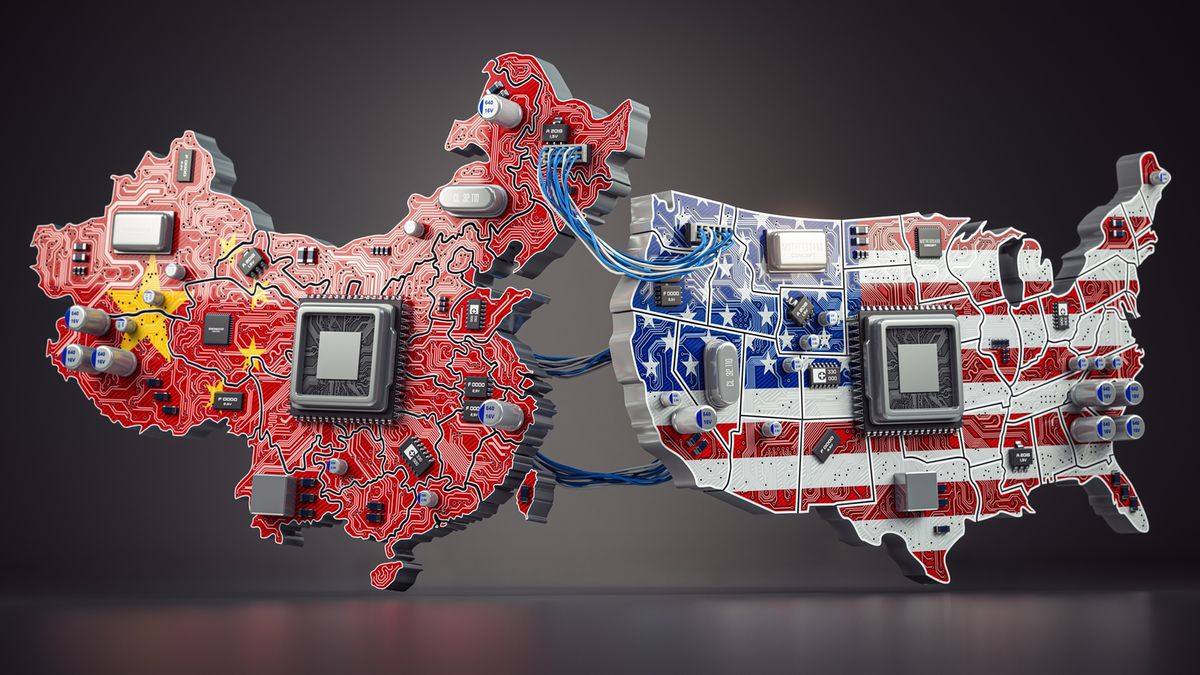

President Trump’s imposition of 54% tariffs on Chinese goods prompted a swift retaliation from Beijing, including 34% duties on U.S. goods and export restrictions on seven rare earth metals crucial for advanced technologies. This action, unlike previous retaliatory measures, preceded the tariff implementation and coincided with a deadline for TikTok’s U.S. sale, suggesting strategic leverage in upcoming negotiations. While computer chips and copper remain temporarily exempt, the tariffs and rare earth restrictions will likely increase production costs for U.S. chipmakers, forcing price hikes across the board. The escalating trade war significantly impacts the cost of imported goods, particularly semiconductors.

Read the original article here

China’s retaliatory 34 percent tariff on US goods, coupled with a ban on rare earth element exports, represents a significant escalation in the trade war with the United States. This isn’t just about higher prices on imported goods; the rare earth mineral ban cuts directly into the heart of US technological capabilities and national security. The impact on soybean farmers, already struggling, is expected to be devastating, potentially triggering a further economic downturn.

The strategic nature of this move is unmistakable. China’s actions demonstrate a long-term perspective that contrasts sharply with what some perceive as short-sighted, impulsive decisions by the US. While the US focuses on immediate gains, China seems to be playing a longer game, aiming to solidify its global economic dominance. The ban on rare earth elements is particularly telling; these minerals are essential for a vast array of high-tech applications, including military hardware and advanced electronics. Cutting off access to these critical resources significantly weakens US manufacturing and technological competitiveness.

The consequences for the United States are potentially dire. The lack of readily available alternative sources for rare earth minerals, especially considering the US’s past rejection of potential partnerships, means there’s a significant vulnerability. This lack of diversification creates a dependence on China that extends far beyond the immediate economic impact of the tariff. This situation isn’t merely an economic setback; it’s a strategic blow to US technological independence.

The move highlights the complex interplay between economics and geopolitics. It’s not just about tariffs and trade; it’s about securing control over vital resources and shaping the global technological landscape. This action by China underscores the nation’s growing economic and technological strength, and its willingness to leverage this strength to achieve its strategic goals.

The immediate impact extends to various sectors. The automotive industry, heavily reliant on rare earth minerals for electric vehicle production, faces substantial disruptions. Similarly, the defense industry, dependent on these materials for advanced weaponry, is left vulnerable. The broader technological sector also faces significant challenges, impacting everything from consumer electronics to medical devices.

Some argue that the US’s aggressive trade policies have backfired spectacularly, creating an environment where China feels empowered to respond decisively. The lack of foresight and the focus on short-term gains are seen as contributing factors to this predicament. The broader global economy is also affected, with the trade war leading to uncertainty and disruptions across various markets. This situation is more than just a trade dispute; it’s a clash of geopolitical strategies with far-reaching consequences.

The situation further exacerbates concerns about the US’s ability to compete in the global technological arena. This isn’t solely an economic issue; it’s a matter of national security. The reliance on China for critical resources jeopardizes the US’s military capabilities and its ability to maintain technological leadership. The future competitiveness of US industries is significantly impacted, with long-term implications for economic growth and global influence.

In conclusion, China’s retaliatory actions are far more than a simple response to tariffs. The ban on rare earth exports represents a strategic move that exposes the US’s vulnerability in critical technological sectors. The long-term consequences for the US economy and national security are likely to be profound, prompting a serious reassessment of trade policies and strategic resource dependencies. The immediate impact is a significant blow to US industries, but the longer-term ramifications could reshape the global economic and geopolitical landscape. The situation underscores the need for a more nuanced and strategic approach to international trade and resource management.