This landmark Biden administration rule eliminates medical debt from consumer credit reports, significantly impacting credit scores. The new regulation prevents lenders from using unpaid medical bills to assess creditworthiness. This change aims to alleviate the financial burden of medical debt on millions of Americans and promote fairer lending practices. The impact is expected to improve access to credit for those previously hindered by medical debt.

Read the original article here

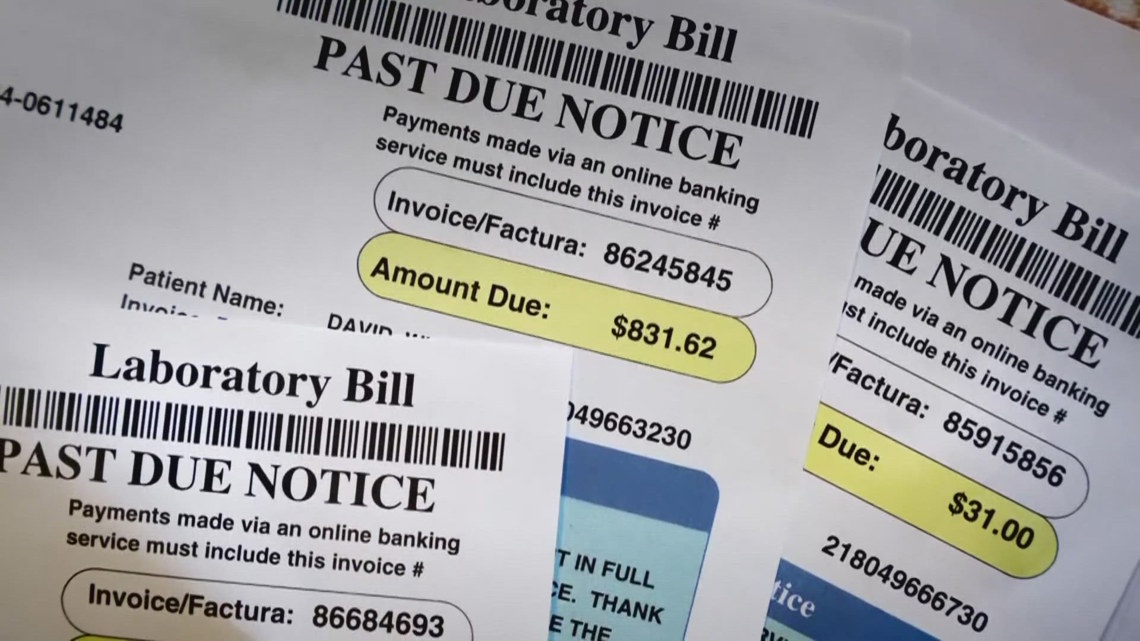

Medical debt banned from credit reports under a new Biden administration rule represents a significant shift in how medical debt impacts individuals’ financial lives. This rule aims to alleviate the crushing burden of medical debt, a leading cause of bankruptcy for many Americans. By removing medical debt from credit reports, the administration hopes to improve the credit scores of millions, opening up opportunities for better housing, loans, and overall financial stability.

This policy change directly addresses the pervasive issue of credit scores being negatively affected by medical debt. For years, unpaid medical bills have severely hampered individuals’ ability to secure housing, obtain loans, and even find employment, creating a vicious cycle of financial hardship. Removing this obstacle could significantly improve the financial outlook for countless families.

However, some concerns have been raised about the potential impact on healthcare providers. The removal of medical debt from credit reports might affect their ability to collect outstanding payments. This could potentially lead to increased costs for healthcare providers, which could, in turn, lead to higher healthcare costs for everyone. It’s a complex issue with far-reaching consequences.

The effect on the collection practices of healthcare providers remains a key question. While medical debt will no longer affect credit scores, other collection methods, such as wage garnishment or liens on property, remain available. The actual impact on collection rates will depend largely on the effectiveness of these alternative methods and the willingness of providers to pursue them vigorously. This element introduces a degree of uncertainty into the overall equation.

Predicting the long-term effects of this policy is challenging, with arguments on both sides. While proponents argue it’ll offer significant relief to those struggling with medical debt, critics suggest it might lead to increased healthcare costs due to reduced collection efficiency and a decrease in the overall availability of credit for lower-income individuals. The true extent of its impact will only become clear over time, as data on debt collection rates, healthcare costs, and credit availability is collected and analyzed.

The political implications of this rule are also significant. The move has been met with both praise and condemnation, largely along partisan lines. Supporters view it as a necessary step to address healthcare inequality and provide financial relief to vulnerable populations. Conversely, critics argue it’s government overreach, potentially leading to unintended negative consequences, particularly in the realm of healthcare costs. This predictable partisan divide underscores the highly political nature of healthcare policy in the United States.

The potential for legal challenges to the rule further complicates the situation. Given the contentious nature of healthcare policy, legal action from opposing parties seems likely. The outcome of any such challenges could significantly impact the longevity and effectiveness of the rule. This uncertainty underscores the temporary nature of the rule and leaves the outcome uncertain.

Beyond the legal and political dimensions, there’s a broader discussion about the fairness of the credit reporting system and its impact on individuals’ economic well-being. Critics argue that the current system disproportionately affects lower-income individuals and those from marginalized communities, exacerbating existing inequalities. The ban on medical debt from credit reports might be viewed as a step toward addressing these systemic issues, prompting a broader conversation on credit scoring reform.

The situation also highlights the need for comprehensive solutions to the intertwined problems of healthcare costs and financial stability. The Biden administration’s rule addresses one aspect of this complex issue, but a more holistic approach is required to tackle the root causes of healthcare affordability issues. This includes addressing rising healthcare costs, expanding access to affordable insurance, and promoting preventive care.

In conclusion, the Biden administration’s ban on medical debt from credit reports is a significant policy change with potentially far-reaching consequences. While it aims to alleviate the burden of medical debt on individuals, its long-term effects remain uncertain and are likely to be debated extensively. The debate around the rule highlights the ongoing complexities of healthcare access, affordability, and the intricate relationship between healthcare and personal finances in the United States. Only time will tell if this rule truly achieves its intended goals and avoids unintended negative consequences.