Monday’s stock market experienced dramatic volatility due to a false report about President Trump considering a tariff pause. The Dow Jones Industrial Average ultimately fell 349 points, while the S&P 500 dropped 11 points, though the NASDAQ saw a slight increase. This followed a devastating Friday, marking the worst week for the market since 2020, triggered by Trump’s announcement of widespread tariffs. The market swings underscore investor anxieties surrounding the global economic impact of these tariffs.

Read the original article here

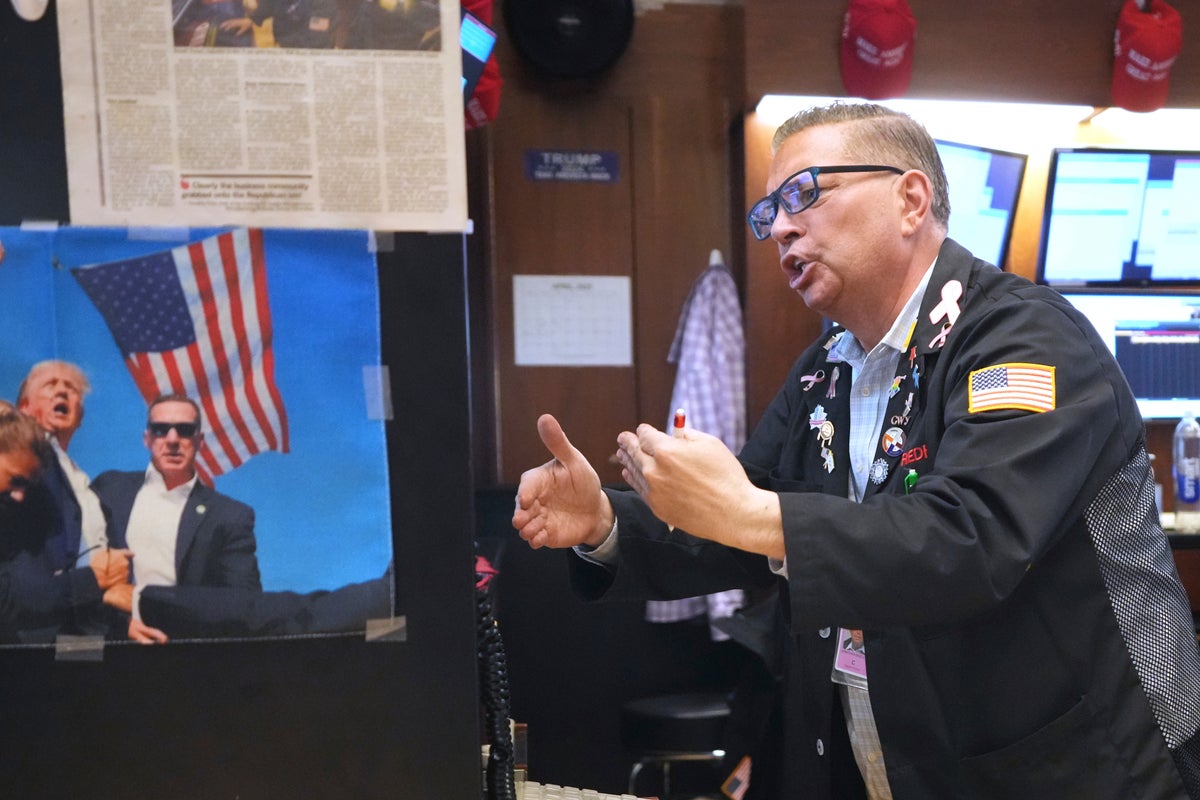

The stock market experienced a dramatic upheaval following the dissemination of a “fake news” report concerning the future of President Trump’s tariff plan. The rumor, which circulated rapidly on CNBC and social media, suggested that National Economic Council Director Kevin Hassett had indicated a potential 90-day pause on tariffs for all countries except China.

This unsubstantiated claim initially triggered a significant surge in stock prices, with the Dow Jones Industrial Average experiencing a sharp upward trajectory. However, this rally proved short-lived, as the market quickly reversed course, plummeting hundreds of points. The S&P 500 mirrored this volatile behavior, demonstrating the market’s extreme sensitivity to this unverified news.

The White House’s swift and emphatic denial of the rumor further fueled the market’s instability. This rapid response, despite the initial positive impact on the market, strongly suggests that the administration had no intention of altering its tariff policy, at least not in the way the rumor suggested. This swift denial, coupled with the market’s immediate downturn following the initial rally, points toward a significant level of market manipulation, driven primarily by the spread of the false information.

The sudden and substantial market swings left many observers perplexed. The rapid shift from a positive to a negative trajectory highlighted the fragility of investor confidence and the influence of easily spread misinformation. This volatility underscores the critical role of reliable information in maintaining market stability.

The speed at which the rumor spread and the intensity of the market’s reaction raised concerns about the vulnerability of the financial markets to fake news and deliberate manipulation. It fueled discussions about the need for more robust fact-checking mechanisms and tighter regulation to mitigate the risks associated with the dissemination of false information that influences market behavior. The incident served as a stark reminder that even unsubstantiated reports can have profound and immediate consequences on the global economy.

The incident raised questions about the potential for malicious intent behind the spread of the false news. Many speculated about whether it was a deliberate attempt to manipulate the market for personal financial gain, a strategy known as “pump and dump.” This would involve artificially inflating the price of an asset through false information and then selling it off at the peak, leaving others to absorb the losses. The suspicion centered on the possibility of insider trading or coordinated efforts to profit from the market’s volatility.

The market’s reaction, and the subsequent White House denial, fueled speculation that significant actors were positioned to profit from both the initial surge and the subsequent decline. This led to concerns that sophisticated players were not only aware of the false information but actively used it to their advantage. The substantial swings could imply a carefully orchestrated plan, benefiting those with knowledge of the rumor’s falsity.

Beyond the immediate market turmoil, the incident highlighted broader concerns about political influence on the economy. The administration’s tariff policies have already been a source of considerable uncertainty and volatility. The incident only served to amplify these concerns, underscoring the interconnectedness of politics, information, and financial markets. The impact extended beyond the United States, as global markets showed signs of instability following the news.

Moreover, the event raised questions about the role of social media in shaping market sentiment. The rapid dissemination of the false information through various social media platforms underscored the growing power of these platforms to influence financial markets. This incident served as a potent example of the challenge of managing information flows in an environment where fake news can spread rapidly and have a significant economic impact. The event spurred conversations about the need for greater media literacy among investors and more effective mechanisms to combat the spread of misinformation.

In conclusion, the stock market’s haywire reaction to the fake news regarding Trump’s tariff plan served as a stark illustration of the dangers of misinformation in a digitally interconnected world. The incident exposed the vulnerability of financial markets to manipulation and highlighted the urgent need for enhanced regulatory oversight and stronger mechanisms for countering the spread of fake news to protect market integrity and investor confidence. The event also fueled debate about the wider impact of political decisions and the role of social media in shaping market sentiment and driving investment strategies. The episode serves as a cautionary tale, underscoring the need for vigilance and critical evaluation of information in the ever-evolving landscape of financial markets and news dissemination.