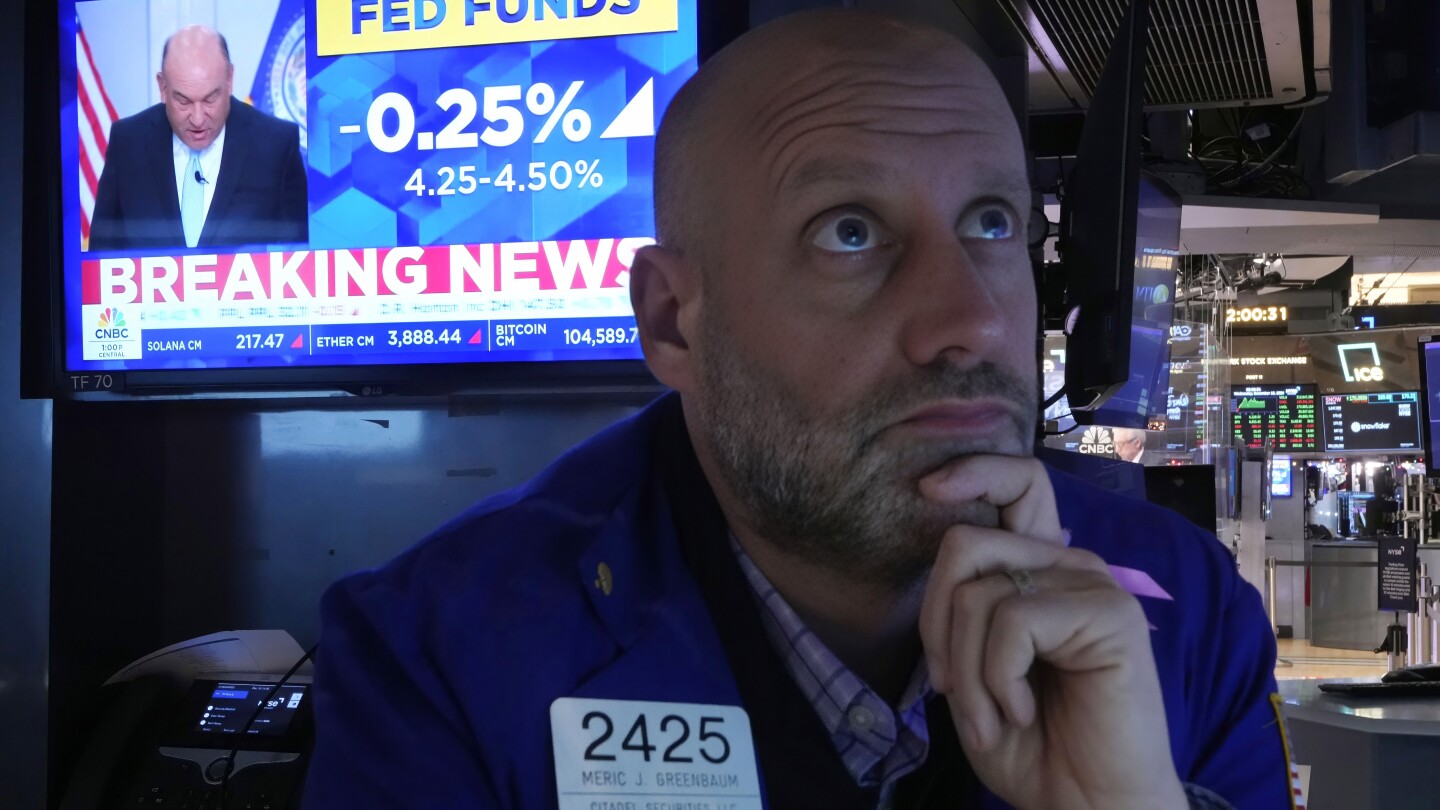

The Federal Reserve’s announcement of fewer-than-expected interest rate cuts in 2025 triggered a significant market downturn, with the S&P 500 experiencing one of its worst days of the year, falling 2.9%. This decision, driven by a robust job market and rising inflation, contrasts with earlier projections of more substantial cuts. The resulting increase in Treasury yields negatively impacted stocks, particularly those of smaller companies heavily reliant on borrowing. The shift reflects the Fed’s cautious approach amid economic uncertainties, including those potentially stemming from the incoming administration’s policies.

