The Trump administration, through the Office of Management and Budget, has effectively shut down the Consumer Financial Protection Bureau (CFPB), halting all proposed rules, suspending effective dates on finalized rules, and ceasing all investigations and supervisory activities. This action, following similar efforts against other agencies, aims to curtail the CFPB’s work despite its congressional mandate and significant consumer protection achievements, including securing nearly $20 billion in relief. The administration’s move clashes with Trump’s past populist promises and highlights ongoing tensions between regulatory oversight and deregulation. While the CFPB’s physical headquarters temporarily closed, the agency remains susceptible to further action as the administration seeks to limit its authority.

Read the original article here

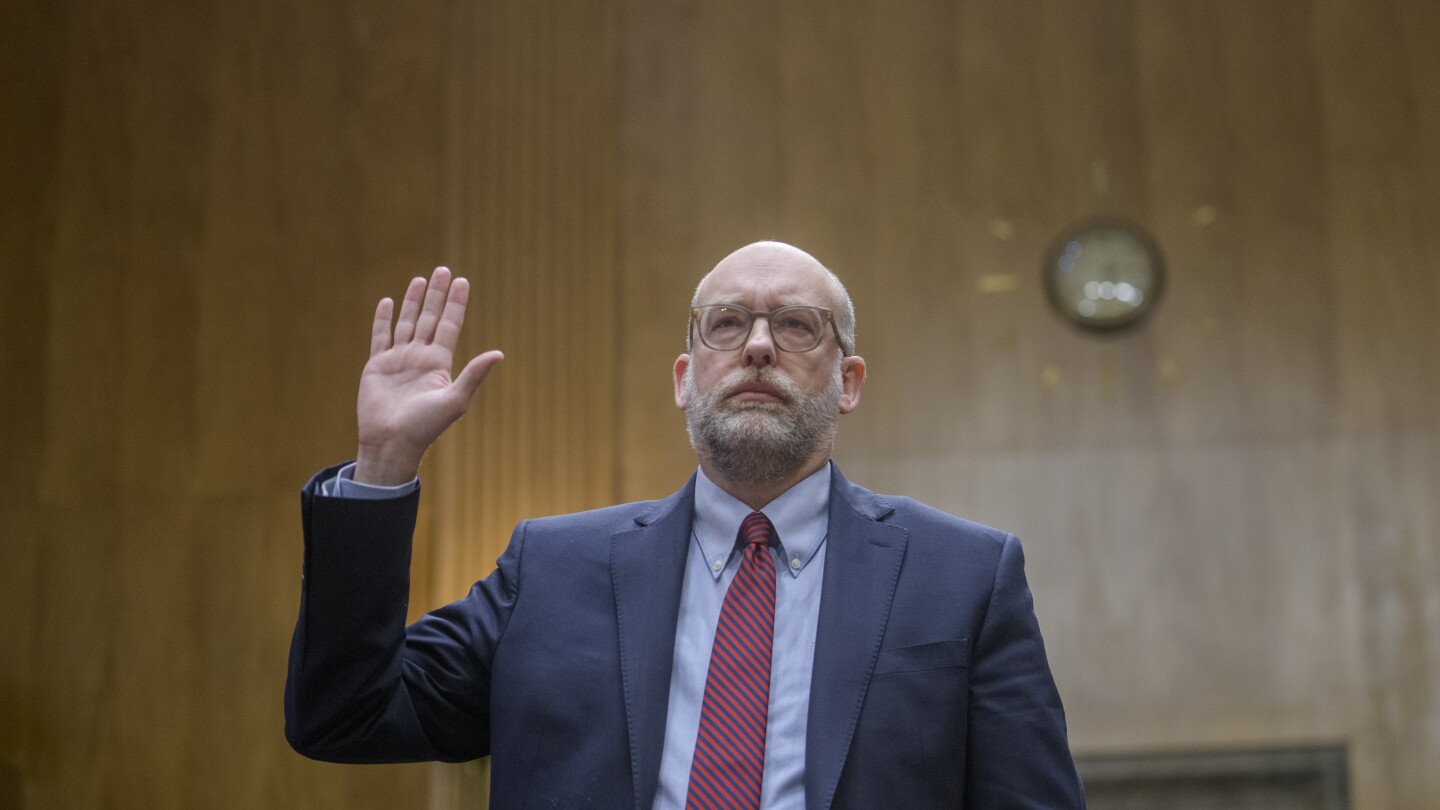

A Trump official recently ordered the Consumer Financial Protection Bureau (CFPB) to cease operations, a decision that has sparked widespread outrage and concern. This action effectively halts the agency’s ongoing work, including the implementation of a crucial new rule designed to protect consumers from the devastating effects of medical debt.

The recently finalized rule, which would have prevented banks and lenders from considering unpaid medical bills when assessing loan applications, is now suspended indefinitely. This means millions of Americans will continue to struggle under the weight of medical debt, hindering their ability to secure loans for homes, cars, or small businesses. The rule’s suspension is particularly detrimental to people of color, who are disproportionately affected by medical debt.

The CFPB had meticulously researched this issue, finding that outstanding medical debt is a poor indicator of an individual’s creditworthiness. The agency’s data revealed that one in five Americans have medical debt collections on their credit reports, and more than half of all collection entries stem from medical expenses. The proposed rule would have removed a staggering $49 billion in medical debt from the credit reports of 15 million people.

This decision to halt the CFPB’s operations raises serious questions about the administration’s commitment to consumer protection. The agency had successfully challenged tech giants in a class-action lawsuit, demonstrating its dedication to defending consumer rights. Now, with this latest move, the administration appears to be actively undermining consumer safeguards, allowing corporations to operate with minimal accountability.

This action is not an isolated incident; it’s part of a broader pattern of dismantling consumer protections. The removal of these safeguards benefits corporations at the expense of consumers, potentially leading to increased scams, fraud, and financial hardship for ordinary citizens. The weakening of regulations leaves consumers vulnerable to predatory practices, with potentially catastrophic consequences.

The decision to stop the CFPB’s work also raises significant legal questions. The agency was established by an act of Congress, implying that its dismantling requires Congressional action, not a simple executive order. This arbitrary shutdown underscores a disregard for established legal processes and raises concerns about the rule of law.

Moreover, this action is likely to have a negative impact on consumer confidence. With diminished protections, consumers are less likely to trust businesses, potentially leading to a decrease in spending and economic stagnation. The administration’s disregard for consumer well-being suggests a prioritization of corporate profits over the welfare of its citizens.

The broader implications of this decision are far-reaching. It’s not just about medical debt; it’s about a pattern of undermining agencies designed to protect consumers and workers. The removal of oversight invites corporate abuse, leaving citizens vulnerable to exploitation and financial ruin. This underscores a disregard for the well-being of ordinary Americans and prioritizes the interests of large corporations.

This action has ignited intense debate and outrage among citizens who fear the consequences of this sweeping decision. The erosion of consumer protection represents a significant blow to the fabric of a just and equitable society. Many believe the lack of accountability will further destabilize an already fragile economy. It also calls into question the administration’s professed commitment to the interests of its constituents. The long-term effects remain to be seen, but the immediate consequences are a significant loss of protection for millions of Americans.