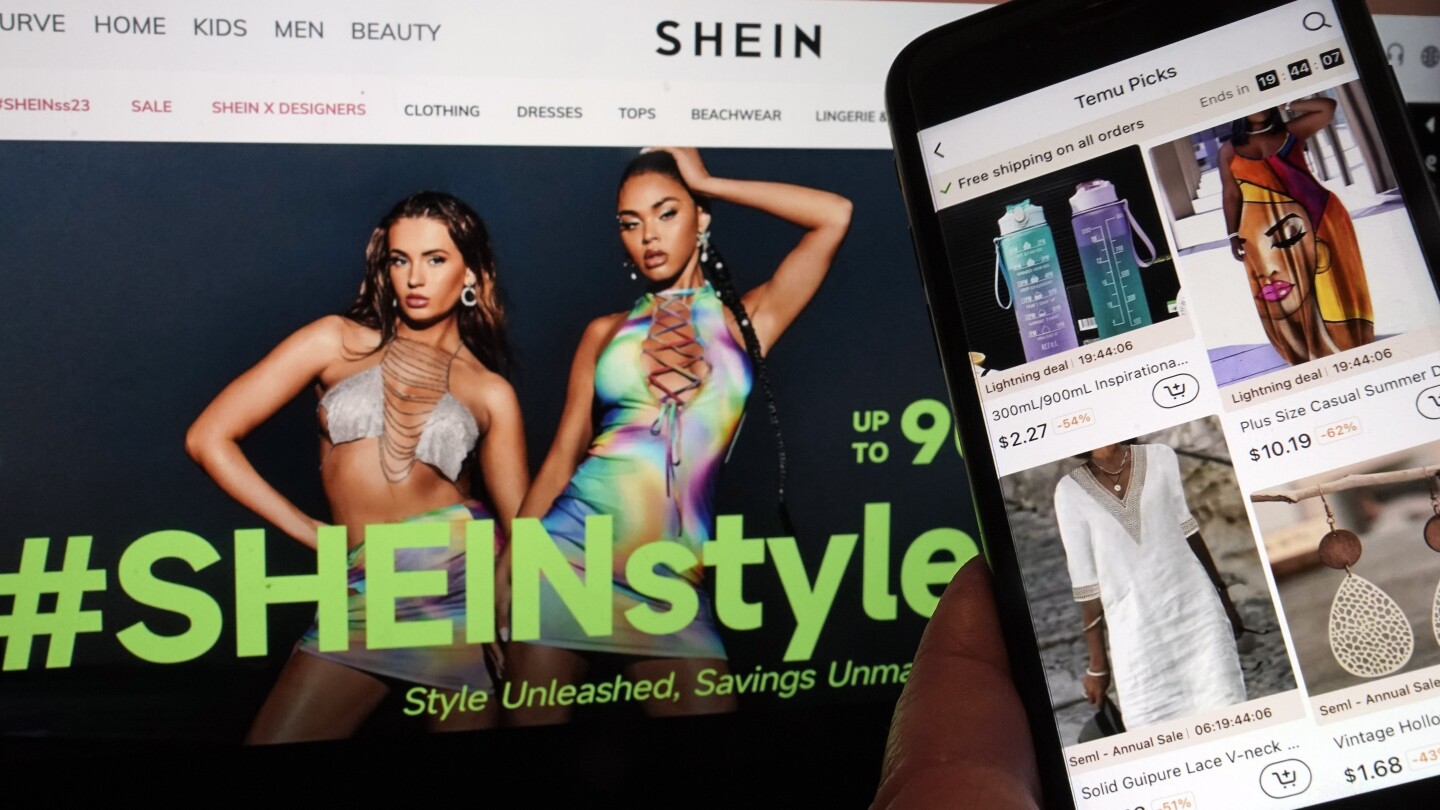

Temu and Shein, facing increased operating expenses due to new global trade rules and tariffs imposed by the Trump administration, will raise prices starting April 25th. The price hikes are a direct result of the 145% tariff on goods from China and the elimination of a duty-free exemption for goods under $800. This change significantly impacts the business models of these e-commerce giants, known for their ultra-low prices. Despite the price increases, both companies assure customers that they are working to minimize the impact and maintain service.

Read the original article here

Temu and Shein, the online retail giants known for their incredibly low prices, are poised to raise prices for US customers. This is a direct consequence of the tariffs imposed during the Trump administration, a fact that has seemingly surprised many American consumers. The belief that China, and not American consumers, bears the brunt of these tariffs has proven to be inaccurate, leading to a foreseeable price increase on the already budget-friendly items offered by these platforms.

This price hike will likely impact a broad range of consumers. While some may be relieved to see potentially lower demand for cheaply made, disposable goods, many others rely on Temu and Shein for affordable necessities. Educators, for example, often use these platforms to supplement classroom supplies from their own pockets, particularly in underfunded school districts. Increased prices on even everyday items will place an additional financial strain on those already struggling to make ends meet. The increased cost of items from these platforms will disproportionately affect those who may not have many other options for affordable shopping.

The impact will extend beyond everyday essentials. Many consumers use these platforms to access goods at significantly lower prices than those available through traditional retailers or even Amazon. One example highlights a significant price difference, demonstrating that the same ear wax removal tool that sells for $59 on other platforms is available for only $3.45 on Temu. This level of price disparity emphasizes the reliance some Americans have on these platforms for affordable purchasing. Even items like home goods – dressers, closets, and tables – are offered at significantly reduced costs.

This increase will affect the overall appeal of these platforms. The very low prices have fueled a “haul culture” which may diminish as costs rise and these platforms become less attractive from a purely cost perspective. While this may result in less cheaply made products entering the market, it simultaneously eliminates an accessible source of inexpensive goods for many American consumers. This is particularly concerning for those who rely on these retailers for everyday necessities or more niche hobby supplies otherwise unavailable or extremely expensive locally.

The argument that these companies sell nothing but low-quality, disposable items is partially true but overly simplistic. While a significant portion of their merchandise is indeed of low quality and designed for short-term use, these platforms also carry functional items that last, especially for everyday needs or niche hobby supplies which are far more expensive elsewhere. Whether it’s classroom supplies, kitchen tools or unique crafting materials, these platforms can offer options that are either unavailable or excessively expensive through other retail channels. The rise in prices may lead consumers back to brick-and-mortar stores, but that may not solve the problem of affordability.

It’s important to understand the broader context of this situation. The convenience and low prices offered by Temu and Shein have contributed to the difficulties faced by traditional retailers. The ability to purchase directly from manufacturers, bypassing the higher costs associated with middlemen, has made these platforms incredibly attractive. This is especially true when considering the identical products frequently offered on platforms like Amazon at significantly higher prices. The rising prices on Temu and Shein could further exacerbate this issue and possibly drive consumers towards even more expensive, traditional retailers.

Ultimately, the price increases resulting from the tariffs will disproportionately affect those who rely most on the affordability of these online retailers. While the quality concerns are valid, the impact will likely be most felt by those with limited financial resources, and perhaps this raises broader questions about the US economic system and the accessibility of affordable goods to consumers. The implications extend beyond the simple loss of cheap products and touch upon broader concerns regarding economic accessibility and the long-term consequences of trade policies. The tariffs’ effect will undoubtedly ripple through the consumer landscape in more complex ways than initially anticipated.