Read the original article here

Wall Street experienced a significant downturn today, with the Dow Jones Industrial Average plummeting by a staggering 1,100 points. This sharp decline follows the Federal Reserve’s indication that fewer interest rate cuts are anticipated for the coming year. This news sent shockwaves through the market, leaving many investors reeling.

The market’s reaction underscores the uncertainty surrounding the economic outlook, particularly in light of the incoming administration’s policies. Concerns are growing that the potential for increased tariffs and other protectionist measures could fuel inflation, thereby counteracting the stimulative effect of lower interest rates. The Fed’s decision to curb rate cuts reflects this concern, prioritizing the need to manage inflation over further economic stimulation.

This situation highlights a delicate balancing act for the Federal Reserve. While lower interest rates typically boost economic activity, the potential for increased inflation due to protectionist policies requires a more cautious approach. The Fed’s decision to signal fewer rate cuts reflects a calculated attempt to navigate this complex economic landscape.

The magnitude of the market drop has sparked debate about the best course of action for investors. Some are questioning whether the current situation presents a buying opportunity, while others are urging caution. The significant point drop, while dramatic in raw numbers, needs to be considered within a broader context, particularly the overall market size, which is far larger now than in previous market crashes. While a 1000+ point drop used to represent a significantly larger percentage change, the current percentage decline is smaller relative to the overall market capitalization.

Many commentators are already attributing blame for the downturn, highlighting the potential impact of specific policies on market performance. The interplay between political actions and economic policy is clearly influencing market sentiment, creating significant volatility.

It’s worth noting that market fluctuations are common, and sharp single-day drops, while unsettling, don’t necessarily signal a long-term trend. However, the current situation reflects a confluence of factors—the Fed’s policy shift, concerns about upcoming policies, and inherent market volatility—that have created a challenging environment for investors.

Some analysts believe that the Fed’s move may be a strategic maneuver to influence the administration’s approach to trade policy, using monetary policy to indirectly pressure a shift away from potentially inflationary measures. This hypothesis hinges on the idea that the potential economic consequences of certain trade policies might prompt a reevaluation of those policies.

The longer-term implications remain uncertain, and the market is likely to experience further fluctuations as investors try to assess the unfolding situation. Market volatility is expected as investors and traders grapple with the uncertain future, weighing the potential outcomes of various scenarios.

Concerns about inflation are not unfounded, given the potential effects of proposed trade policies. The looming impact of these measures on prices and economic growth is a significant driver of the market’s current anxiety. This uncertainty is further amplified by the inherent unpredictability of the political landscape, making it challenging for investors to accurately predict future market trends.

Looking ahead, the market’s response will likely be influenced by several key factors, including any further pronouncements on trade policy, the broader global economic climate, and the continued adjustment of monetary policy by the Federal Reserve. The coming weeks and months will likely witness significant market volatility as investors continue to adjust to the newly emerging economic and political realities.

The current situation emphasizes the importance of a well-diversified investment strategy and a long-term perspective. It’s essential to avoid making rash decisions based on short-term market fluctuations and instead focus on a robust, long-term financial plan. The inherent volatility in the markets, especially during periods of heightened political and economic uncertainty, should always be factored into investment decisions. The importance of due diligence and informed decision-making cannot be overstated.

The Dow’s drop serves as a stark reminder of the interconnectedness of political actions, economic policies, and market performance. Navigating this complex landscape requires careful analysis, strategic planning, and a level-headed approach to managing risk.