A Republican budget bill, supported by President Trump and passing the Senate 51-48, has sparked controversy. Senator Sanders criticized the bill for potentially hindering Social Security access amidst reported SSA staff reductions and office closures, exacerbating existing economic inequality. Republicans countered that the bill prevents a large tax increase, while Democrats argued it favors the wealthy and increases national debt. The bill’s passage sets the stage for further legislative action, but faces potential challenges in the House.

Read the original article here

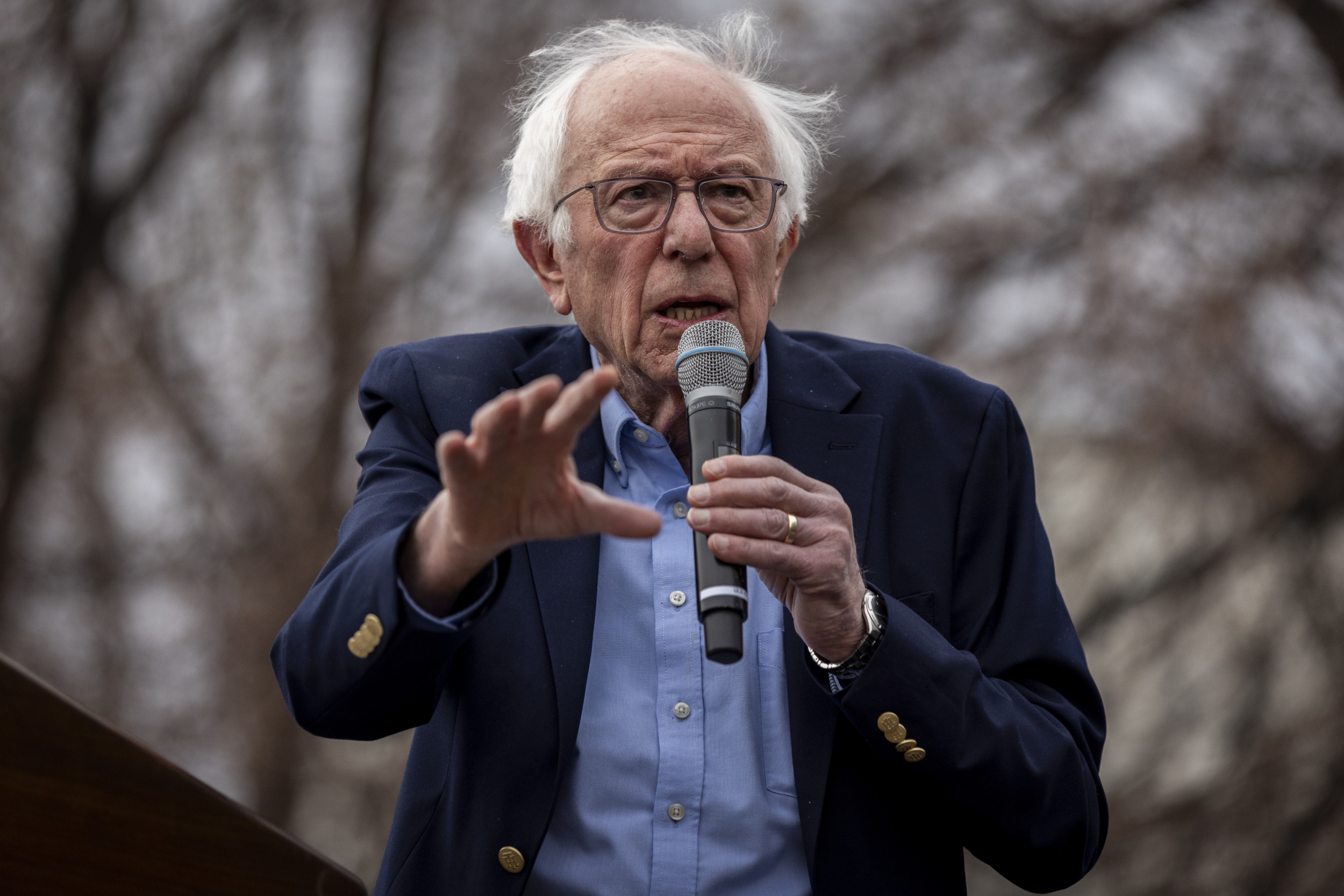

Senator Bernie Sanders has issued a stark warning regarding the potential impact of a proposed Trump budget bill on Social Security. His concerns center around the bill’s potential to drastically reduce funding for the program, jeopardizing the financial security of millions of retirees and vulnerable Americans.

