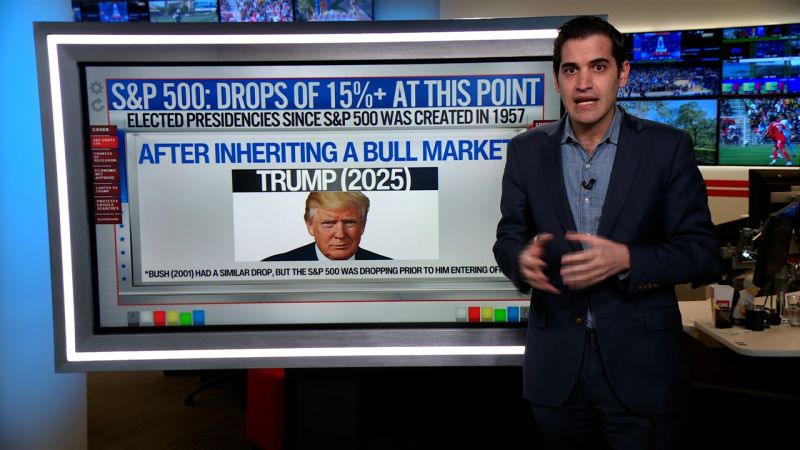

New tariffs have triggered a dramatic market downturn, with US stock futures plummeting and Asian markets experiencing significant losses. The S&P 500 is teetering on a bear market, fueled by fears of a global recession stemming from the increased trade tensions. Oil prices have fallen sharply, and even Bitcoin has experienced declines. Analysts predict continued market volatility as investors grapple with the uncertainty and potential economic consequences of the escalating trade war.

Read the original article here

Dow futures plummeting over 1,500 points underscores a continuing, dramatic market selloff. This isn’t just a dip; it’s a significant and unsettling plunge, raising serious concerns about the economic trajectory. The sheer magnitude of the drop is alarming, hinting at a deeper underlying issue than just typical market volatility. This isn’t a minor correction; it feels more like a freefall.

The scale of this downturn is remarkable, especially considering the absence of major triggering events like a natural disaster, war, or significant geopolitical crisis. This unusual severity points to a potential internal fragility within the system, perhaps a consequence of underlying vulnerabilities that are now being exposed. The absence of external shocks makes this economic downturn particularly concerning.

Many are pointing fingers, attributing this market collapse to specific policy decisions. The economic consequences of these policies are now undeniably apparent, manifested in this drastic market reaction. The speed and intensity of this decline are shocking, suggesting a lack of preparedness or a miscalculation of potential repercussions. This rapid descent leaves many feeling a sense of unease and uncertainty about the future.

The severity of the market’s response suggests a deep-seated lack of confidence. Investors are clearly reacting to something—a perceived lack of stability, a potential for further losses, or perhaps a fundamental distrust in the current economic management. The scale of this reaction reflects a wider-spread sentiment of fear and uncertainty.

This market downturn is affecting everyone, from those with retirement savings to those investing in 401(k) plans. Trillions of dollars are at stake, impacting the financial security of countless individuals and families. This isn’t just an abstract financial event; it has very real and tangible consequences for ordinary people.

Concerns are being raised about the administration’s economic policies and their impact on the markets. The absence of experienced hands to mitigate the fallout from these policies is adding to the growing anxieties. This lack of experienced guidance is amplifying the negative consequences of the policies themselves.

This economic turmoil is causing widespread anxiety and panic. Calls for accountability and even impeachment are growing louder, highlighting the gravity of the situation and the public’s loss of confidence. The speed of this market crash is unprecedented.

Some observers are comparing the current situation to previous economic crises, drawing parallels to historical events and suggesting potential outcomes. These comparisons highlight the potential severity of the current downturn and its potential long-term implications. This isn’t just a repeat of past crises; it’s a unique and worrisome situation.

The situation highlights the potential dangers of unchecked power and the importance of robust oversight and accountability in economic management. This economic freefall underscores a need for significant reforms and a re-evaluation of current economic strategies. The consequences of this economic mismanagement are far-reaching and deeply troubling.

There’s a growing sense that this isn’t simply a market correction, but something much more profound. The sheer speed and scale of the drop suggest a deeper systemic problem, one that goes beyond typical market fluctuations. The situation is deeply concerning and demands immediate attention.

The implications of this market crash extend far beyond the immediate financial losses. The potential for social and political unrest is significant, as economic hardship often leads to instability. The economic fallout has the potential to destabilize the entire social fabric.

Many are calling for immediate action to address this crisis. The current situation requires a swift and decisive response to mitigate the damage and restore confidence in the markets. The consequences of inaction will be dire. This is a moment that demands urgent and decisive action.

The Dow futures tumble of more than 1,500 points serves as a stark warning, signaling a much deeper and more complex crisis than a simple market correction. The severity and unexpectedness of this event demand immediate attention and a comprehensive re-evaluation of the economic policies driving this unprecedented decline. The situation warrants a careful examination of its underlying causes and a strategic approach to prevent further harm.