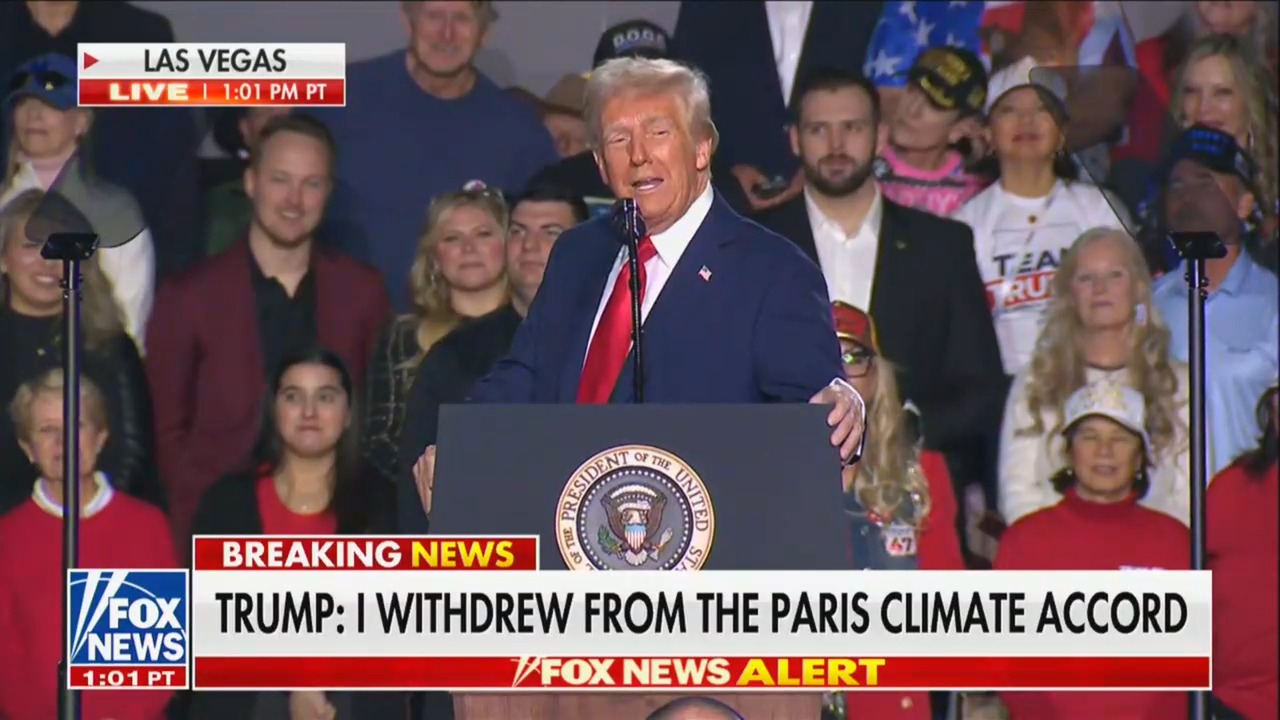

During a Nevada rally, President Trump endorsed a proposal to eliminate all federal income taxes. This suggestion followed a crowd member’s request to suspend all federal taxes, prompting Trump to propose funding the government solely through tariffs on imported goods. He cited a historical period without income tax, suggesting tariffs could generate sufficient revenue. Trump argued this system, while not without drawbacks, led to a period of great American prosperity.

Read the original article here

The idea of funding the government solely through tariffs is, frankly, bewildering. It suggests a fundamental misunderstanding of how economies function and the significant repercussions such a policy would have. The proposal ignores the basic principle that tariffs, essentially taxes on imported goods, disproportionately affect lower and middle-income individuals.

Replacing all taxes with tariffs would dramatically increase the cost of everyday goods. Consumers would face substantially higher prices for imported items, and even for domestically produced goods competing with imports. This is because businesses often pass the cost of tariffs onto consumers to maintain their profit margins. The resulting inflation would cripple household budgets, especially for those already struggling financially. It’s a regressive tax system that heavily burdens the most vulnerable members of society.

Furthermore, the notion that this would somehow stimulate domestic production is naive. While it might provide a temporary boost to certain industries, it would likely lead to retaliatory tariffs from other countries, creating trade wars that ultimately harm everyone involved. It also disregards the complexities of international trade and the significant role imports play in maintaining a diverse and affordable consumer market.

The claim that this approach is somehow a return to a simpler, more effective system ignores history. The pre-income tax era wasn’t a golden age of economic prosperity; it was a time marked by significant inequality and vulnerability to economic shocks. It’s not a model that would work in today’s interconnected global economy. The Great Depression, a period often cited by those who romanticize pre-income tax systems, was partially fueled by restrictive trade policies.

Even if we were to ignore the economic realities, the sheer logistics of collecting enough revenue through tariffs alone to sustain a modern government are daunting. The volume of tariffs needed to fund even a fraction of the current government budget would be astronomical, creating a system of incredibly high prices for goods and services. This would cripple businesses, stifle innovation, and reduce overall economic growth.

This proposed system completely ignores the importance of progressive taxation. A system that places a larger tax burden on those with higher incomes is crucial for funding social programs and reducing income inequality. Replacing it with a system that overwhelmingly affects the poor and middle class is not only economically unsound but also deeply unjust.

The idea that this policy is somehow a clever bargaining chip in international negotiations is equally flawed. Threatening other countries with crippling tariffs is not a sustainable or effective long-term strategy. It’s a short-sighted approach that risks damaging international relationships and alienating key trading partners. The potential gains from such “negotiations” are easily outweighed by the devastating consequences of such a radical policy shift.

In short, the proposal to fund the government solely through tariffs is not just impractical, it’s economically disastrous. It’s a simplistic, deeply flawed idea that disregards fundamental economic principles and would ultimately harm the vast majority of the population. The notion that this could replace a comprehensive tax system highlights a profound lack of understanding of basic economic concepts. It’s a recipe for economic instability, social unrest, and a significant decline in the quality of life for many Americans.