Charles Littlejohn, an IRS contractor, was sentenced to five years in prison for releasing the tax information of wealthy individuals, a sentence far exceeding sentencing guidelines and harsher than those given for comparable crimes. This disproportionate punishment, influenced by Republican lobbying, highlights the undue influence of the wealthy on the justice system. Littlejohn’s actions, which exposed significant tax avoidance by billionaires, were intended to serve the public interest. A presidential commutation is urged to rectify this injustice and protect Littlejohn from potential retribution from President-elect Trump.

Read the original article here

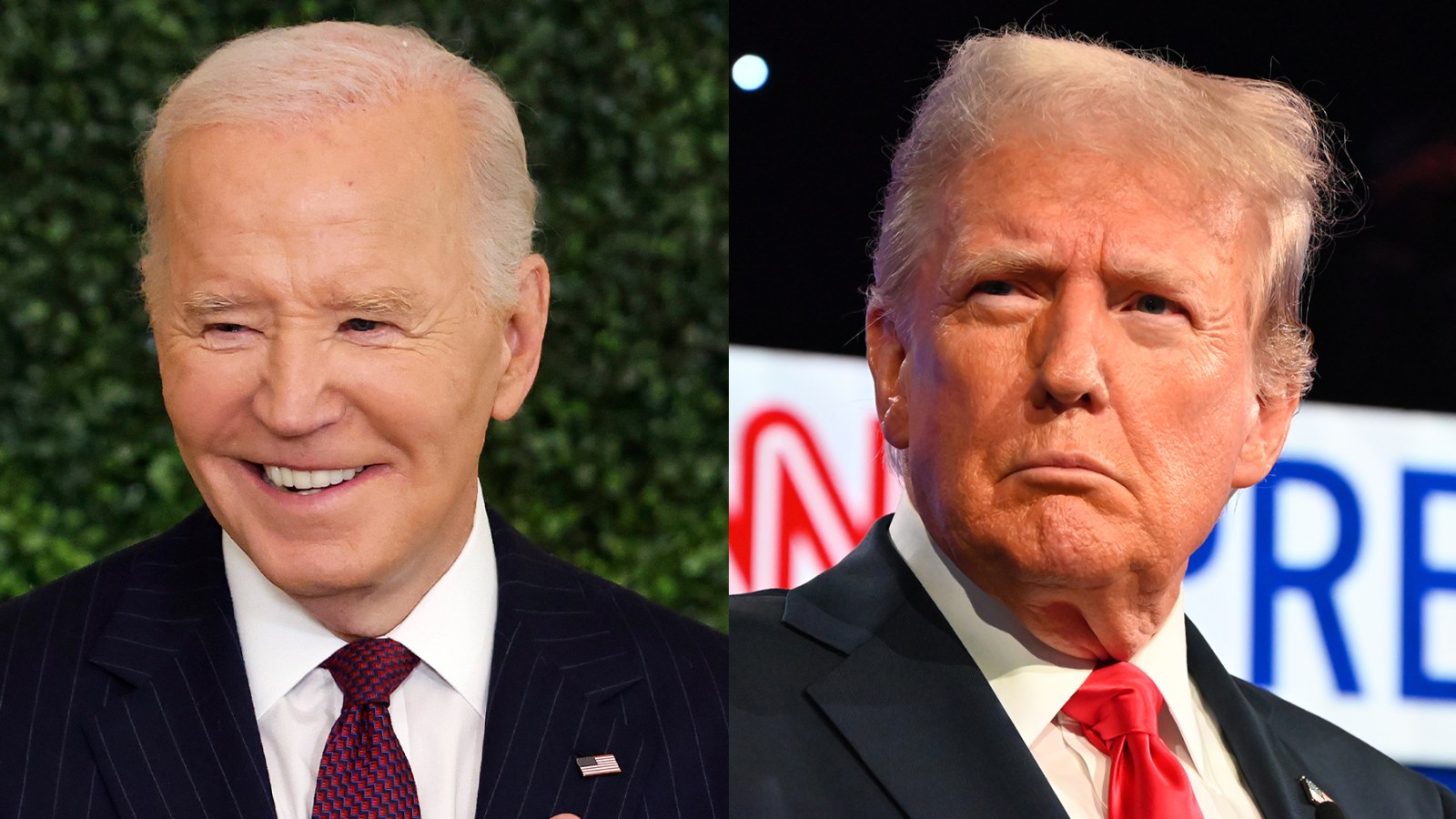

President Joe Biden should immediately commute the sentence of Charles Littlejohn, the former IRS contractor imprisoned for releasing the tax records of Donald Trump and other billionaires. Littlejohn’s actions, while technically illegal, exposed crucial information about the deeply unfair tax system that allows the wealthiest Americans to pay significantly less than their fair share. This information, disseminated through news organizations, served the public interest by revealing a reality many were previously unaware of—a reality where the ultra-rich benefit from loopholes and strategies unavailable to the average American. The public deserves to know how the wealthiest individuals manipulate the system to minimize their tax burdens.

The fact that Littlejohn remains incarcerated while those who benefitted from his exposed tax avoidance remain untouched is a glaring injustice. It underscores a systemic problem where the powerful consistently evade accountability, while whistleblowers who dare to expose their wrongdoing face severe consequences. This stark contrast highlights a profound imbalance in our justice system.

The argument that Littlejohn’s actions violated confidentiality rules ignores the larger context. The confidentiality of tax records is designed to protect individuals, not to shield the wealthy from public scrutiny of their tax practices. Littlejohn’s disclosures revealed widespread tax avoidance, not just by Trump, but by others within the billionaire class, exposing a systemic flaw that undermines fair taxation.

This situation directly contrasts with the actions of previous administrations, particularly the Trump administration, which demonstrated a clear double standard. Trump himself pardoned individuals convicted of serious crimes, including his father-in-law, Charles Kushner, for tax evasion and witness tampering. This blatant disregard for justice underscores the hypocrisy inherent in selectively prosecuting those who expose the powerful while overlooking their own transgressions.

