumulation, the role of regulation in maintaining financial stability, and the perceived injustices within current economic systems.