The core of Sanders’ warning highlights the inherent unfairness of the proposed cuts. The argument is that this budget prioritizes tax cuts for the wealthy while simultaneously threatening the lifeline of a social safety net program that many Americans rely on for their survival. This raises serious questions about the administration’s commitment to the well-being of its citizens, suggesting a skewed allocation of resources that favors the already affluent.

The senator’s message emphasizes that Social Security is not “free money” as some may claim. Instead, it’s a system funded by payroll deductions throughout working lives, rightfully earned by those who have contributed to it. It is a system that is essential to the financial stability of millions of seniors and disabled individuals. The idea that this entitlement is under threat fuels Sanders’ alarm.

Sanders’ warning resonates deeply with the lived experiences of many Americans. Numerous anecdotes highlight the crucial role Social Security plays in everyday life, from enabling seniors to pay rent to providing a financial safety net for those with chronic health conditions and disabilities. These personal accounts underscore the tangible human cost of any potential reductions in Social Security benefits.

The proposed budget cuts are further contextualized within a broader criticism of economic inequality. The argument is presented that the wealthiest individuals and corporations receive disproportionate tax breaks, while essential social programs face potential cuts. This highlights the perceived imbalance in the distribution of wealth and resources within society, exacerbating the concerns about the potential damage to the social safety net.

Central to Sanders’ message is the ethical consideration of fairness and equitable taxation. The proposed tax cuts overwhelmingly benefit the ultra-wealthy, those with vast financial resources who can certainly afford to contribute a greater share. This leads to the question of why the wealthy should be exempt from paying their “fair share,” while those who rely on Social Security endure potential cuts to their benefits.

The proposed budget cuts are also characterized as a betrayal of those who have consistently contributed to Social Security throughout their working lives. The argument is that these individuals deserve the benefits they’ve earned, and the potential elimination of these hard-earned benefits constitutes a breach of trust. The impact on the dignity and wellbeing of vulnerable citizens is highlighted.

Critiques of the proposed budget’s financial mechanism extend beyond simple cuts. There is discussion of a long-standing narrative spun by those in power that characterizes opponents’ proposals as attacks on entitlements. This is cast as a mere distraction tactic meant to obfuscate the actual impacts of the budget on the lives of ordinary citizens.

The debate also touches upon the long-term sustainability of Social Security and the challenges posed by evolving demographics. While recognizing the inherent complexities and potential difficulties in reforming the system, the overall message highlights the critical need to protect the current recipients, emphasizing that the system requires reform to secure its future but any change cannot compromise the current benefits of those who have earned them.

The current situation is seen as a culmination of decades of political choices, highlighting the need for immediate action and a change in political priorities. The argument stresses the need for a policy shift that prioritizes the well-being of ordinary citizens over the financial interests of the wealthy and powerful. This underscores a sentiment that the current political system has consistently failed to adequately address economic inequality and protect the most vulnerable members of society.

This crisis has prompted calls for a stronger, more proactive approach to protecting Social Security. The ideal is presented as a system that ensures a comfortable and dignified retirement for all who have contributed, irrespective of their background or income levels.

In conclusion, Senator Sanders’ warning serves as a cautionary tale about the potential consequences of prioritizing tax cuts for the wealthy while simultaneously endangering the financial security of millions of vulnerable Americans who rely on Social Security. The urgency and severity of the warning stem from the potential to shatter the safety net upon which many citizens depend for survival, and is a wake-up call to reassess current priorities and policy decisions.