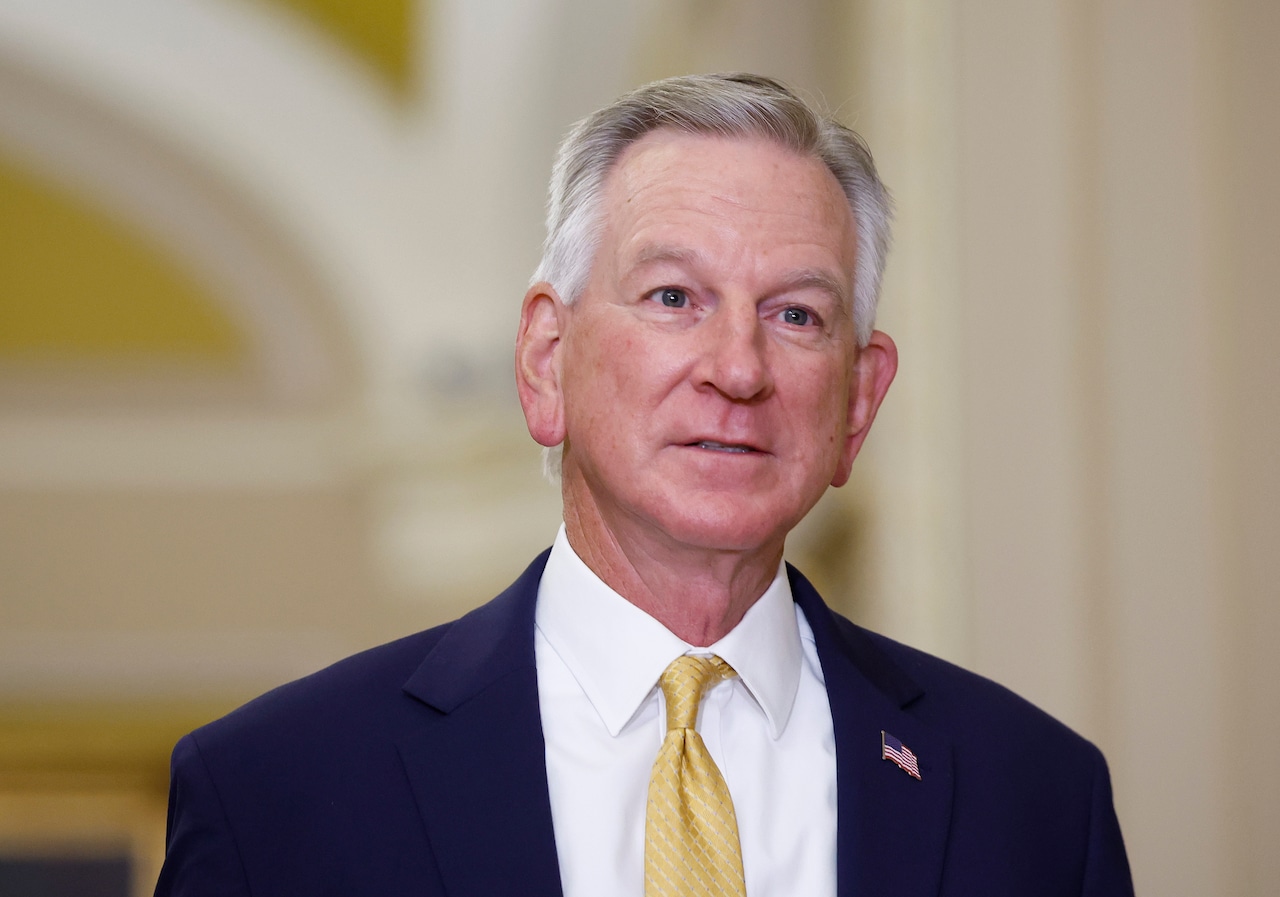

Senator Tommy Tuberville’s claim of paying close to $1 million in Social Security taxes is demonstrably false. Even using the current maximum taxable wage and assuming maximum contributions for 40 years, his total contributions would not exceed $418,128. This figure is a conservative estimate that does not account for lower taxable wage bases and tax rates in previous years. Despite this inaccuracy, Tuberville continues to criticize Social Security, referring to it as a “Ponzi scheme” and expressing skepticism about its solvency.

Read the original article here

Tommy Tuberville’s claim of paying “close to a million dollars in Social Security” is factually impossible. The maximum amount anyone can contribute to Social Security in a lifetime is significantly less than a million dollars. There’s a cap on the amount of earnings subject to Social Security taxes, meaning high earners like a Senator don’t pay into the system on their entire income. This naturally creates a limit on maximum lifetime contributions.

Even considering the highest possible lifetime contributions under current laws, reaching a million dollars is simply not feasible. A significant amount can be paid, certainly, but nowhere near the seven-figure sum Tuberville boasted. The discrepancy between his statement and the reality of Social Security’s contribution limits is substantial and undeniable.

This significant exaggeration raises questions about the senator’s grasp of basic economic concepts and the accuracy of his public pronouncements. The implausibility of his statement casts doubt on his credibility and suggests a disregard for factual accuracy. His assertion is easily disproven through a simple examination of Social Security contribution laws and calculations.

It’s not simply a matter of a small rounding error or an unintentional misstatement. The difference between his claim and the realistic maximum is so vast as to be an outright falsehood. One wonders if his claim is a deliberate attempt to mislead the public, perhaps to garner sympathy for his perceived “burden” of Social Security contributions or, conversely, to undermine support for the system itself.

The potential implications of this misstatement are worrying. A public figure intentionally misrepresenting a key fact relating to government programs erodes trust in both the individual and the institutions he represents. Tuberville’s claim has already become a talking point within certain political circles, fueling further misinformation and potentially influencing policy debates based on a fundamental untruth.

The ease with which this claim can be debunked underscores the importance of media literacy and fact-checking. Without verification, such statements can quickly spread through social media and other platforms, leading to a widespread misunderstanding of social security’s structure and financing.

If Tuberville’s intention was to highlight the burden of Social Security taxes on high earners, his method was deeply flawed. His outright falsehood overshadows any potential argument he might have attempted to make. Focusing on factual inaccuracies is a detrimental strategy for influencing public policy in a thoughtful and responsible manner.

The incident highlights a pattern of inaccurate and misleading statements by political figures. While there may be disagreements on the best way to reform or fund social security, initiating those discussions through falsehood is destructive and counterproductive.

Considering the senator’s background, one might expect more attention to detail and accuracy. However, this instance casts doubt on his intellectual rigor and commitment to honest communication. His actions highlight the risks associated with uncritical acceptance of claims made by public figures, particularly those made with a clear political motive.

Beyond the specific amount, the overall implication of Tuberville’s claim is arguably the most disturbing. His attempt to frame his contribution as exceptionally large, when in reality it falls far short, paints a picture of a skewed perspective on wealth and social responsibility. It’s a subtle yet powerful strategy, aiming to portray wealth as unfairly burdened by the Social Security system while ignoring the struggles faced by those who rely on it for survival. This reinforces the need for thorough examination of all claims, especially those made by those in positions of power.

In conclusion, Senator Tuberville’s claim regarding Social Security contributions is simply not credible. The blatant discrepancy between his statement and verifiable facts raises serious concerns about his honesty and understanding of the system he is supposed to represent. This incident serves as a cautionary tale about the importance of critical thinking, fact-checking, and the need for greater transparency and accountability from those holding public office.