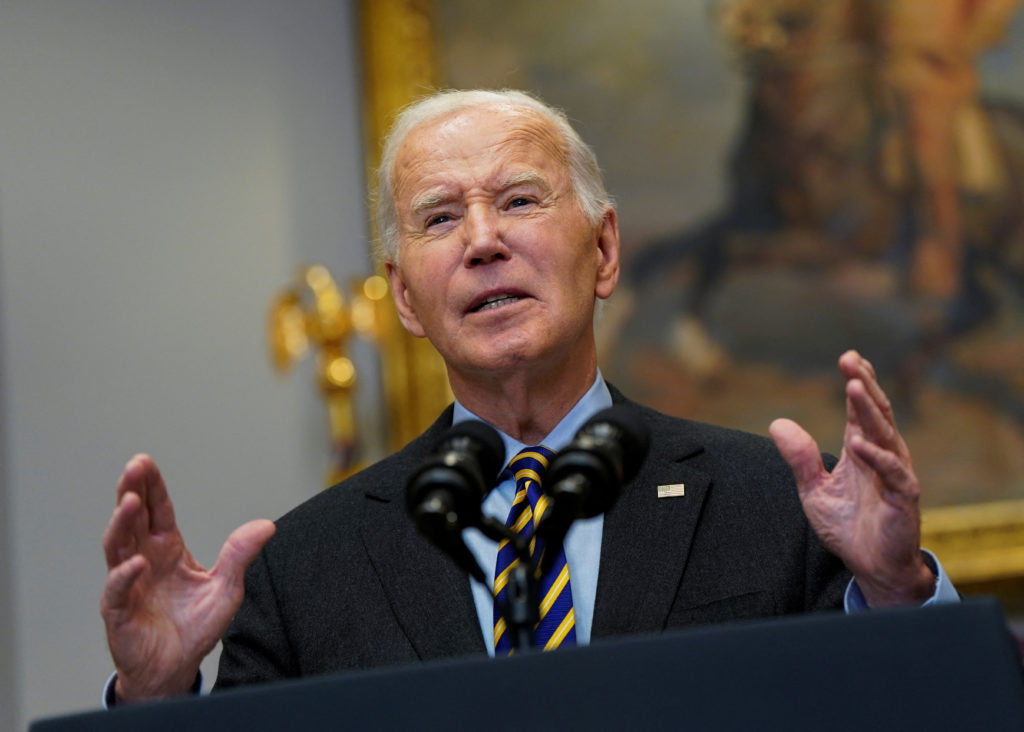

December’s jobs report revealed a robust 256,000 job increase and a decrease in unemployment, defying expectations and bolstering President Biden’s claims of a strong economy. This unexpected surge in growth, occurring despite high interest rates, lessens the likelihood of further rate cuts by the Federal Reserve, potentially impacting consumers and businesses. While the economy shows strength with low unemployment and GDP growth exceeding 3 percent in four of the last five quarters, inflation remains above the Fed’s target, and high interest rates persist. Consequently, President Biden leaves office handing a generally strong, albeit complex, economic legacy to his successor.

Read the original article here

President Biden’s claim that he’s leaving the American economy “stronger than ever” as his term concludes is certainly a bold statement, and one that sparks a wide range of reactions. It’s a claim that hinges heavily on perspective, and understanding that perspective is crucial to grasping the full picture.

The assertion undeniably resonates with some segments of the population. For those who have seen significant gains in their investments or who work in thriving sectors, the economic landscape might indeed feel stronger than ever before. The stock market, a key indicator for many, may support this viewpoint, reflecting growth and positive trends for certain companies and investors.

However, this rosy outlook doesn’t fully encompass the experiences of many other Americans. For a large portion of the population, the daily realities are far less positive. Soaring costs of essential goods and services like groceries, rent, and utilities are outpacing wage increases, leaving many struggling to make ends meet. This creates a stark contrast between the “stronger than ever” narrative and the lived experiences of ordinary citizens.

The housing market, for example, presents a complex scenario. While homeownership might seem prosperous for those already owning property, the reality is that the cost of buying a home has become prohibitive for many aspiring first-time buyers. This affordability crisis is not just about inflation; it’s also tied to the broader pressures of a dynamic real estate market increasingly influenced by corporate investors and limited housing supply.

The issue of wages is equally critical. While some sectors have seen wage growth, many workers are experiencing stagnant wages that are not keeping up with the rising costs of living. This is especially true for those working minimum-wage jobs where a raise might not offset even the simplest price increases. The result is a squeeze on household budgets and a growing sense of economic insecurity.

The widening wealth gap further complicates the assessment. The gains often highlighted in economic data frequently benefit the wealthiest members of society disproportionately. While the overall economy might be growing, the benefits may not be distributed fairly, exacerbating inequality and leaving many feeling left behind.

The argument about the economy’s strength inevitably boils down to defining what “strong” truly means. Is it simply the growth of the stock market, or does it include a broader measure of well-being, encompassing affordability, wage growth, and equitable distribution of wealth?

While the positive indicators undoubtedly exist, ignoring the struggles of a significant portion of the population renders the claim incomplete. A truly strong economy ought to be one where prosperity is broadly shared, not concentrated among a select few. The current state of affairs suggests a gap between the perception of economic strength and the lived experience of millions of Americans, painting a nuanced picture that extends beyond the headline figures.

The debate surrounding the economy’s strength is not merely about numbers; it’s about the lived reality of individuals and families across the nation. And while the economic data might point towards growth, ignoring the daily struggles of those who are not experiencing that growth creates a disconnect between policy and the needs of the populace.

Ultimately, President Biden’s claim highlights a fundamental challenge in economic evaluation: aggregating complex data into a single, concise statement that encompasses the diversity of individual experiences is impossible. The economy is more than just a set of statistics; it’s the sum total of the financial well-being of each individual within that system.