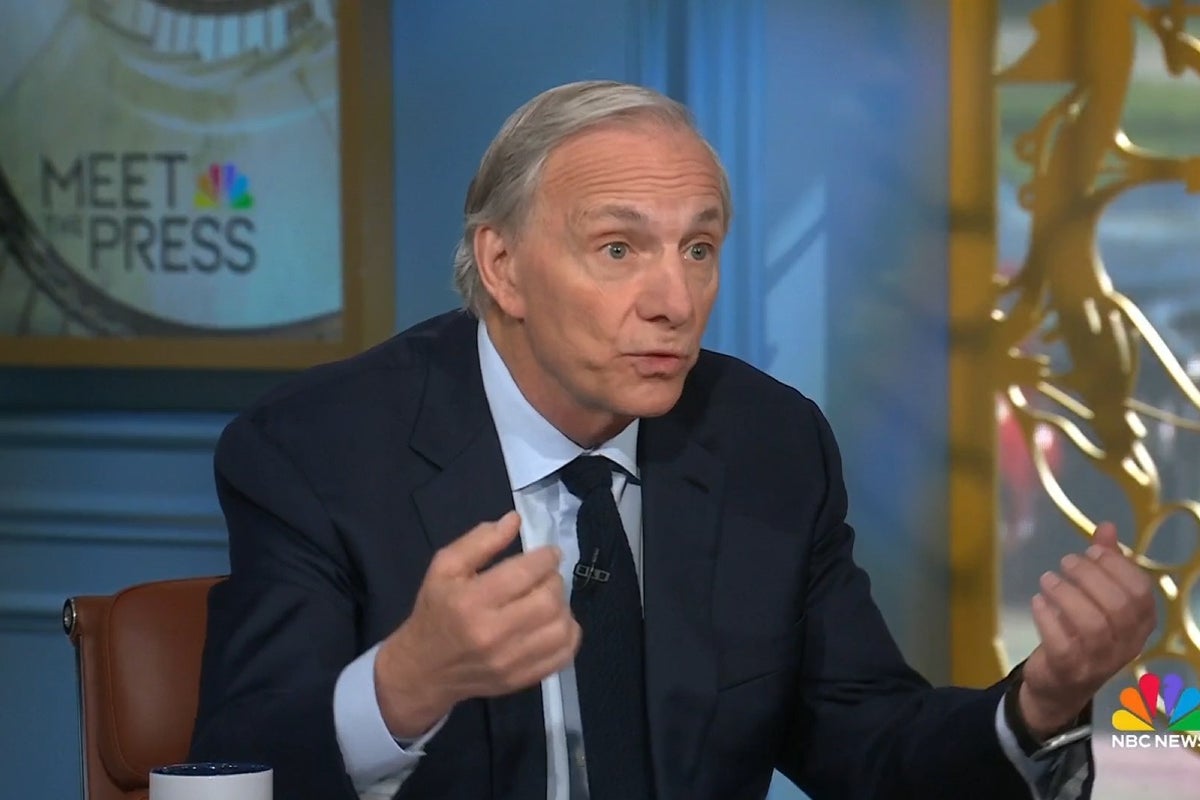

Billionaire investor Ray Dalio warns of a potential economic crisis far exceeding a recession, citing disruptive trade policies and a soaring national debt as major contributing factors. He points to the instability caused by President Trump’s tariffs, creating uncertainty for businesses and global trade partners, echoing similar concerns from other industry leaders. Dalio emphasizes the need for strategic handling of these issues to mitigate a severe economic downturn, suggesting a significant reduction in the budget deficit as a crucial step. The unpredictable nature of the tariffs and their potential long-term impacts add to the growing economic anxieties.

Read the original article here

A prominent billionaire hedge fund manager is sounding the alarm, warning that the United States is facing an economic crisis far exceeding the severity of a typical recession. The situation, he suggests, is far more dire and could lead to a complete societal collapse.

This isn’t just a downturn in the economy; it’s a potential unraveling of the established financial order. The warning signals are everywhere – instability both in the domestic and global economic landscapes, causing uncertainty across various financial markets.

The ongoing economic turmoil extends beyond traditional economic indicators and delves into the realm of geopolitical instability. International relations are strained, with global powers reassessing their alliances and economic strategies in response to unexpected and unpredictable actions.

The warning reflects a deeper concern about the long-term sustainability of the U.S. financial system. There’s a growing apprehension that the traditional methods of financing government debt and maintaining the dollar’s status as a global reserve currency may be failing.

A significant shift is occurring in the global financial landscape, as countries diversify their investments and reduce their reliance on U.S. Treasury bonds. This shift erodes the U.S.’s ability to finance its deficits and maintain its financial dominance.

This potential shift in global financial power dynamics will drastically impact the American economic system, potentially triggering a cycle of escalating interest rates and deepening debt, creating a feedback loop that exacerbates the overall financial predicament.

Some argue that the current situation is a direct result of specific political decisions and policies that have undermined the stability of the U.S. economy. These decisions have eroded trust in the United States as a safe haven for investment and sparked a reassessment by global partners.

The consequences of these actions extend beyond economic instability and touch upon the social fabric of the nation. The potential for widespread hardship and social unrest is a major concern. This could lead to scenarios far beyond the scope of a traditional recession.

The crisis is not simply a matter of economic policy; it reflects a deeper systemic issue, characterized by a breakdown of trust, both domestically and internationally. The situation is aggravated by a lack of decisive action to address the root causes of the problem.

There is a sentiment of frustration and disillusionment among many, particularly toward the political leadership and the perceived inadequacy of their responses to the developing crisis. Concerns mount over the lack of accountability and the perceived indifference to the consequences of certain political decisions.

Many observers believe the situation is far more critical than a simple recession, and some believe that a full-blown economic depression is inevitable. The scale and scope of the impending economic turmoil, according to these analysts, would far exceed any previously experienced downturn.

There’s a growing unease about the potential for social upheaval and conflict arising from economic hardship. The potential for societal instability and unrest is a major concern as people grapple with the consequences of the crisis.

While the precise trajectory of the economic crisis remains uncertain, a widespread feeling of apprehension permeates various sectors of society. The potential consequences range from severe financial hardship to a complete restructuring of the global economic order.

The severity of the situation is accentuated by the fact that the underlying problems are systemic and deeply ingrained, requiring comprehensive and decisive action to mitigate the impending fallout. The lack of such action further amplifies the concern surrounding the future.

The billionaire’s stark warning isn’t simply a prediction; it’s a call for immediate action to address the underlying causes of the instability and prevent the potential for catastrophic consequences. The looming crisis demands immediate attention and decisive action.