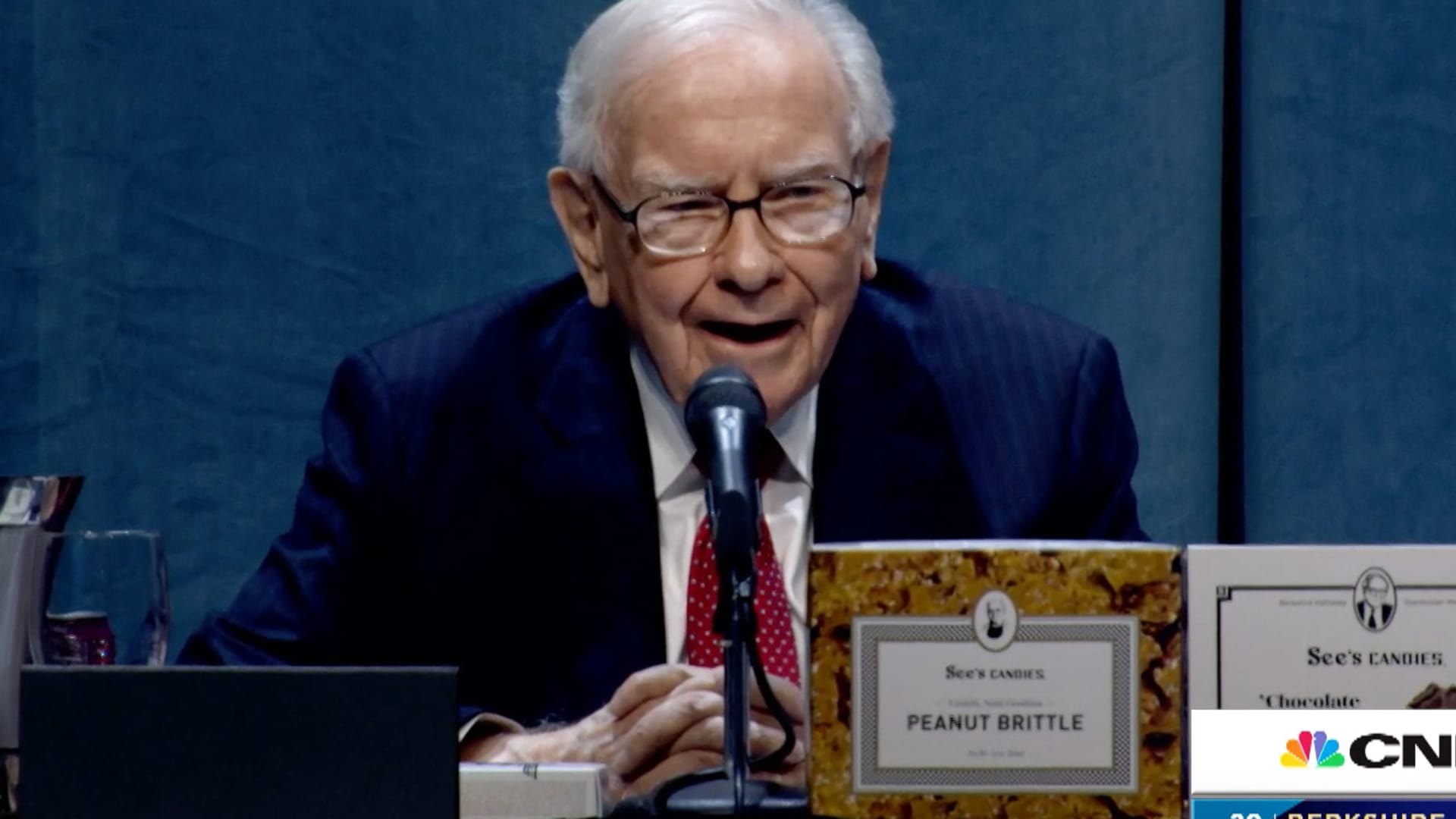

In a rare public statement, Warren Buffett characterized tariffs as a “tax on goods,” akin to an act of war, expressing concern that they could fuel inflation and harm consumers. He highlighted the economic ripple effect, questioning the long-term consequences of such policies. This comment marks Buffett’s first public assessment of President Trump’s recent tariff announcements, which include increased levies on goods from Mexico, Canada, and China. Buffett’s remarks come amidst market volatility and his own recent shift towards a more conservative investment strategy.

Read the original article here

Tariffs are, in essence, a tax on goods. This is a fundamental economic principle, and it’s not a matter of opinion; it’s a straightforward definition. The money collected from tariffs doesn’t magically appear; it’s paid by businesses and ultimately, consumers, who bear the increased cost of imported goods. It’s not a hidden fee or some sort of accounting trick; it’s a direct transfer of funds to the government, which is the very definition of a tax.

This simple reality, however, is often lost in the political discourse surrounding tariffs. The idea that some external entity or mystical force pays these tariffs—the claim that “the Tooth Fairy doesn’t pay ’em”—is a fundamentally flawed understanding of how these economic mechanisms operate. It’s a dismissive and inaccurate statement, suggesting an almost magical ability to shift economic costs without affecting real-world players.

The argument that tariffs don’t constitute a tax frequently arises from a misunderstanding of who ultimately shoulders the burden. The initial payment might be made by an importer, but the increased cost gets passed down the supply chain. Ultimately, consumers pay more for goods subject to tariffs, making it a de facto tax on consumers, though the money flows to the government initially. This isn’t some esoteric financial maneuver; it’s a direct result of supply and demand. Higher prices reduce the quantity demanded of goods; fewer imports decrease demand, which forces price increases.

The impact of tariffs extends beyond the simple act of transferring funds. They distort markets, create inefficiencies, and harm international trade relations. Tariffs can lead to retaliatory measures from other countries, negatively impacting exports and jeopardizing economic stability. In essence, they function as a tax with multiple, interconnected consequences that extend far beyond the initial transaction.

The claim that tariffs are not a tax often stems from a political desire to avoid acknowledging the negative economic consequences. The simplification that tariffs are merely a means to protect domestic industries or balance international trade overlooks the complexities of global economics and the significant burden placed on consumers. It is a convenient way to overlook the real-world impact of policies on everyday citizens.

The assertion that tariffs are not a tax, especially when countered by the clear and concise statement that they are, highlights a disconnect between economic reality and political rhetoric. This gap is made even more apparent when prominent figures in the financial world explicitly state that tariffs act as a tax on goods. This reinforces the importance of distinguishing between political assertions and established economic principles.

It’s important to approach these economic issues with a clear understanding of basic principles. Complex economic systems shouldn’t be simplified to the point where fundamental realities are disregarded. This is crucial for informed discussions and the creation of sound economic policies. Ignoring this reality not only misrepresents the impact of tariffs, but also undermines the ability to have constructive dialogues about economic policy.

Ultimately, the debate over whether tariffs constitute a tax shouldn’t be a matter of opinion. It’s a question of basic economic principles. Ignoring the clear economic consequences of tariff policies—that they are a tax on goods borne by consumers—is akin to ignoring the laws of gravity; you can deny their existence, but they’ll still apply. The simple truth is that when the government levies a tariff, the burden is ultimately shouldered by consumers and businesses in the form of increased prices.