Following President Trump’s appointment of Russell Vought as acting director, the Consumer Financial Protection Bureau (CFPB) was effectively shut down, sparking widespread outrage. This action, seemingly orchestrated with Elon Musk’s involvement, directly contradicts the CFPB’s crucial role in protecting consumers from financial fraud, having returned over $20 billion to consumers. Critics argue this dismantling will exacerbate financial hardship for Americans, especially during times of economic uncertainty, while supporters of the move remain largely silent. The CFPB’s website displayed a 404 error, though some functionality remained active.

Read the original article here

The outrage over Elon Musk’s apparent desire to dismantle the Consumer Financial Protection Bureau (CFPB) is understandable. The agency, despite its relatively modest annual budget of $800 million, has demonstrably returned over $20 billion to consumers victimized by fraudulent financial practices. This is a significant return on investment, highlighting the CFPB’s effectiveness in protecting everyday Americans from predatory lending and scams.

This return of billions to consumers directly contradicts the narrative of wasteful government spending. The sheer scale of the money recovered dwarfs the agency’s operational costs, showcasing a clear benefit to the public far outweighing the expenses. The argument that the CFPB is inefficient or unnecessary simply doesn’t hold water in the face of such concrete evidence.

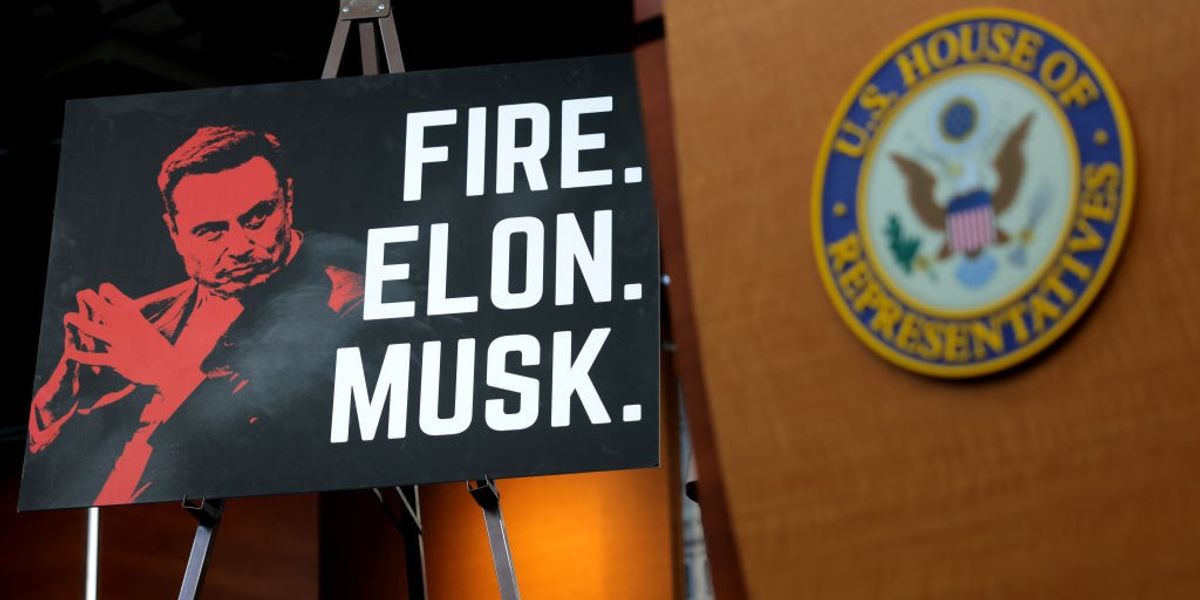

The anger directed at Musk stems from the perception that he’s actively working to dismantle an agency designed to prevent wealthy individuals and corporations from exploiting ordinary citizens. The implication is that he prioritizes his own financial interests and those of his associates over the well-being of millions of Americans struggling to make ends meet. This perceived self-serving action has sparked widespread accusations of him acting against the public good.

This is not merely a partisan issue; it impacts everyone, regardless of political affiliation. The CFPB has assisted people across the political spectrum, from those struggling with predatory debt to those defrauded by unscrupulous businesses. The potential loss of this protection disproportionately affects lower- and middle-income families, who are often the most vulnerable to financial exploitation.

The criticism extends beyond Musk to the individuals and political forces enabling this apparent dismantling. Questions are being raised about the motivations behind such a move and whether it reflects a broader agenda to weaken consumer protections and increase the power of corporations at the expense of individuals. Many see this as a wealth transfer, further concentrating power and resources in the hands of the already wealthy.

The narrative of “lowering costs” feels disingenuous in this context. While cost-cutting is a legitimate goal in government, it shouldn’t come at the expense of essential protections for vulnerable populations. The potential savings pale in comparison to the billions of dollars the CFPB has helped consumers recover. It seems more like a calculated move to benefit the wealthy at the cost of the many.

The timing of this action, coupled with rising living costs, only exacerbates the public’s concern. Many feel that the weakening of consumer protections will further increase financial burdens on those already struggling to afford basic necessities. It creates an atmosphere of mistrust and anger toward those in positions of power, who seem to be prioritizing profit over the well-being of their constituents.

The concerns extend to the broader implications of this action. If an agency with such a demonstrably positive impact on the financial lives of millions can be so easily targeted, what other consumer protections might be at risk? This perceived assault on the CFPB raises deeper questions about the future of regulations and oversight in the financial sector.

This situation is not just about numbers; it’s about fairness and justice. It raises questions about power, wealth inequality, and the role of government in protecting its citizens. Many feel that dismantling the CFPB sends a clear message that the interests of the wealthy are being prioritized over the needs of the average person, creating a profound sense of injustice. The hope that this will be reversed is palpable, but the fear that it won’t is even stronger. Ultimately, the consequences of such actions will be felt far beyond the immediate financial impact.