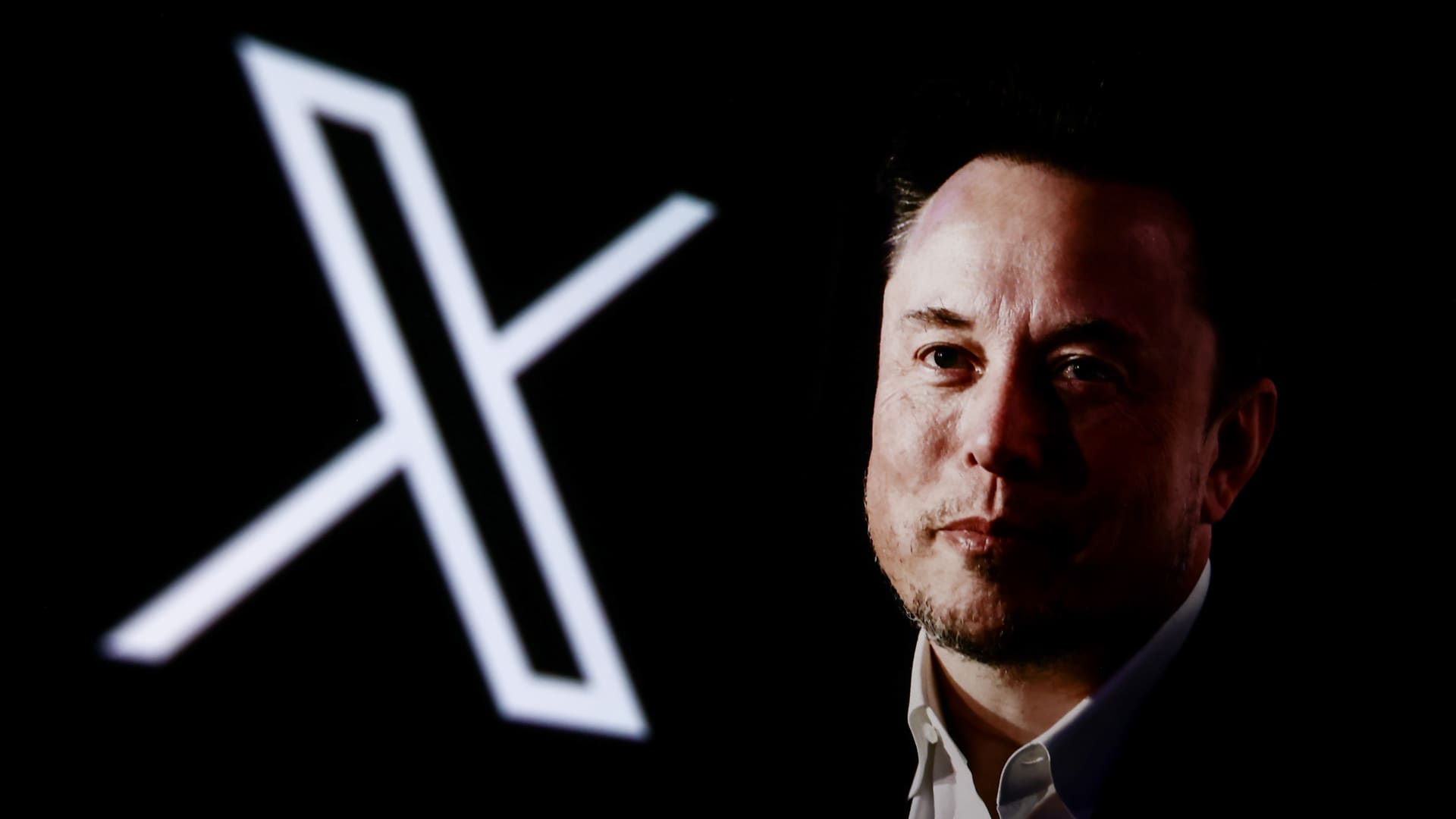

The SEC is suing Elon Musk for securities fraud, alleging he concealed his acquisition of over 5% of Twitter’s stock before its purchase, enabling him to buy shares at artificially low prices and save at least $150 million. Musk’s lawyer dismissed the suit as a “sham” and a result of harassment. The SEC claims Musk was required to disclose his holdings by March 24, 2022, but didn’t do so until April 4th, after purchasing hundreds of millions of dollars of shares. The lawsuit seeks disgorgement of Musk’s profits and civil penalties.

Read the original article here

The SEC’s lawsuit against Elon Musk, alleging improper disclosure of his Twitter ownership, is a fascinating case study in the intersection of law, power, and public perception. The core of the SEC’s claim centers on Musk’s failure to timely disclose his growing stake in Twitter, a violation that allegedly allowed him to purchase shares at artificially low prices before the market reacted to his significant ownership. This action, according to the SEC, defrauded unsuspecting shareholders out of over $150 million.

The SEC’s assertion that Musk waited longer than legally required to disclose his ownership is the foundation of the lawsuit. Their argument hinges on the idea that had this information been publicly available sooner, the price per share would have risen, meaning Musk would have had to pay a higher price for his acquisitions. The difference between the price he paid and the inflated price the SEC believes would have resulted is the claimed $150 million loss to other shareholders. The SEC is alleging a deliberate attempt to manipulate the market for personal gain, a serious accusation with potentially significant consequences.

The sheer scale of Musk’s wealth frequently enters the discussion surrounding the case. The potential fines, even substantial ones, represent a tiny fraction of his net worth. Many believe that the financial penalty, whatever it may be, would be a mere inconvenience, a view that diminishes the seriousness of the SEC’s allegations. This perception fuels speculation that the lawsuit is more about sending a message than about recovering financial losses for shareholders.

The timing of the lawsuit also raises eyebrows. The proximity to a potential change in presidential administration has led to widespread speculation about political motivations. The idea that a new administration might bury the case lends credence to the belief that the SEC is trying to finalize the case before a potential shift in priorities occurs. Some posit that the urgency demonstrates a need to act before any changes in the commission’s composition might dilute or derail the effort.

The narrative surrounding Musk himself plays a significant role. His past clashes with the SEC and his often provocative public statements fuel the perception that this lawsuit is just another chapter in a long-running saga. His reputation for unconventional business practices and his disregard for established norms have become part of the public narrative surrounding him, potentially influencing opinions on the validity of the SEC’s claims. This perception is further reinforced by numerous comments on Musk’s past behaviors, including accusations of manipulating Tesla stock prices through misleading statements about the company’s products and capabilities.

The case is far from straightforward. While the SEC’s accusations seem clear, the defense likely rests on arguments about the complexity of large-scale stock acquisitions and the inherent challenges in precisely predicting market reactions to information. Additionally, there’s the matter of how these claims will be interpreted by a judge, and the potential for lengthy legal battles ahead. The timeline for resolution remains uncertain, especially given the potential for appeals and the inherent complexities of financial litigation.

Ultimately, the outcome of this lawsuit will be crucial for understanding how future regulatory enforcement operates. The implications stretch far beyond the case’s direct players and will likely shape the way future business deals are conducted, particularly those involving high-profile figures and significant market influence. It’s a potent reminder of the complexities of corporate law, the ongoing battle between regulatory bodies and those they oversee, and the ever-present question of how much justice any individual, no matter how wealthy, truly can afford. The eventual resolution of this case will undoubtedly be closely watched, not only for its legal ramifications but also for its impact on the broader public perception of regulation and corporate governance.