Some argue that Littlejohn’s actions should be punished regardless of the public benefit derived from the information exposed. This perspective ignores the immense societal impact of unveiling the widespread tax avoidance practices of billionaires. The information released fueled crucial discussions about tax reform, highlighting the urgent need for changes to the current system. The argument of maintaining confidentiality above transparency overlooks the importance of public accountability for the ultra-wealthy.

The lack of action by the Biden administration is deeply concerning. It suggests a failure to prioritize justice and transparency in the face of powerful interests. The silence surrounding Littlejohn’s case feeds cynicism and distrust in the political system. The perception that the Democratic party, like the Republican party, prioritizes corporate interests above public interest needs to be addressed through decisive action, starting with Littlejohn’s release.

Delaying a decision on Littlejohn’s case only reinforces the narrative that the political establishment protects its own, regardless of the moral implications. This inaction allows the perception of complicity to fester, ultimately eroding public trust in institutions intended to serve the people. A prompt commutation of Littlejohn’s sentence would send a powerful message, demonstrating a commitment to fairness, transparency, and accountability, and would go a long way to repair this damage. Failing to act decisively only serves to strengthen the impression that the current system is rigged against the average American.

The argument that pardoning Littlejohn would open the door to future pardons for those convicted of crimes against political opponents is a weak counterargument. The context of Littlejohn’s case—exposing systemic tax evasion by the wealthy—is unique and should be considered separately. Furthermore, a clear and transparent process for evaluating future pardon requests could easily mitigate this concern.

Ultimately, freeing Littlejohn is not merely a matter of justice for one individual, but a necessary step to rectify a deeply flawed system. It is a statement that the pursuit of truth and accountability, even in the face of powerful opposition, is paramount. President Biden must act decisively to correct this injustice and show a commitment to transparency and fair taxation for all. Ignoring this crucial opportunity sends a chilling message to those who dare to challenge the established power structures, hindering the very principles of a just and equitable society.