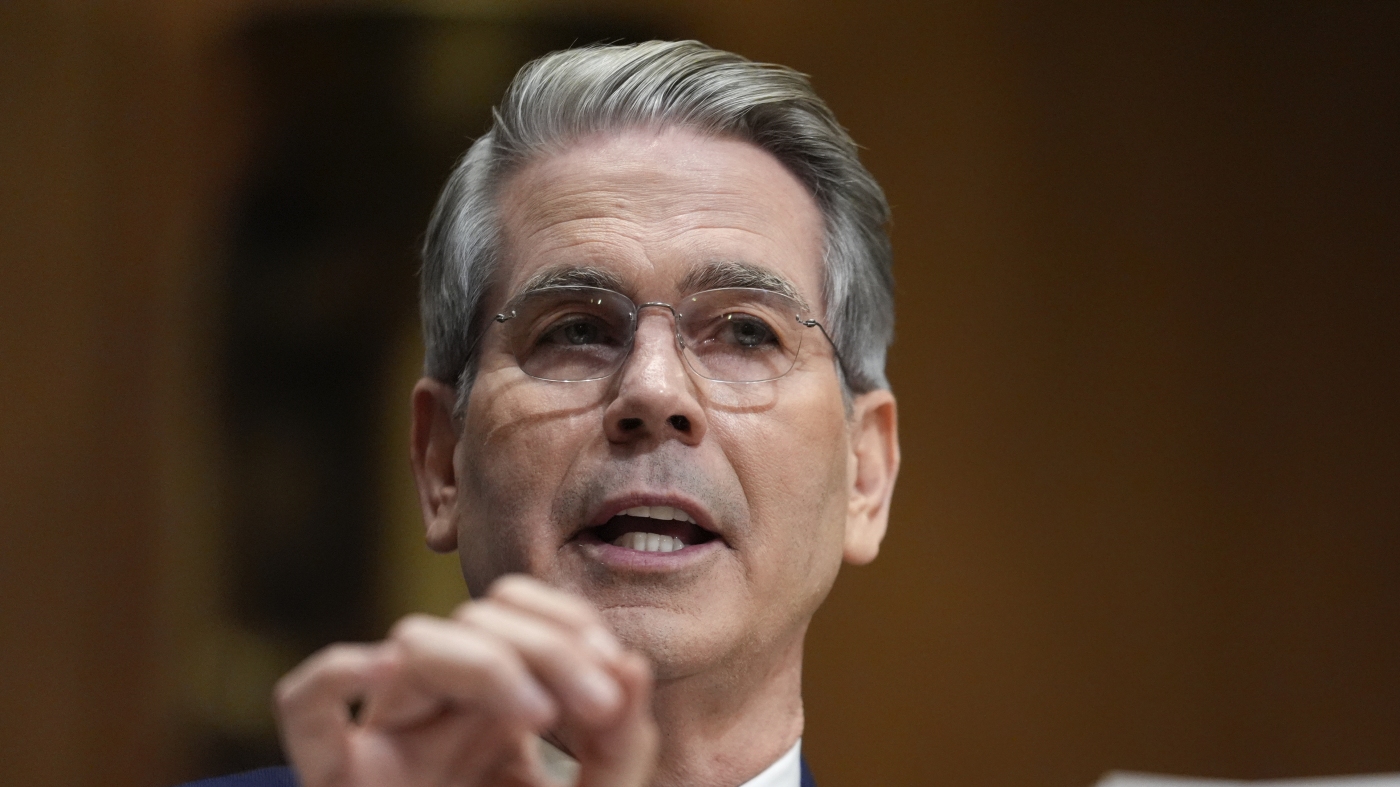

Newly appointed CFPB Acting Director Scott Bessent, a hedge fund manager, has instructed agency staff to halt most operations, including enforcement actions and the issuance of new rules. This directive, intended to align with the administration’s goals, suspends ongoing cases against major financial institutions like Capital One and Walmart. The move has drawn sharp criticism from Senator Elizabeth Warren, who argues it contradicts the administration’s stated aim of lowering costs for consumers. Conversely, the Consumer Bankers Association welcomed Bessent’s appointment and hinted at the potential reversal of consumer-protective regulations enacted under the previous director.

Read the original article here

Treasury Secretary Bessent, tapped to run the Consumer Financial Protection Bureau (CFPB), has ordered a halt to all staff work. This decision immediately raises concerns about the future of consumer protections in the United States, given the administration’s apparent disinterest in regulations that limit corporate profits. It suggests a deliberate effort to dismantle safeguards designed to protect citizens from predatory financial practices.

This move is consistent with a broader pattern of deregulation and a disregard for consumer well-being. The lack of concern for potential harm to individuals and the environment, as long as profits are maximized, reflects a dangerous prioritization of unchecked capitalism. The implication is that accountability is secondary to the relentless pursuit of wealth, even if it means defrauding consumers or causing significant economic instability.

This action is not unexpected; the CFPB has been a target of conservative groups since its inception. The bureau’s mandate, to protect consumers from financial abuse, directly conflicts with the administration’s agenda of minimizing regulatory oversight and fostering an environment where unchecked profit-seeking is prioritized above consumer welfare. Senator Warren’s role in creating the CFPB further fueled opposition from those who view consumer protection as an impediment to business growth.

The decision to halt work has sparked outrage among many. The move is viewed as a deliberate attempt to cripple the CFPB’s effectiveness and undermine its ability to protect consumers from financial exploitation. This belief is further solidified by Bessent’s statement emphasizing his commitment to advancing the President’s agenda rather than the CFPB’s mission. This is perceived by many as a blatant disregard for the agency’s purpose and a clear indication that consumer protection is not a priority for the administration.

The timing of this action is particularly troubling, coming at the end of tax season. This raises anxieties about the potential for increased financial vulnerability among citizens already facing financial strain. By effectively shutting down the CFPB, the administration is removing a critical layer of protection for individuals at a time when many are most susceptible to financial scams and predatory lending practices. The already existing increase in scam calls further highlights the potential risk.

The consequences could be far-reaching, affecting everything from access to credit to retirement savings. The potential erosion of consumer protections, coupled with the dismantling of regulatory frameworks, could lead to widespread financial harm. The long-term economic implications of such actions are potentially disastrous, potentially resulting in a significant widening of the wealth gap and an increase in financial instability for ordinary Americans.

This situation is viewed by many as a form of hostile takeover, a calculated move to cripple an agency that protects consumers. The actions taken are not just symbolic; they represent a significant threat to financial security and stability. This perceived assault on consumer protection has understandably fueled public unrest and concern. The administration’s actions seem designed to benefit large corporations and the wealthy at the expense of ordinary citizens, exacerbating existing economic inequalities.

The responses to this situation range from outrage and calls for action to practical suggestions on how to mitigate the risks. There are discussions on the best ways to protect oneself against potential financial abuse in this new regulatory landscape, along with considerations on what political action can be taken to resist the dismantling of consumer protections. This includes the consideration of strategic approaches to tax payment and advice on ways to minimize personal financial risk in this changing climate.

The ultimate impact of Bessent’s order remains to be seen. However, it is clear that this action has significant ramifications, not only for the immediate future of the CFPB but also for the broader financial well-being of American citizens. The potential for increased financial instability, coupled with the erosion of consumer trust in government agencies designed to protect them, presents a significant challenge moving forward. Whether this signals a complete disregard for consumer welfare or is a tactical move with a hidden agenda remains a critical question.