This article is protected by copyright and all rights are reserved by Fortune Media IP Limited. Use of this site is governed by the Terms of Use and Privacy Policy. Note that Fortune may receive compensation for certain linked products and services. Finally, advertised offers are subject to change.

Read the original article here

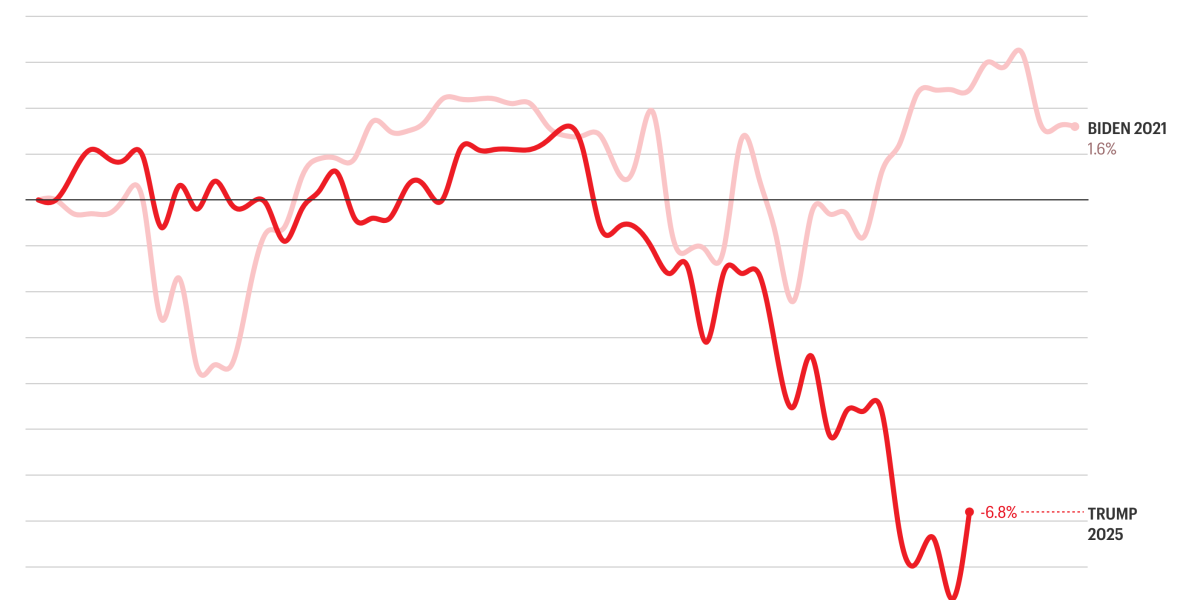

The stock market’s performance under different presidential administrations is a topic that frequently sparks debate. A recent comparison highlights a stark contrast between the initial 60 days of the Biden and Trump presidencies. While the market saw a 2% gain during Biden’s first two months in office, a significant downturn occurred during Trump’s initial 60 days, with a reported 7% drop. This discrepancy immediately raises questions about economic policy and its impact on investor confidence.

The difference in market behavior between these two administrations is striking. A 2% increase suggests a degree of stability and perhaps even cautious optimism among investors during Biden’s early days. Conversely, the 7% decrease under Trump suggests a considerable loss of confidence, prompting fears about the potential for further economic instability.

Many attribute this dramatic difference to the vastly different approaches to economic policy. Biden’s administration, upon taking office, inherited a struggling economy still recovering from the COVID-19 pandemic. Their focus seemingly lay in rebuilding economic stability through infrastructure investment and social programs. This may have provided investors with a sense of stability, though cautious.

In contrast, Trump’s economic policy during his initial tenure was characterized by aggressive trade protectionism, including widespread tariff implementations. This aggressive approach triggered retaliatory tariffs from other countries, creating uncertainty and instability in global trade. The resulting disruptions to supply chains and increased costs for businesses likely contributed to the significant market downturn. The unpredictability inherent in Trump’s approach could certainly have contributed to investor unease.

The narrative surrounding these events often points to differing interpretations of the economic landscape. Some see Biden’s early gains as a testament to a measured, less disruptive approach. Others argue the market under Biden’s administration has experienced greater volatility in the long run. These arguments frequently cite specific market indices and their overall trends. These long term comparisons however often obscure the specific contrast of the initial 60 days.

The 7% market decline under Trump stands in sharp contrast to the claims of “winning” frequently made during his presidency. The significant drop during his first 60 days directly contradicts the narrative of consistent economic prosperity often presented by supporters. This discrepancy highlights the complexities of linking short-term market fluctuations directly to specific policies and the potential for misinterpretations of economic data.

It’s crucial to remember that the stock market is a complex system influenced by numerous factors beyond any single administration’s control. Global events, technological shifts, and broader economic trends all play significant roles. Attributing market changes solely to presidential actions is a simplification, though undeniably, policy decisions can have a substantial impact on market sentiment.

The significant difference in the stock market’s initial performance under Biden and Trump underscores the importance of considering the long-term effects of various economic policies. While a 2% gain versus a 7% loss represents a clear difference in the short-term, the long-term consequences of these differing approaches are likely to become more apparent over time. It is this longer-term picture which offers a more complete evaluation of the success of each administration’s economic strategies.

Ultimately, drawing definitive conclusions based solely on the first 60 days of each presidency is risky. Economic trends are complex, with multiple contributing factors, and short-term fluctuations do not necessarily predict long-term outcomes. The comparison between the Biden and Trump administrations’ first 60 days, however, does offer a compelling insight into the potential impacts of differing economic philosophies on market confidence. The stark contrast in market performance highlights the ongoing debate about the role of government in shaping economic growth and stability. Further analysis and examination of long-term trends are essential to achieving a fully informed understanding of the issue.