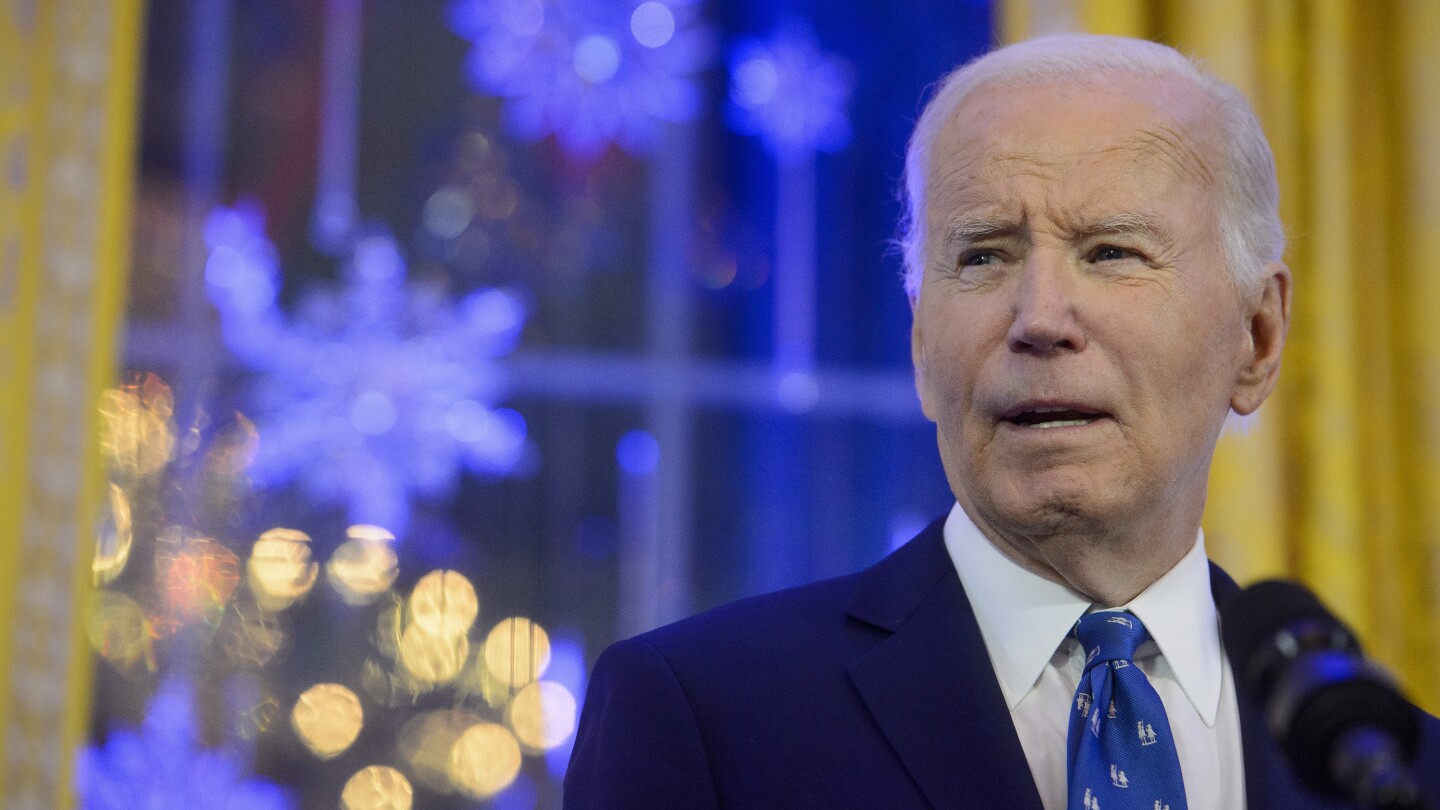

President Biden has finally endorsed a ban on congressional stock trading, stating that lawmakers shouldn’t profit from the market during their terms. This long-awaited statement, made in an interview with Sen. Bernie Sanders’ advisor, comes just a month before the end of Biden’s presidency. While a bipartisan bill to ban such trading already exists, it lacks a vote. Biden’s endorsement adds significant weight to the debate fueled by concerns about insider trading and conflicts of interest.

Read the original article here

Biden calls for a ban on congressional stock trading, a move that has been advocated for years and finally receives presidential endorsement. This belated call for action, coming just a month before the end of his term, raises questions about its potential impact and timing.

The president’s statement, made during an interview with a pro-labor organization and subsequently reviewed by the Associated Press, is straightforward: no member of Congress should profit from the stock market while serving in office. This simple declaration, however, speaks volumes about the long-simmering concern regarding conflicts of interest within the legislative branch.

Many believe this initiative is long overdue. The potential for insider trading, using privileged information gained through congressional service for personal financial gain, has long cast a shadow over the integrity of the political process. Concerns about politicians prioritizing personal enrichment over public service are pervasive and deeply rooted.

Critics point to the timing of Biden’s announcement, questioning its effectiveness given its proximity to the end of his presidency. They argue that such a significant policy proposal should have been advanced earlier in his term, allowing for more extensive debate and potentially legislative action. The perception is that this is a late attempt at bolstering his legacy, rather than a genuinely impactful policy shift.

The proposed ban’s enforceability also raises questions. Even with a ban in place, loopholes and indirect methods of profiting from market information could still exist. The complexity of financial transactions makes it challenging to completely eliminate the possibility of illicit activities. The suggestion of requiring real-time reporting of all congressional stock trades, while potentially helpful, could face strong opposition from members who wish to maintain privacy regarding their personal financial dealings.

Beyond a simple ban, some advocate for broader reforms. These include stricter regulations on post-congressional employment, preventing former legislators from immediately leveraging their connections for lucrative private sector positions. Limiting the types of investments allowed, perhaps confining them to broadly diversified index funds, is another suggestion designed to minimize the potential for insider trading.

Linking congressional salaries to the minimum wage has been suggested as a way to keep lawmakers connected to the economic realities of their constituents. Such measures, while potentially symbolic, aim to address the perceived disconnect between legislators’ financial realities and those of ordinary citizens.

There’s considerable discussion on whether a ban will actually pass through Congress. The self-interest of many sitting members presents a significant hurdle. The fact that this seemingly bipartisan issue could face strong opposition from both sides highlights the deep-seated problems of self-preservation and lack of accountability within the political system. This skepticism reflects a cynical view that politicians will prioritize their own interests over implementing reforms that could limit their future financial opportunities.

Calls for increased transparency and stricter regulations are not limited to the federal level. There’s growing momentum for state-level initiatives to address these concerns. Allowing states to decide on the issue, or even implementing mechanisms for voter recall of representatives who fail to uphold ethical standards, are examples of approaches aimed at empowering citizens and bolstering democratic accountability.

Ultimately, Biden’s call for a ban, though potentially too late in its timing, underscores a critical need for reforms within the political system. The potential conflicts of interest inherent in congressional stock trading represent a significant threat to public trust and democratic integrity. Whether or not this specific initiative succeeds, the broader discussion it ignites regarding ethical standards and accountability within government is undoubtedly significant and vital for the health of the democratic process. The ongoing debate reflects a crucial need for greater transparency, more stringent regulations, and ultimately, a stronger commitment from lawmakers to prioritize the public interest over personal financial gain.