The Department of Government Efficiency (DOGE) has released a second batch of “receipts” detailing purported cost savings, but these also contain significant inaccuracies. Despite doubling the number of listed contracts to 2,299, the itemized savings dropped from $16.6 billion to $9.6 billion, while DOGE simultaneously claims total savings of $65 billion, a figure lacking supporting documentation for the vast majority of its claimed reductions. Numerous instances of double-counting, misreporting, and errors in the original $16.6 billion figure have been identified, raising serious concerns about the accuracy and reliability of DOGE’s reported savings. The discrepancies highlight the need for greater transparency and independent verification of these claimed cost-cutting measures.

Read the original article here

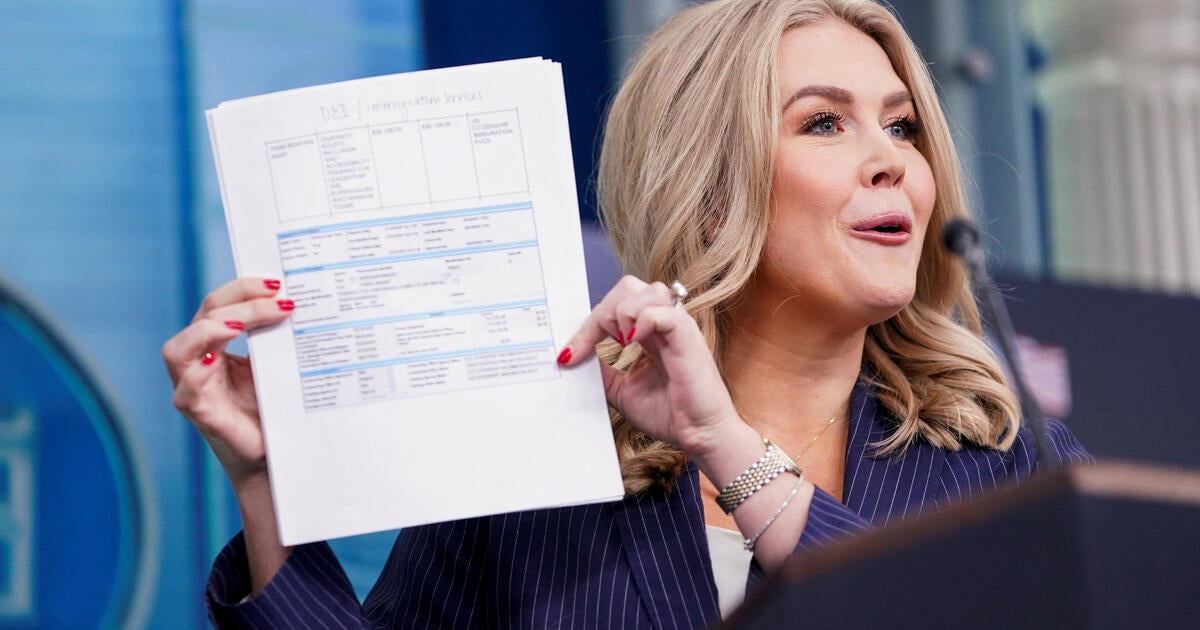

DOGE’s recently updated “wall of receipts,” intended to showcase purported budget savings, has instead highlighted numerous discrepancies and fueled widespread skepticism. The document itself is criticized for its lack of detail, presenting vague descriptions of spending cuts without specifying the programs affected or justifying the claimed savings. This lack of transparency makes it impossible to verify the validity of the claimed reductions.

The sheer volume of claimed savings, however, is not seen as a substitute for verifiable data. Critics argue that the sheer number of entries is intended to overwhelm scrutiny and encourage acceptance based on quantity alone, rather than quality of evidence. This tactic is reminiscent of past political maneuvers where a large, seemingly comprehensive document was presented without sufficient detail to withstand scrutiny.

Concerns have been raised about the potential fabrication of government records to support the stated budget cuts. The process seems to resemble more of a public relations exercise than a genuine accounting of government spending. This mirrors past instances where numbers were manipulated to fit a desired narrative, with little regard for accuracy.

The method of compiling the data, with its reliance on vague descriptions and a lack of supporting documentation, undermines its credibility. There’s widespread agreement that the listed cuts lack context and justification, making it impossible to independently assess their validity. It is argued that this approach is intentionally opaque, allowing for manipulation and misrepresentation.

Multiple commentators point out the ease with which numbers can be manipulated to create a desired impression, regardless of the underlying reality. The process seems to rely on presenting figures without clarifying the methodology or providing verifiable source data. The potential for intentional misrepresentation and outright fabrication is significant.

The comparison to past instances of accounting irregularities, such as the Enron scandal, is also made. This highlights the concern that the reported savings are inflated or entirely fabricated, using accounting techniques to misrepresent the actual financial impact of the purported cuts. This alleged manipulation mimics strategies used in past corporate accounting scandals.

The lack of proper accounting practices, including the apparent absence of thorough forensic accounting, is further criticized. The absence of such scrutiny is seen as a major flaw that allows for the manipulation of data and the misrepresentation of budget savings. The use of AI to generate these reports is also viewed with suspicion, leading to concerns about the accuracy and reliability of the data presented.

Critics point out the potential for intentionally vague phrasing to allow for different interpretations. This strategy makes it incredibly difficult to challenge the claims presented and allows the administration to deflect criticism and maintain their narrative. The intentional ambiguity is seen as a tool to control public perception rather than to provide accurate information.

The reaction from supporters is also a source of concern. The unwavering belief in the presented data, despite its obvious flaws, illustrates the power of confirmation bias. The ease with which millions can be confused with billions demonstrates the susceptibility of the public to accept unsubstantiated claims, particularly when reinforced by media outlets with inherent political biases.

The response to criticism highlights a pattern of doubling down on claims rather than admitting errors. This approach further erodes public trust and strengthens the perception of intentional deception. The administration’s disregard for transparency and accountability raises concerns about the legitimacy of the entire process.

The potential for legal ramifications is undeniable. The evidence of potential fraud is compelling and raises serious questions about the ethical and legal behavior of those responsible for compiling and releasing the data. The lack of accountability and the continued propagation of demonstrably false information raise serious concerns about the integrity of the administration and the rule of law.

The situation highlights a broader concern about the erosion of trust in government institutions. The lack of transparency, the apparent manipulation of data, and the failure to acknowledge errors raise serious questions about the ability of the government to function effectively and ethically. This lack of accountability ultimately undermines the public’s faith in democratic processes and institutions.