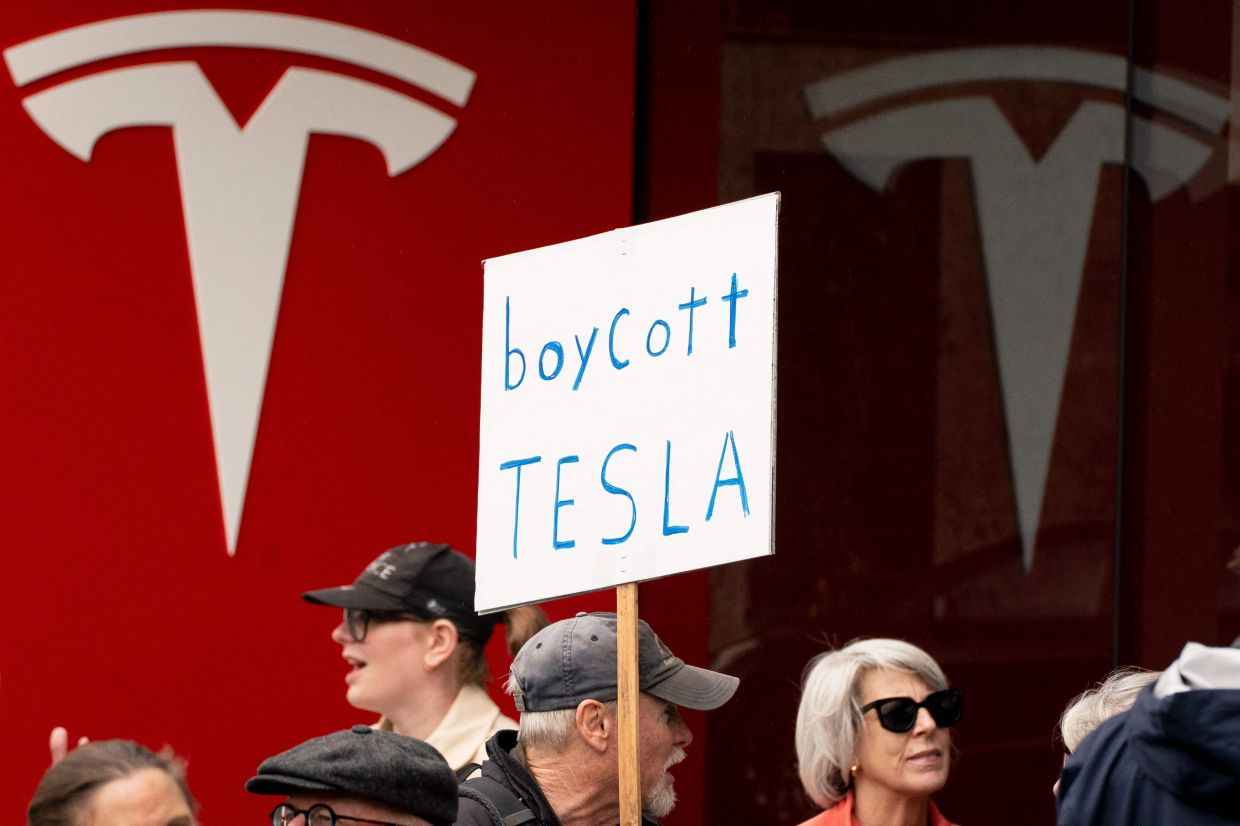

Elon Musk’s controversial “Department of Government Efficiency” has sparked widespread outrage, resulting in mass layoffs and budget cuts within the federal government. Simultaneously, a burgeoning protest movement, Tesla Takedown, is targeting Musk’s personal wealth through boycotts and efforts to lower Tesla’s stock price, citing his extremism and damaging actions. This movement aims to pressure Tesla shareholders and the board to address Musk’s toxicity, leveraging the connection between his personal brand and Tesla’s value. While Tesla’s stock has seen recent dips, particularly in Europe following Musk’s controversial political endorsements, the long-term impact of the protests remains uncertain. Tesla Takedown represents a significant escalation of corporate accountability movements, given Musk’s close ties to the White House.

Read the original article here

The Tesla takedown, a burgeoning national protest movement, aims to significantly impact Elon Musk’s net worth. The strategy hinges on targeting Tesla’s share price, hoping a substantial devaluation will translate into a considerable financial blow to Musk. This isn’t merely about inconveniencing a billionaire; it’s about sending a message that actions have consequences, even for those seemingly untouchable.

This movement argues that Musk’s controversial political stances and actions justify such a campaign. Participants cite specific instances, highlighting the belief that Musk’s influence extends far beyond business and that his actions warrant a consumer-led response. The intent isn’t simply to damage a brand; it’s to hold him accountable for his perceived transgressions.

The protest extends beyond simple boycotts. Organizers are planning a sustained, nationally focused campaign to bring attention to Musk’s perceived extremism and to encourage shareholders to reconsider their investments. The movement’s organizers are employing a multi-pronged approach, combining public demonstrations and advocacy with an active push to highlight the issues within the company itself.

The core argument driving this movement is the belief that Musk’s wealth is intrinsically linked to Tesla’s success, and that hitting the company’s valuation directly hits him. There’s a clear understanding that this strategy relies on a collective effort, emphasizing the power of consumers to influence corporate behavior and, indirectly, the financial well-being of its leadership. The focus is less on individual actions and more on a coordinated, nationwide effort.

Some participants envision the ideal outcome as driving Tesla’s stock valuation back to pre-election levels, suggesting a substantial loss for Musk. More radical perspectives propose pushing him to complete insolvency. While these are ambitious goals, the underlying sentiment indicates a desire to make a concrete, impactful statement about holding the powerful accountable.

The movement isn’t limiting its focus to Tesla. Participants are actively discussing extending boycotts to other companies and entities owned or significantly influenced by Musk, such as SpaceX, Starlink, and The Boring Company. This broader strategy emphasizes the interconnectedness of Musk’s business empire and seeks to maximize the impact of the protest.

Concerns about the potential impact on national security, specifically relating to SpaceX and Starlink, have also been raised. This adds a layer of complexity to the movement, highlighting the potential unintended consequences of targeting a company with significant government contracts. The discussion points towards potential avenues for government intervention, including nationalization, to mitigate such risks.

However, there’s a recognition that this approach may not fully impact Musk’s immense wealth. His holdings are diversified and his personal wealth may extend beyond any immediate financial impact on Tesla’s valuation. Yet the protest aims to make a symbolic and substantial statement that transcends mere financial considerations.

Despite this, the Tesla takedown is not devoid of skepticism. Some question the practicality and long-term effectiveness of a consumer-driven movement against such a powerful figure. Others express concern about the potential for unintended consequences, such as harming employees or disrupting essential services. These counterpoints highlight the complexities of such a campaign and the need for a nuanced approach.

The ongoing debate about the effectiveness of this movement underscores its multifaceted nature. It’s not just about economics; it’s about ethics, politics, and the growing sentiment that corporate power needs to be checked. The movement’s proponents believe their actions are justified given Musk’s actions and influence, highlighting the desire for greater accountability from powerful individuals and corporations. The movement’s success, therefore, hinges not just on financial impact but also on its ability to set a precedent and generate wider public support.